AIBOBOU Raises Concerns Over Unfair Accountability in Bank of Baroda

The All India Bank of Baroda Officers’ Union has urged the bank’s top management to ensure fair and transparent accountability in the ₹61.40 lakh RBI penalty case, alleging that junior officers are being unfairly targeted while senior officials remain unexamined.

Author: Meera

Published: October 20, 2025

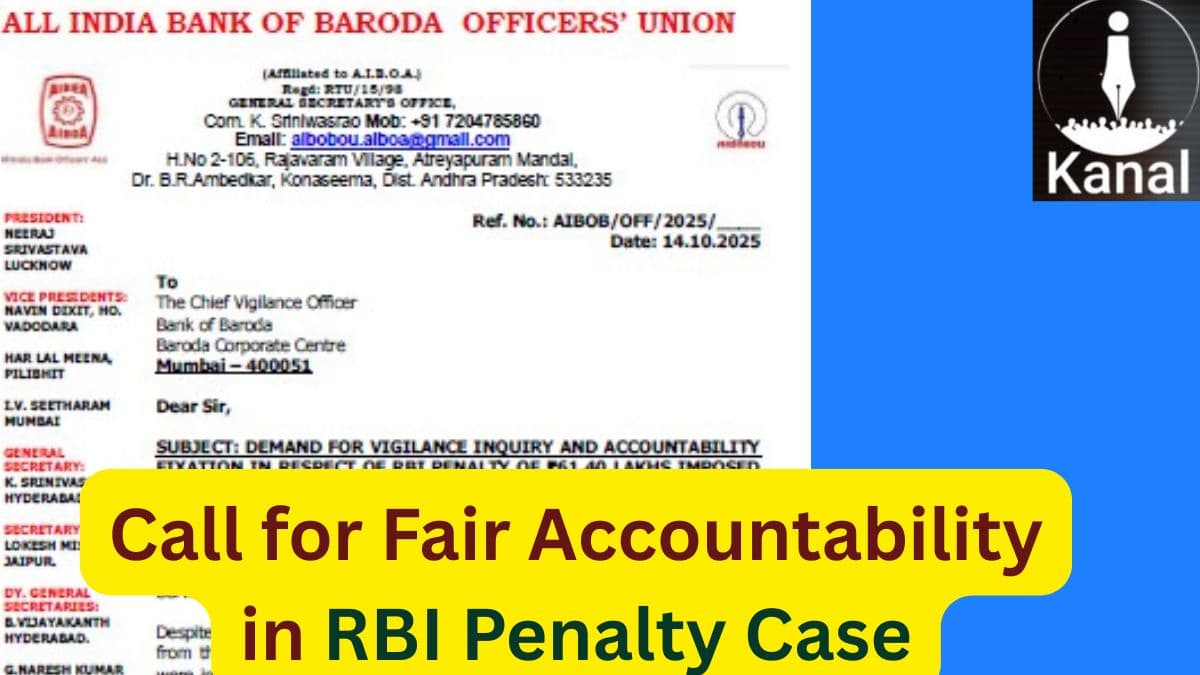

The All India Bank of Baroda Officers’ Union (AIBOBOU) has written to the Chief Vigilance Officer and Managing Director of Bank of Baroda, raising serious concerns about how staff accountability is being handled in relation to an RBI penalty of ₹61.40 lakh imposed on the bank.

Image - AIBOBOU letter to Chief Vigilance Officer

In its letter dated 14 October 2025, the union states that the penalty was linked to regulatory lapses by the bank, but the subsequent internal action unfairly targeted junior-level officers while overlooking the role of senior executives who were involved in key policy and decision-making.

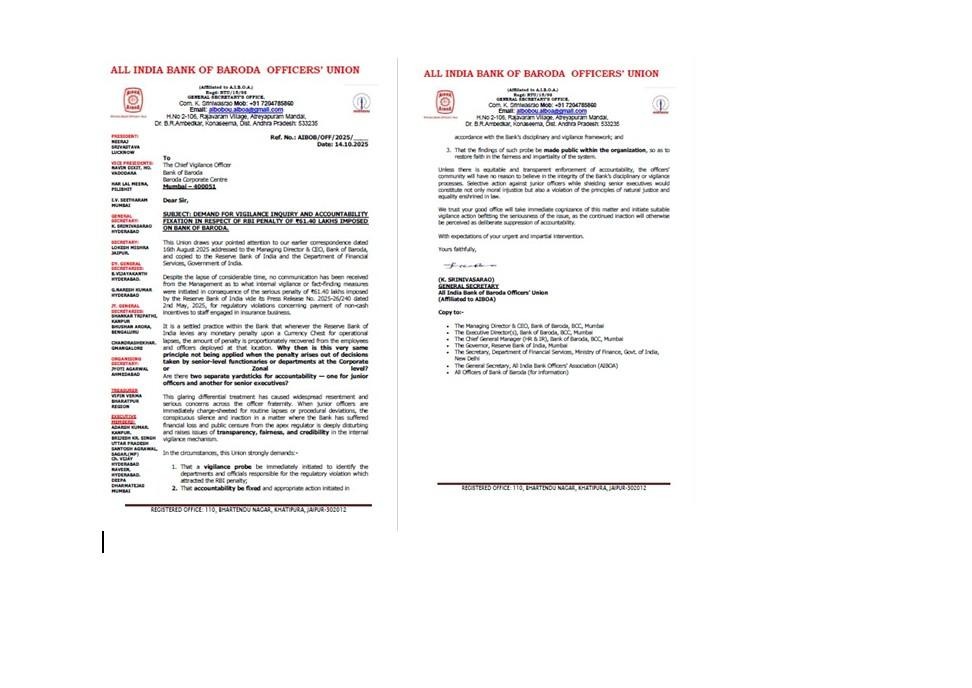

AIBOBOU argues that this selective approach to accountability damages trust within the organisation and creates a sense of injustice among employees. The union stresses that accountability should be transparent, fair, and consistent across all levels of the bank.

Advertisement

The union has urged the management to:

- Initiate a vigilance inquiry to identify the actual causes and those responsible for the RBI penalty.

- Fix accountability appropriately after a fair investigation.

- Make the findings public within the organisation to restore faith in the fairness and impartiality of the system.

According to the union, the current method of fixing responsibility—by penalising junior officers while protecting senior officials—undermines employee morale and credibility in the bank’s internal vigilance system.

AIBOBOU further warns that continued inaction or biased enforcement could be seen as a deliberate suppression of accountability. The union has called for the intervention of top management and the Ministry of Finance to ensure justice and transparency.

Advertisement

Comments

- Rajni Jani

Such practices not possible without support of Ministry. Bank is made laboratory

Posted on October 27, 2025