Punjab National Bank to Absorb 100% TDS on Employee Loan Benefits

Punjab National Bank has announced that it will bear 100% of the TDS liability on the perquisite value of interest-free and concessional-rate loans for employees for FY 2025-26.

Author: Meera

Published: November 12, 2025

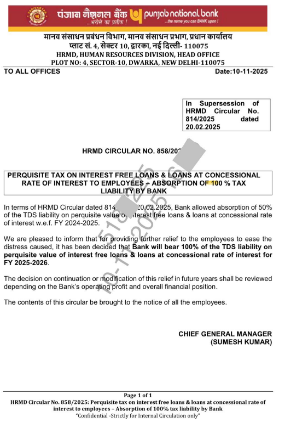

Punjab National Bank (PNB) has announced significant relief for its employees by deciding to absorb 100% of the tax liability on the perquisite value of interest-free loans and loans offered at concessional rates for the financial year 2025-26. This decision, detailed in HRMD Circular dated 10 November 2025, supersedes the earlier circular dated 20 February 2025, which had allowed the bank to absorb only 50% of the TDS liability.

The new directive, issued by the Human Resources Management Division (HRMD), Head Office, Dwarka, New Delhi, states that the move is aimed at providing further relief to employees and easing financial distress arising from tax deductions on perquisites. Under the Income Tax Act, interest-free or concessional-rate loans extended by employers are treated as taxable perquisites, and employees are liable to pay tax on the notional interest

value.

Image:HRMD Circular

Recognising the impact of this provision on staff members, PNB has decided to fully absorb the TDS (Tax Deducted at Source) liability on such loans for FY 2025-26. This means that employees availing of loans under these categories will not have to bear any tax burden on the perquisite value, as the bank will pay it on their behalf.

The circular further notes that the decision on whether to continue or modify this benefit in subsequent financial years will depend on the bank’s operational profit and overall financial position. The initiative reflects the bank’s ongoing commitment to employee welfare and financial support during challenging times.

All offices have been instructed to circulate the information among employees to ensure awareness and compliance.

The circular, signed by Sumesh Kumar, Chief General Manager, highlights PNB’s proactive approach in maintaining a balance between fiscal responsibility and staff welfare, reinforcing its position as a people-oriented public sector bank.

Advertisement

No comments yet.