AIBOBOU’s Call for Fairness: Key Resolutions from the Bank of Baroda Officers’ Union Meeting

The resolutions adopted by the All India Bank of Baroda Officers’ Union (AIBOBOU) urging the Government and Bank management to ensure transparency, fairness, and better welfare for officers.

Author: Sruthysh

Published: October 17, 2025

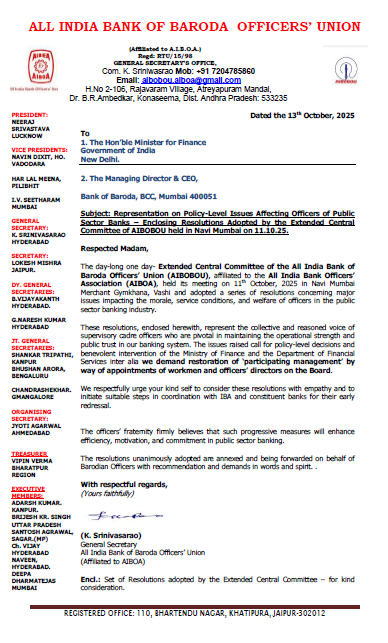

On 11 October 2025 the All India Bank of Baroda Officers’ Union (AIBOBOU) held an Extended Central Committee meeting in Navi Mumbai and adopted a long set of resolutions. The union sent these resolutions (dated 13 October 2025) to the Finance Minister and the Bank’s CEO, asking for policy level changes on transfers, promotions, leave, staffing, working hours, digital surveillance and other matters that affect officers’ welfare and service conditions.

Image -The resolutions adopted by the All India Bank of Baroda Officers’ Union (AIBOBOU)

Background and Purpose

The document is a formal representation from the union (affiliated to AIBOA). It opens with a preface noting that banking has changed quickly mergers, new technology and added duties while officers face increasing stress, opaque HR practices and what the union describes as arbitrary managerial action. The resolutions are presented as a book of specific demands for the bank, the Department of Financial Services and the Ministry of Finance.

Main Concerns Raised

1. Transfer policy : The union says current transfer practice is opaque, arbitrary and inhumane; it asks for publication of stay lists, transparent cycles and a two-tier appeal mechanism as per DFS guidelines.

2. Promotions : Complaints about non-transparent promotion processes, withheld marks and excessive weight to general awareness topics (GCEMP); the union demands published marks, balanced weightage and seniority cum merit.

3. Sick leave and medical verification : The union objects to reliance on single empanelled doctors and asks for medical boards (including public-sector doctors) and restoration of pay where leave was wrongly denied.

4.Unauthorized absence and pay loss : Cases where officers were marked absent due to administrative delay; union asks for provisional on-duty treatment and refund of withheld pay.

5. Toxic work culture and mental health : Reports of extreme stress and tragic suicides; union calls for a wellness cell, an employee well being report and a joint committee to study causes.

6. Abuse of discretionary powers : Demand to codify and audit discretionary decisions (transfers, postings, ratings) and to record reasons in the HR system.

7. Closed-door management : Request to restore bipartite dialogue, include officer representatives in policy committees and allow officers’ directors on the Board.

8. Staff shortages : Urgent call for a rational manpower policy, region-wise staffing data and planned recruitments.

9. Right to disconnect / five-day week : Strong demand that officers should not be expected to be digitally available after hours except for recorded emergencies; also a demand for five-day banking.

10. Digital surveillance and privacy : Opposes invasive monitoring (GPS, call verification, personal device checks); asks for a Digital Data Ethics Charter and DPO compliance with the Data Protection Act, 2023.

11. Accountability for regulatory penalties : Wants root cause analysis and review before any punitive action against field officers; calls for an annual Compliance Responsibility Report.

12. Other issues : Performance linked incentive (PLI) implementation per the 8 March 2024 joint note, opposition to outsourcing of perennial jobs, pension updation and objection to further bank amalgamations.

What the Resolutions Ask for

* Transparency measures : publish marks, stay lists, vacancies and appraisal analytics.

Advertisement

* Procedural fairness : two-tier grievance redressal, audio-video recording of inquiries, proportionate punishments and the right to defence by retired officers.

* Health and wellbeing : permanent wellness cells, mandatory rest norms, counselling and a yearly employee well being report.

* Workload and staffing : data-driven manpower planning, relief staff for short-staffed branches and advance recruitment plans.

* Policy redressal at higher level : ask Ministry of Finance / DFS and IBA to issue sector-wide guidelines where needed (e.g., medical verification, right to disconnect, accountability).

Likely Implications

* If taken seriously, these changes would shift Bank of Baroda’s HR approach towards more recorded, auditable decisions and stronger worker protections likely improving morale and reducing legal disputes.

* Some demands (five day week, Board representation for officers, pension updation, reversal of outsourcing) require policy-level decisions and coordination with IBA, DFS and the government; they are not sole management fixes.

* Implementation would have operational cost and require cultural change e.g., wellness cells, transparent promotion publication and limiting after hours messages.

Recommendations

1. Acknowledge receipt and offer a timetable for a consultative dialogue with unions. 2.Start quick wins : publish stay lists and promotion marks, and set up a joint committee on transfers and promotions.

3. Set up an independent medical review for contested sick leave cases while reviewing past denials and restoring pay where appropriate.

4. Pilot right to disconnect in a few regions and produce an employee well being baseline report to guide scale-up.

Transparency, Trust, Reform

The AIBOBOU resolutions present a comprehensive, officer centred reform agenda: transparency, humane treatment, clear accountability and protection from digital overreach. Many demands are administrative fixes that can be started quickly; others need sectoral policy decisions. If the bank and regulators engage constructively, the changes could restore trust and reduce stress among officers which in turn would help the bank’s long term performance.

No comments yet.