SBI: Acute Staff Shortage, Stagnant Recruitment and Sale of Shares; Whistle Blowers Alarm Privatisation Threat

State Bank of India (SBI) faces severe staff shortages and stagnant recruitment, with over one lakh employees having exited in recent years. Union leaders warn that outsourcing, contractual labour, and recent share sales point towards phased privatisation.

Author: Abhivad

Published: September 16, 2025

The country’s largest public sector bank, State Bank of India (SBI), is grappling with acute staff shortages amid growing concerns of privatisation, following large-scale share sales. Data disclosed under the Right to Information (RTI) Act and press statements from bank unions reveal that between 2018 and 2024, more than one lakh employees, clerks, and sub-staff left SBI. Employee unions allege that vacancies remain unfilled, outsourcing is increasing, and the recent Rs 25,000 crore qualified institutional placement (QIP) reflects a systematic push towards privatisation.

Advertisement

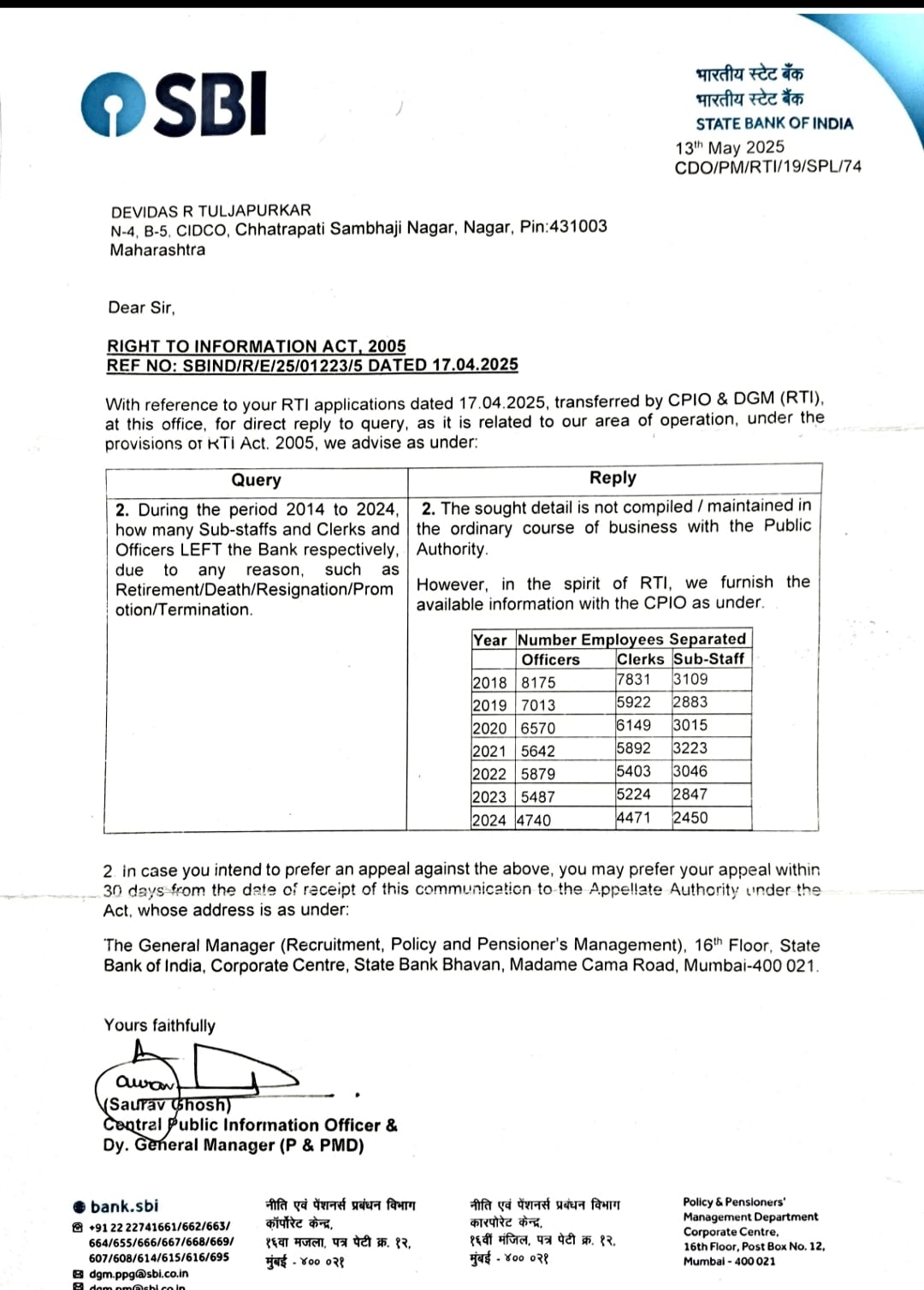

Image - RTI response obtained by Devidas Tuljapurkar on separation of staff from SBI, indicating the vacancies.

RTI Data on Staff Exit

According to the RTI response received by Devidas Tuljapurkar, Joint Secretary of AIBEA, SBI reported separation of 43,506 officers, 40,892 clerical staff, and 20,573 sub-staff between 2018 and 2024. The data shows a consistent year-on-year reduction in employee strength across all cadres.

Advertisement

Union leaders have highlighted that the scale of exits has created nearly one lakh vacancies in the bank. Considering the number of new branches opened during this period, the actual number of vacancies would be much higher. Despite this, recruitment has remained stagnant, resulting in mounting work pressure on the existing workforce. The unions argue that non-replacement of retiring or resigning staff is a deliberate move to weaken the public sector character of SBI.

Union Concerns Over Privatisation

Saji Varghese, All India Vice President of SBI Employees Federation and the Bank Employees Federation of India (BEFI), observed, “In seven years alone, SBI’s staff strength has reduced by a total of 1,04,971 employees across all cadres. As reported by the Finance Minister in reply to the debate on the Banking Company Amendment Act 2024, all public sector banks together have recruited around one lakh employees in the last 10 years, for which members of the house appreciated her statement. However, they did not take into account that more than one lakh employees have exited from SBI alone during the same period. This is revealing.”

Advertisement

“From this data SBI is having huge vacancies unfilled. Despite the vacancies of about one lakh employees and officers, the outsourcing of jobs and the deployment of daily wage workers without making them permanent is a prelude to privatisation”, he added.

“Since the merger of State Banks with SBI on 31 March 2017, staff strength in the clerical cadre has declined by at least 75,000. Outsourcing and contractual labour is being increasingly enforced. Fixed term employment is implemented via subsidiaries like SBOSS. Employing contractual labour for core banking activities will compromise the confidentiality and customers’ trust in SBI”, Saji Varghese told Kanal.

Share Sale and QIP Fundraising

The privatisation concerns have intensified with SBI’s recent fund-raising moves. On 11 July 2025, BEFI had issued a press statement cautioning that the government’s decision to sell shares worth Rs 25,000 crore through a QIP is part of a phased privatisation strategy. Reports suggest that the government’s stake in SBI has become below 55 percent.

Saji Varghese said, “The sale of shares worth Rs 25,000 crore in State Bank of India is aimed at phased privatisation. In 2017, the bank had sold 522 crore shares, reducing the government’s stake to 56.92 percent. Now, with the latest sale, the stake falls further below 55 percent. This is nothing but an open attempt to privatise the bank in a phased manner, sacrificing national interests.”

The government had earlier announced in the budget that public sector banks, including SBI, would undertake share sales. Reports confirm that PSBs are set to raise up to Rs 45,000 crore in FY26 through similar fundraising mechanisms.

Saji Varghese also highlighted severe staff shortage leading to customer anger, employee harassment, long working hours, work-life imbalance, and reported suicides of over 500 bank staff in recent years.

Speaking to Kanal, Soumya Datta, Joint Convenor of Bank Bachao Desh Bachao Manch and the former General Secretary of All India Bank Officers’ Confederation(AIBOC), criticised the bank management’s approach to assessing manpower needs in branches. “Artificial collation of data has been used to determine manpower requirements in SBI branches for the past six to seven years. This does not reflect the actual needs of the branches or the staff. Due to staff shortages and excessive responsibilities, bankers face immense work pressure and stress, affecting both their mental and physical health. As a result, the attrition rate has risen sharply in recent years, particularly among officers. Recruitment is far from adequate to offset separations caused by attrition and retirements. Many eligible workmen are also declining promotions to officer posts because of the heavy pressure and distant transfers,” Datta, who is also a retired officer from SBI, told Kanal.

UFBU Representation to Finance Ministry

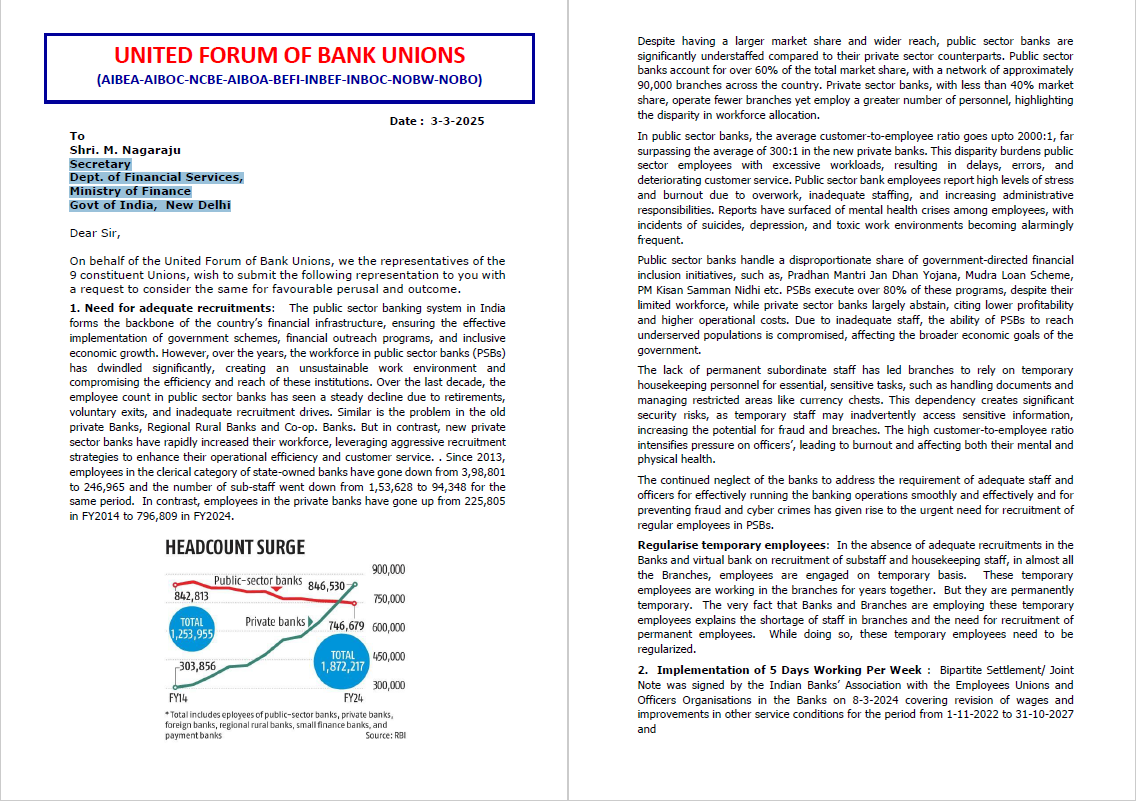

The United Forum of Bank Unions (UFBU), in its letter dated 03 March 2025 to the Secretary, Department of Financial Services(DFS), Ministry of Finance, raised concerns over the acute staff shortage, stagnant recruitment, and increasing work burden on public sector bank employees. The letter noted that while private banks are expanding aggressively with new recruitments, PSBs including SBI are failing to replenish their workforce.

Image - UFBU’s letter to the Secretary of DFS highlighting the need for adequate recruitment.

The UFBU pointed out that public sector banks handle over 60 percent of India’s banking business but operate with a significantly understaffed workforce compared to private banks. The letter urged the government to intervene and ensure adequate recruitment to protect the efficiency and reach of public sector banks.

Impact on Customers and Operations

Union representatives have repeatedly warned that contractualisation of banking jobs and outsourcing critical functions such as cash handling, verification, and security management could compromise customer confidentiality and increase risks of fraud and data breaches. Employees face mounting work pressure, which has led to reports of stress, health issues, and deteriorating customer service standards.

The combined trends of large-scale employee exits, lack of recruitment, outsourcing of core banking functions, and the government’s share sale programme have heightened concerns among unions about the future of SBI as a public sector bank. With SBI holding a pivotal role in implementing financial inclusion programmes and serving the common people, the ongoing developments are being viewed by unions as a systematic attempt towards privatisation. The outcome of this debate will have significant implications for the country’s banking sector and financial stability.

(NB: A response was sought from representatives of the SBI Staff Union, affiliated to NCBE, the majority organisation of workmen in SBI. It will be included if received.)

No comments yet.