AIWBOA Flags 16% Interest Recovery on TA Bills After PNB Issues 100% Perquisite Tax Relief

The All India We Bankers Officers’ Association has raised concern over 16% interest charged on Travel Allowance bill recoveries at Punjab National Bank. The issue surfaced soon after the bank announced 100% perquisite tax relief for employees.

Author: Kalyani Mali

Published: 2 hours ago

The All India We Bankers Officers’ Association (AIWBOA) has formally raised the issue of 16% interest recovery applied on previously reimbursed Travel Allowance (TA) bills at Punjab National Bank (PNB). AIWBOA National General Secretary Prabin Kumar Biswas told Kanal that the association was the first to flag the matter publicly.

Reference to Bank’s Perquisite Tax Circular

The development comes shortly after the bank issued a circular dated 10 November 2025, announcing 100% absorption of tax liability on the perquisite value of interest-free loans and concessional-interest loans for FY 2025–26.

Advertisement

Read More: Punjab National Bank to Absorb 100% TDS on Employee Loan Benefits

An officer who wishes to remain anonymous also told Kanal that interest at 16% was deducted from the date of suspense debit for the reversal of TA bills, covering a period of nearly three months.

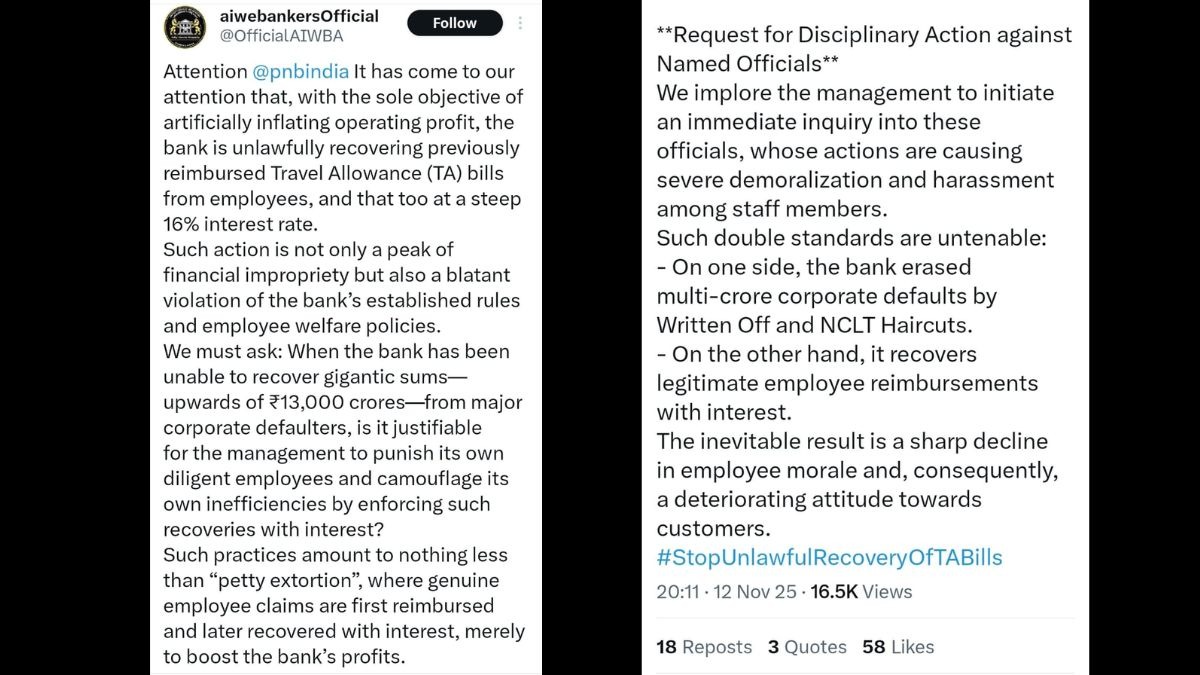

AIWBOA’s Objections and Request for Inquiry

AIWBOA stated in its public post that the recovery of previously reimbursed TA bills with 16% interest has raised concern among employees and, according to the association, goes against established rules and employee welfare guidelines. The union described the action as financially improper, questioned the need for such recoveries when large corporate dues remain pending, and referred to it as “petty extortion.” AIWBOA has requested the management to review the decision, conduct an internal inquiry, and take disciplinary action against the officials involved, stating that the issue has led to staff demoralisation.

Advertisement

Image: AIWBOA’s public statement raising concern over TA bill recoveries with 16% interest

Source: aiwebankersOfficial

Post Referencing the TA Recovery Issue

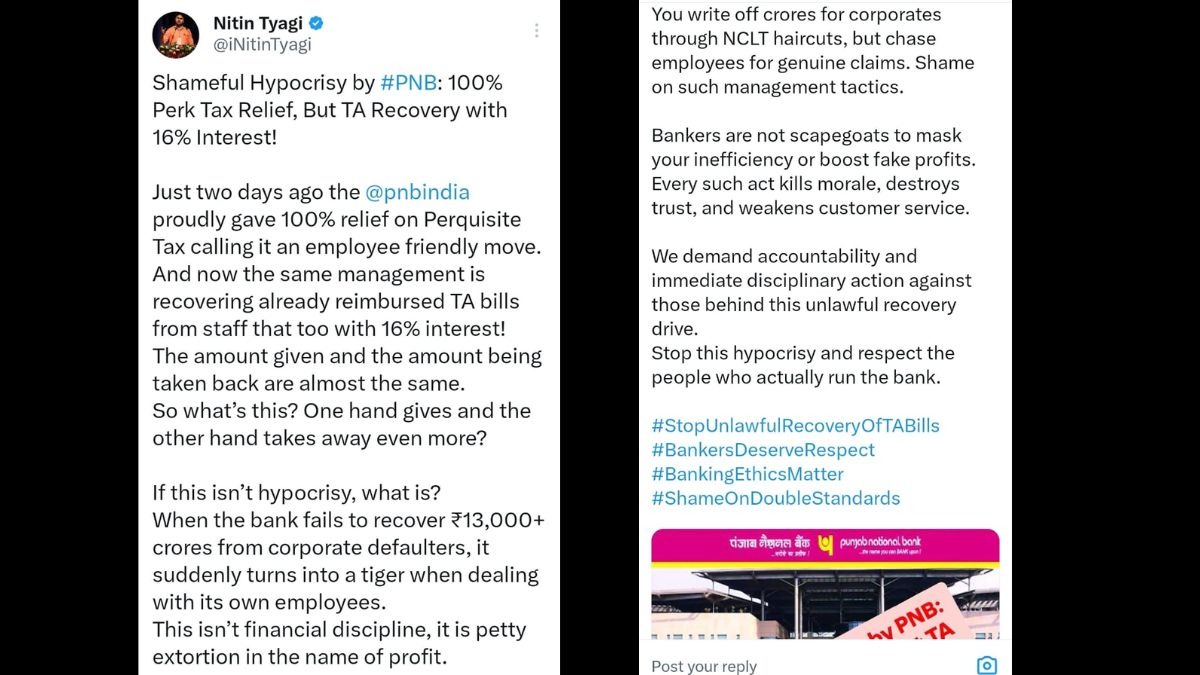

A tweet by Nitin Tyagi commented on the recovery of previously reimbursed TA bills with 16% interest and compared it with the recent announcement of 100% perquisite tax relief for employees.

Image: Tweet referring to the 16% interest recovery on TA bills

Source: Nitin Tyagi

AIWBOA has formally highlighted the issue of 16% interest recovery on previously reimbursed TA bills and has sought an internal review and action from the bank. The association’s statements and related public references outline the concerns raised regarding the recovery process.

Advertisement

No comments yet.