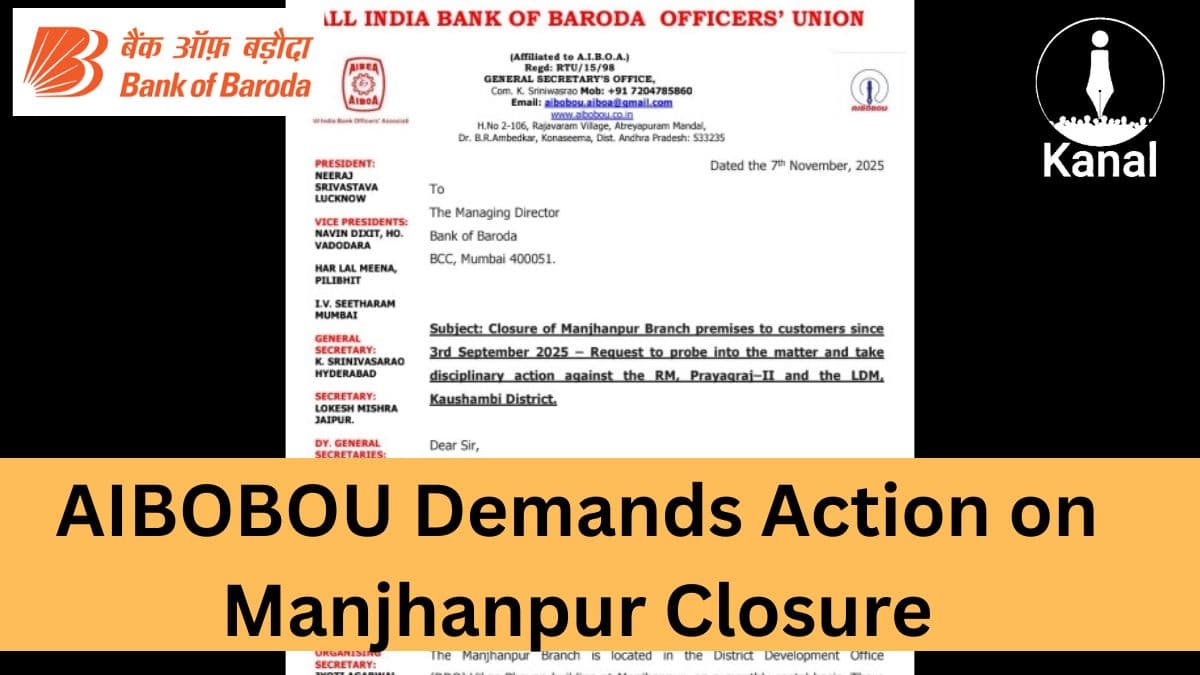

AIBOBOU Flags Concerns Over Manjhanpur Branch Closure, Calls for Formal Inquiry

The All India Bank of Baroda Officers’ Union has raised concerns regarding the closure of the Manjhanpur Branch. The union has requested an investigation, citing operational disruptions and communication lapses.

Author: V.Gayathri

Published: 11 hours ago

The All India Bank of Baroda Officers’ Union (AIBOBOU) submitted a detailed representation to the Managing Director of Bank of Baroda (BoB) regarding the closure of the Manjhanpur Branch premises. The Union highlighted customer inconvenience, operational challenges, and several procedural issues. The letter seeks a formal probe and disciplinary action against officials responsible for decisions taken at the branch and district levels.

Advertisement

Image: AIBOBOU’s circular dated November 7, 2025

Courtesy: K. Srinivasarao, General Secretary, AIBOBOU

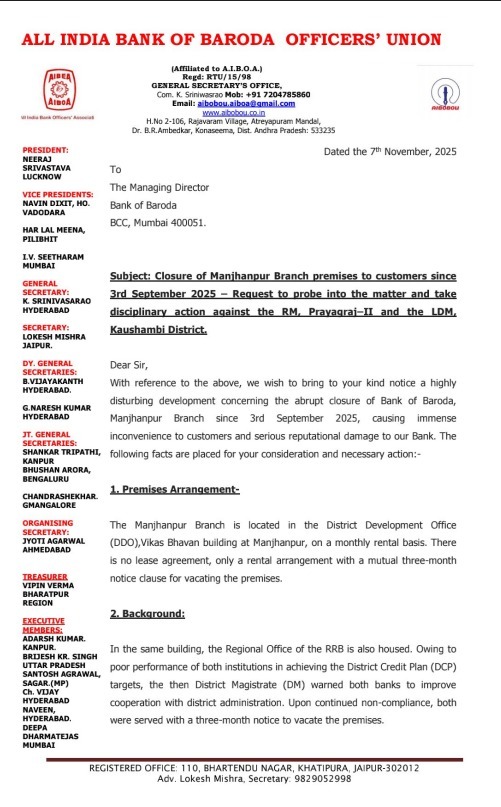

Premises Arrangement

The Union states that the Manjhanpur Branch operates from a rental space inside the District Development Office (DDO) building at Vikas Bhavan, Manjhanpur. The arrangement is described as a mutual rental understanding with a three-month notice period for vacating the premises.

Background of the Issue

The representation mentions that the Regional Office of the RRB also functioned from the same building. When performance under District Credit Plan (DCP) targets did not meet expectations, the District Magistrate instructed both banks to vacate the premises after continued non-compliance.

Failure of BOB to Act

According to the Union, while the RRB vacated within the notice period, BoB officials did not initiate any relocation process. Instead of showing progress on DCP parameters, attempts were allegedly made to manage the issue without results, which further displeased authorities.

Advertisement

Image: Internal document detailing concerns over the bank’s response within the notice period

Final Notice and DM Meeting

The representation states that in the last week of August 2025, bank officials held a meeting with the District Magistrate. The Union notes that the DM allowed continuation of branch operations on the condition that the bank would show tangible progress. However, the Union claims that officials did not follow up, leading to an order for immediate vacation of the premises.

Advertisement

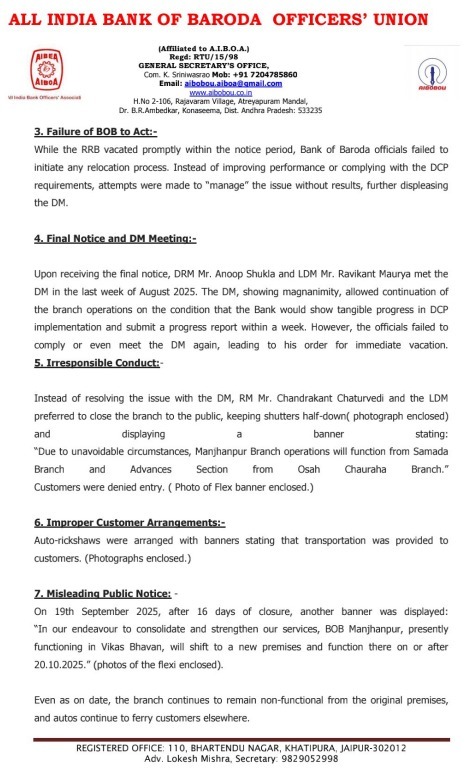

Branch Closure Notice and Customer Impact

The Union reports that instead of resolving the situation, the branch was closed with shutters half-down and a banner was displayed informing customers that operations would temporarily shift to nearby branches. Some customers were denied entry.

Image: Banner displayed informing customers about temporary operational shifts to nearby branches and Autorickshaws arranged by the branch for customer movement

Improper Customer Arrangements

The representation notes that autorickshaws were deployed to transport customers to other functioning branches.

Image: Branch closed with half shutter down during business hours

Misleading Public Notice Allegation

The Union states that a banner dated September 19, 2025 announced that the branch would function from new premises on or after October 20, 2025. However, the branch reportedly remained non-functional in its original location, and customers continued visiting alternate branches.

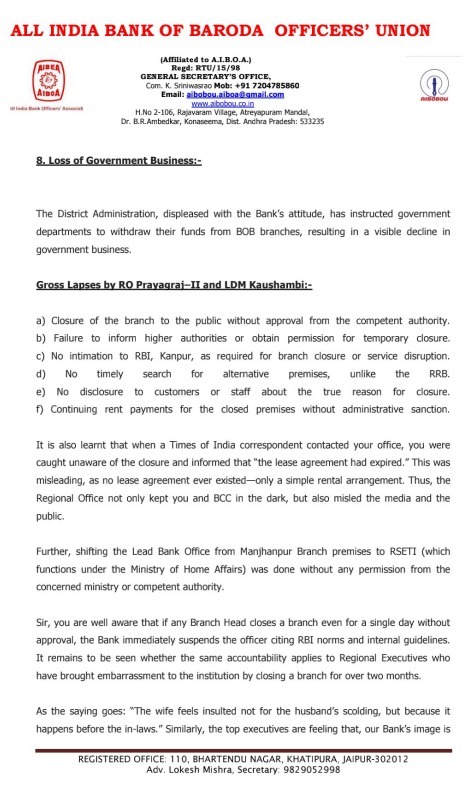

Image: Extract from the Union’s communication detailing lapses and loss of government business

Loss of Government Business

The Union claims that dissatisfied district authorities instructed government departments to withdraw their funds from the branch, causing a decline in government-related business.

Union’s Listed Lapses and Concerns

The document outlines various concerns, including:

- Closure of the branch without required approvals.

- Failure to inform higher authorities or obtain permission for temporary closure.

- Absence of timely search for alternative premises.

- Lack of communication to customers and staff regarding reasons for closure.

- Continued rental payments despite the branch being non-operational.

The Union also notes that the shift of the Lead Bank Office from Manjhanpur Branch to another location was done without required approvals.

Union’s Demands

The AIBOBOU has requested:

- An immediate investigation into the incident.

- Fixing of responsibility and accountability on the concerned officials.

- Disciplinary action for alleged guideline violations and concealment of facts.

The Union expresses the expectation that the bank’s leadership will ensure fairness, accountability, and preventive measures to avoid recurrence.

Image:Final section of the Union’s letter outlining key demands and request for action

The representation submitted by the AIBOBOU outlines procedural lapses and operational disruptions related to the Manjhanpur Branch closure. The Union stresses the need for transparent inquiry, accountability, and corrective measures to address customer inconvenience and administrative concerns.

No comments yet.