National Pension System (NPS): Funds, PFMs and Investment Choices

Sreenath Induchoodan, General Secretary of Union Bank Officers' Association Kerala State (UBOAKS/AIBOC) writes in detail about the National Pension System (NPS) and how to choose among multiple Pension Fund Managers (PFMs). He has compiled a comprehensive article and says a well-managed PFM and investment strategy can increase the pension corpus by nearly 60% compared to passive management. The one-stop guide designed for easy understanding and practical application.

Author: Sreenath Induchoodan

Published: August 16, 2025

This message is specifically intended for NPS subscribers and officers under the Old Pension Scheme who are eager to understand the nuances of the National Pension System (NPS) and the recent developments concerning it.

As you're aware, the Bank, through Staff Circular No. 100454-2025 dated July 4, 2025, has introduced a significant update: employees can now change their Pension Fund Manager (PFM) once a year and revise their investment choice and asset allocation up to four times a year.

While this is a welcome step, many officers remain unclear about the process and the implications of these options. Questions like What is a PFM? What are investment choices? How should one evaluate a PFM? What are the risks involved? How do age and risk appetite correlate? How can you maximize returns while minimizing risks?—are common, and deserve clarity.

It’s crucial to understand that a well-managed PFM and investment strategy can increase your pension corpus by nearly 60% compared to passive management. Yes, that’s how impactful the right choices can be.

Advertisement

To help you navigate this important subject, I’ve compiled a comprehensive article that breaks down:

* The basics of NPS

* What a PFM is and how to choose one

* The different types of investment choices

* How NAV works and how to track fund performance

* A clear, step-by-step flowchart and process guide for changing your PFM and asset allocation

Advertisement

This is a one-stop guide designed for easy understanding and practical application.

If you find it useful, please share it with your fellow colleagues who are equally keen to secure and grow their pension corpus smartly and safely.

The National Pension System (NPS) is a government-regulated, defined-contribution retirement scheme designed to provide old-age income through market-based investments. It is a voluntary, portable and low-cost plan that lets you choose among multiple Pension Fund Managers (PFMs) and asset classes. Under NPS, contributions accumulate in a Tier-I (mandatory pension) account (and optionally Tier-II), and upon retirement you must use at least 40% of your corpus to buy an annuity for pension. The scheme offers flexibility – subscribers can pick their PFMs, asset allocation (via Active or Auto mode), and annuity provider . The returns are market-linked (not guaranteed) and are published regularly by the NPS Trust. Below we detail how a subscriber should choose and manage PFMs, investment options, and strategies to build a larger corpus.

Choosing a Pension Fund Manager (PFM)

When you join NPS (Corporate model Tier-I), you must select one PFM to manage your funds. For corporate (non-government) subscribers, there are currently ten PFMs registered (SBI, LIC, UTI, HDFC, ICICI Prudential, Kotak Mahindra, Aditya Birla Sun Life, Tata, Axis, and formerly Max Life) . (Note: as of April 2025, Max Life Pension Fund ceased operations and its schemes merged with Axis .) Each PFM manages four asset classes (Equity, Corporate debt, Government securities, and Alternative investments) for you.

To choose a PFM, compare their track records in the asset classes relevant to your goals. Since one PFM manages all your asset classes, decide your desired equity/debt mix first and then pick the manager with strong historical returns in that area . For example, if you plan a high-equity portfolio, pick a PFM whose equity fund has consistently outperformed; if you prefer safety, choose one known for stable bond performance . Use official sources (NPSTRUST charts) or finance platforms to check each PFM’s NAV growth and returns. We also recommend an annual review: if your chosen PFM significantly underperforms peers, you can switch (allowed once per year) to a better-performing manager . In summary, list out the PFMs, review their historical performance (consistency, Sharpe ratio, etc.), and align with your risk preference. Remember that you can switch PFMs once a year under NPS rules, so review regularly

NPS Investment Options: Active vs. Auto Choice

NPS offers two scheme preference options for how your contributions are allocated across asset classes:

Active Choice: You manually select the percentage of your funds in each asset class (Equity ‘E’, Corporate debt ‘C’, Government bonds ‘G’, and Alternative ‘A’). You have control over the asset mix (subject to limits: Equity ≤75%, Corporate ≤100%, Government ≤100%, Alternate ≤5%). This choice suits investors who want to tailor their portfolio.

Auto Choice (Life-Cycle Funds): If you prefer a simpler, passive approach, Auto Choice automatically rebalances your allocation as you age. The default “Moderate” life-cycle fund starts with 50% equity (if you’re young) and gradually reduces equity exposure toward retirement . There are three Auto sub-options: Aggressive (max 75% equity initially), Moderate (max 50% equity), and Conservative (max 25% equity) . For example, in the Moderate plan a 30-year-old’s allocation might be 50% Equity, 30% Corporate, 20% Govt; by age 55 it becomes 10% Equity, 10% Corporate, 80% Govt . The Auto Choice uses a life-cycle model mandated by PFRDA to mitigate risk as retirement nears.

How to choose: If you are new to investing or want a set-and-forget approach, Auto Choice can be useful – it automatically shifts from higher equity when young to higher debt when older . If you prefer active control, pick Active Choice and set your own asset mix. Many advisors suggest starting with Auto (default) and switching to Active later once familiar.

Importantly, NPS allows flexibility: you can change your investment option (Active vs Auto or switch between life-cycle funds) up to 4 times per year . This means you can alter your asset allocation strategy as needed (for example, moving more to bonds as retirement approaches). Always consider your age, risk comfort, and financial goals when deciding.

(Recent update: In Oct 2024 PFRDA introduced a new Balanced Life Cycle (BLC) auto option. BLC extends high-equity investing longer – capping equity at 50% only up to age 45 (instead of 35), potentially boosting returns for young investors)

Growing Your NPS Corpus for Maximum Pension

To maximize your retirement corpus (and thereby your pension), follow strategies that enhance long-term growth:

Higher Equity When Young: Since equity has historically delivered higher returns over long horizons, young subscribers can afford a larger equity share . With ~22 years until retirement (age 60), a 38-year-old officer can choose Active Choice with a high equity mix (up to 75%), or Aggressive Auto Choice initially. Higher equity early on accelerates growth via compounding.

Regular & Additional Contributions: Consistency compounds wealth. Contribute at least the minimum required, but max out your 80CCD tax deduction (₹1.5 lakh under 80C + ₹50k under 80CCD(1B)). Consider voluntary lumpsum top-ups when possible – these also get tax deductions and directly add to corpus . Setting up a fixed monthly contribution ensures you invest systematically.

Stay Invested Long-Term: The bigger your compounded corpus at retirement, the higher your annuity (pension). Avoid long breaks in contributions. NPS is meant to run till 60, so the longer you invest, the more you benefit from compounding returns.

Monitor & Rebalance: Track your account and be ready to rebalance if market moves distort your allocation. Experts advise annual reviews: if market surges have made equity too high, or vice versa, adjust by switching asset weights or changing to a more suitable scheme.

By following these steps—taking full advantage of equity, diversifying across PFMs, contributing consistently, and claiming tax breaks—you can build a larger NPS corpus. This ultimately means a higher monthly pension (which depends on the corpus you convert into annuity).

Risk Factors and Determining Your Risk Appetite

NPS investments are market-linked, so they carry market risks. Key risk elements include:

Advertisement

• Equity Volatility: Equity funds (Scheme E) can swing widely with the market. They offer high returns potential but high short-term risk .

• Interest Rate Risk: Corporate debt (C) and Government bonds (G) are subject to interest rate fluctuations. For example, rising interest rates can reduce bond fund NAVs.

• Credit Risk: Corporate bonds carry risk that issuers might default. Government securities are safest (virtually zero default risk) but still fluctuate with policy rates.

• Liquidity/Market Risk: Large market downturns can affect all assets, and recovering from such lows may take time.

Your risk appetite should guide your choices. Younger investors typically have higher risk tolerance (longer horizon to absorb volatility) and can allocate more to equity. In contrast, as you age, capital preservation becomes more important. Many experts recommend gradually reducing equity exposure and increasing debt to protect gains. For example, Auto Choice’s design reflects this: equity allocation tapers off near retirement to cushion market shocks.

A practical rule: “Focus on principal protection via bonds if you’re risk-averse or near retirement; focus on equities if you seek higher long-term gains”. Ultimately, determine your comfort with swings in fund value: if sharp drops worry you, choose a conservative mix (higher G, C). If you can tolerate volatility and need growth, favor E. NPS’s life-cycle funds inherently manage risk with age, or you can manually rebalance under Active Choice.

NPS Scheme Categories and Their Returns

In NPS, “scheme categories” refer to the different subscriber segments and account types that have separate fund pools and returns.

For example: Central Government (CG) Tier-I/II, State Government (SG), Corporate CG, NPS Lite (Swavalamban), All Citizen (UoS), and Atal Pension Yojana (APY) are subscriber categories.

Within each, funds are further split by asset class (“Scheme – E Tier-I” means equity for Tier-I, “Scheme – G Tier-II” means government bonds for Tier-II, etc.).

Each category and asset scheme has its own NAVs and calculated returns. The NPS Trust publishes weekly and monthly snapshots of returns for each scheme category. For example, the returns “as on 31st July 2025” are shown on the NPSTRUST Returns page. Importantly, NPS returns are market-linked (variable) – there is no fixed or guaranteed return. All gains (or losses) depend on the underlying market performance of equities and bonds. To check returns, you can visit the NPS Trust website’s “Returns under NPS” section (which has interactive charts) or download the Monthly Scheme Data PDFs.

These show percentage returns over 1,3,5-year periods, etc., for each scheme. Use these to compare how, say, SBI’s equity fund versus ICICI’s equity fund has done in the “E Tier-I” category, or how government securities performed in “G Tier-II” funds.

Remember, different schemes serve different purposes: Tier-I is your retirement account (with withdrawal restrictions), while Tier-II is a voluntary savings account. Corporate or Govt schemes depend on your employer. The returns reflect the asset allocations and market conditions for that scheme. Always refer to the NPS Trust updates – the latest returns (as of July 2025) are clearly indicated on their site.

NAV and Analysing Fund Performance

Each NPS fund (PFM + asset class) has a Net Asset Value (NAV) per unit. NAV is essentially the market value of all assets in the fund divided by the number of units. It changes daily based on market movements . In other words, NAV is your fund’s “price”. A rising NAV means the fund’s portfolio value has grown, while a falling NAV means losses.

How to use NAV:

Track Growth: An increasing NAV shows your investment is appreciating. You can monitor NAV trends on the NPS Trust site (there’s a “Daily NAV” and “Scheme-wise NAV” report link).

Compare PFMs: Look at NAV growth of the same asset class across PFMs. For example, compare SBI’s E Tier-I NAV vs HDFC’s E Tier-I NAV over 5 years – this shows which equity fund performed better.

Performance Metrics: Don’t just look at NAV; calculate percentage returns over fixed periods. For instance, the NPS website lets you see 1-year, 3-year, 5-year returns for each scheme . Comparing these gives a clearer picture of performance than absolute NAV.

Benchmarks: Compare your equity NAVs versus a benchmark like Nifty 50. If your fund’s 5-year return beats Nifty 50’s, it’s doing well. For bonds, compare to government bond indices.

To analyse performance, use both NAV trends and returns:

1. Look at recent returns: 1-yr and 3-yr % returns to see short-term behavior.

2. Look at long-term returns: 5-10 year returns gauge consistency and resilience.

3. Compare against peers and benchmarks . Underperformance (or NAV falling relative to peers) signals it may be time to reconsider that fund/PFM.

4. Check risk-adjusted measures: Higher volatility (sharp NAV swings) with only marginally higher returns might not be worth it.

For a more structured approach, some choose tools or third-party trackers (e.g. ValueResearch, or PFMs’ own sites) to monitor NAV trends and return charts. The key is to ensure your selected fund’s NAV is growing in line with your expectations. If not, you have the option to switch funds (subject to NPS rules – see next section).

Age-Based Adjustments: Switching PFMs and Investment Schemes

Your asset mix and choice of PFMs should evolve as you age. When young, you might favor high-growth strategies; near retirement, you should reduce risk. NPS supports this evolution:

• Adjusting Asset Mix: A common strategy is to reduce equity share as you get older. For example, many suggest an equity percentage roughly equal to (100 – age) or using the built-in lifecycle reduction. NPS’s Auto Choice does this automatically . If you chose Active, you should manually tilt more toward debt/govt bonds each decade.

• Switching PFMs: As noted, you can switch your fund manager once per year . If a PFM’s portfolio no longer matches your new risk profile (e.g. its equity fund underperforms when you no longer want high equity), consider moving to another. Similarly, if you need safer management, pick a PFM with strong debt fund track record. Regularly reviewing PFM performance is advised.

• Changing Investment Option: You can also switch between Active and Auto or between different life-cycle funds up to 4 times a year . For instance, one might start with Auto (Moderate) in early career, switch to Active with a custom allocation in mid-career, then maybe shift to a Conservative Auto as retirement nears.

• Use of Auto/Lifecycle Funds: The life-cycle (Auto) mode inherently reduces equity from age 35 onward, ultimately capping at 15% by age 55 . The new Balanced Life Cycle (BLC) fund even allows a higher equity stay until age 45 . If you start with an aggressive equity-heavy plan when young, moving to a moderate or conservative fund at an appropriate age is wise.

In short, don’t “set and forget” your choices. Align your NPS portfolio with your life stage: younger officers can be aggressive, while officers approaching retirement (e.g. age 55+) should be conservative. The flexibility to switch PFMs and schemes means you can implement this dynamic strategy. Just remember NPS limits: one fund-manager switch per year and four scheme changes per year.

Tips to Improve NPS Returns

• Maximize Equity Share (within comfort): Use the allowed 75% equity in Active mode or choose Aggressive Auto if you can tolerate volatility. Equities have outperformed debt over long runs.

• Opt for Tax Benefits: Claim deductions under 80CCD(1)/80CCD(1B)/80CCD(2) fully. Reducing your tax outflow effectively increases your investable income.

• Rebalance Annually: Periodically (at least yearly) rebalance back to your target allocation or switch schemes. Market moves can throw allocations off, so bring them back in line. If a fund consistently lags peers, switch out of it.

• Monitor Fees: NPS is low-cost, but there are annual charges (PFM fee, trustee fee, CRA fee). While you can’t eliminate them, be aware of them when comparing returns (some PFMs might marginally differ in fees).

• Stay Informed: Keep up with regulatory changes (like the new BLC fund ) and choose timely. Read NPSTRUST updates and financial advisories to leverage any new advantage.

By following these tips—leveraging equity growth, full tax benefits, diversified PFMs, and disciplined investing—you can enhance your NPS corpus. Over decades, these strategies compound to a significantly higher retirement fund, translating to a higher monthly pension.

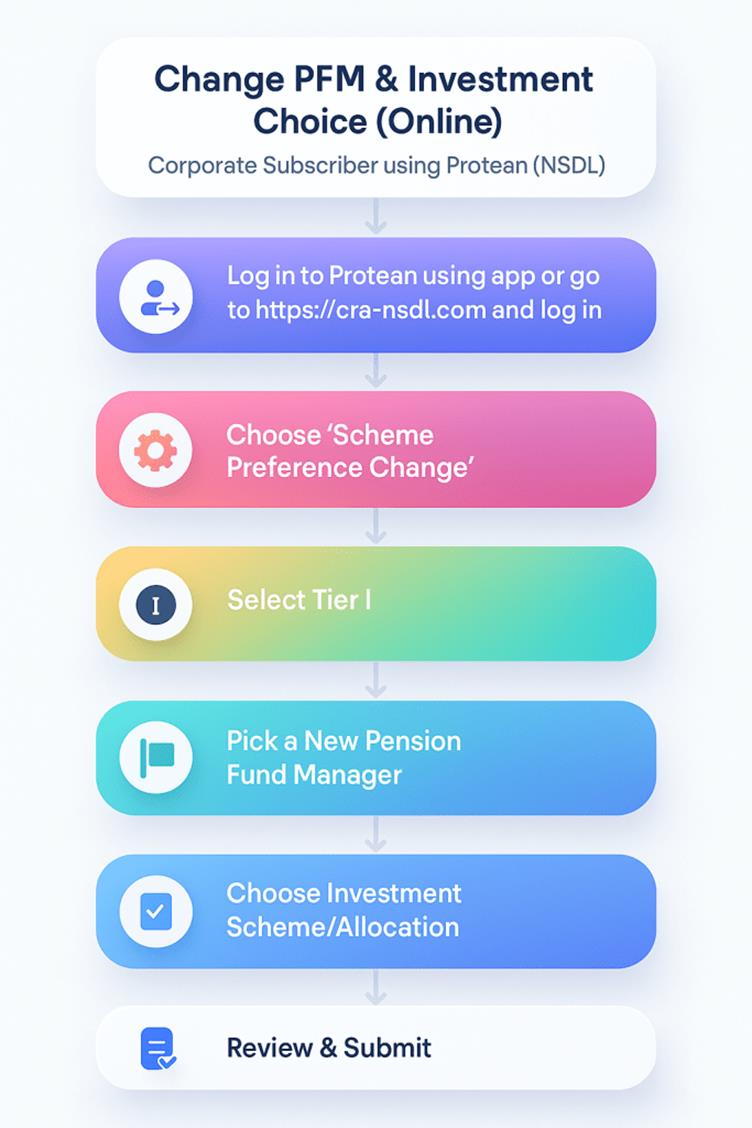

Step-by-Step Guide to Changing Your Pension Fund Manager (PFM) and Investment Scheme under NPS (Tier I) via NSDL/Protean Portal

For a Tier‐I corporate NPS account (e.g. Union Bank of India subscriber), the online process for changing your Pension Fund Manager and investment choice via Protean (NSDL CRA) is as follows:

Log in to NSDL/Protean: Open the Protean NPS mobile app or go to the CRA-NSDL website (https://cra-nsdl.com) and log in with your PRAN (Permanent Retirement Account Number) and security credentials (I-PIN/password or OTP).

Navigate to Transactions: On the dashboard, select the “Transact Online” or “Transactions” menu

Choose “Scheme Preference Change”: Under Transactions, click Scheme Preference Change. (This is where you can change your PFM and allocation.)

Select Tier I: On the Scheme Preference screen, ensure Tier I is selected (since Tier II changes are separate).

Pick a New Pension Fund Manager: From the PFM list, choose the desired new Pension Fund Manager (e.g. SBI Pension Fund, LIC Pension Fund, UTI Retirement Solutions, etc.). This replaces your current PFM.

Choose Investment Scheme/Allocation: Select your investment option. You can opt for Scheme G (100% government bonds) or a lifecycle fund (Scheme LC-25 or LC-50, capping equity at 25% or 50% respectively). (These correspond to the old Active/Auto choices.)

Review & Submit: After making your selections (PFM and scheme), review the details. Confirm and Submit the request. The system will prompt you for an OTP or e-Sign to authorise the change.

Confirmation: Once the OTP is entered, your request is complete. The CRA system updates your account with the new PFM and allocation. You will get a confirmation on screen and via email/SMS.

Note: You are allowed to change your Pension Fund Manager only once in a financial year. Also, you can change your investment scheme up to four times a year (as per PFRDA rules).

Sources: Official NPS Trust documents and reputable analyses were used, including NPSTRUST’s returns snapshots , PFRDA circulars and FAQs, and expert articles

[Disclaimer: The views expressed in this article are those of the author and do not necessarily reflect the editorial stance of this publication.]

No comments yet.