Bank of Baroda’s RCom Fraud Delay Faces AIBOBOU’s Scrutiny: 14 Lenders, Years of Default, and Late Action

The All India Bank of Baroda Officers’ Union has raised concerns with Bank of Baroda regarding the delayed classification of Reliance Communications and Anil Ambani’s loan accounts as fraud. The union has sought accountability and a clear explanation from the bank.

Author: Kalyani Mali

Published: September 8, 2025

On 5 September 2025, the All India Bank of Baroda Officers’ Union (AIBOBOU), raised strong objections regarding Bank of Baroda’s (BoB) decision to classify the loan accounts of Reliance Communications Limited (RCom) and its promoter Anil Ambani as fraudulent only now. The union stated that the delay, despite other lenders having already acted, raises serious concerns about governance, compliance, and accountability.

Advertisement

Background of the Case

As mentioned in AIBOBOU’s letter, BoB informed RCom on 2 September 2025 about classifying its loan accounts as fraud. RCom has been under the Corporate Insolvency Resolution Process (CIRP) since March 2020, with its resolution plan still pending approval before the NCLT, Mumbai. Other lenders such as State Bank of India (SBI) in June 2025 and Bank of India (BOI) in August 2025 had already declared these accounts as fraudulent.

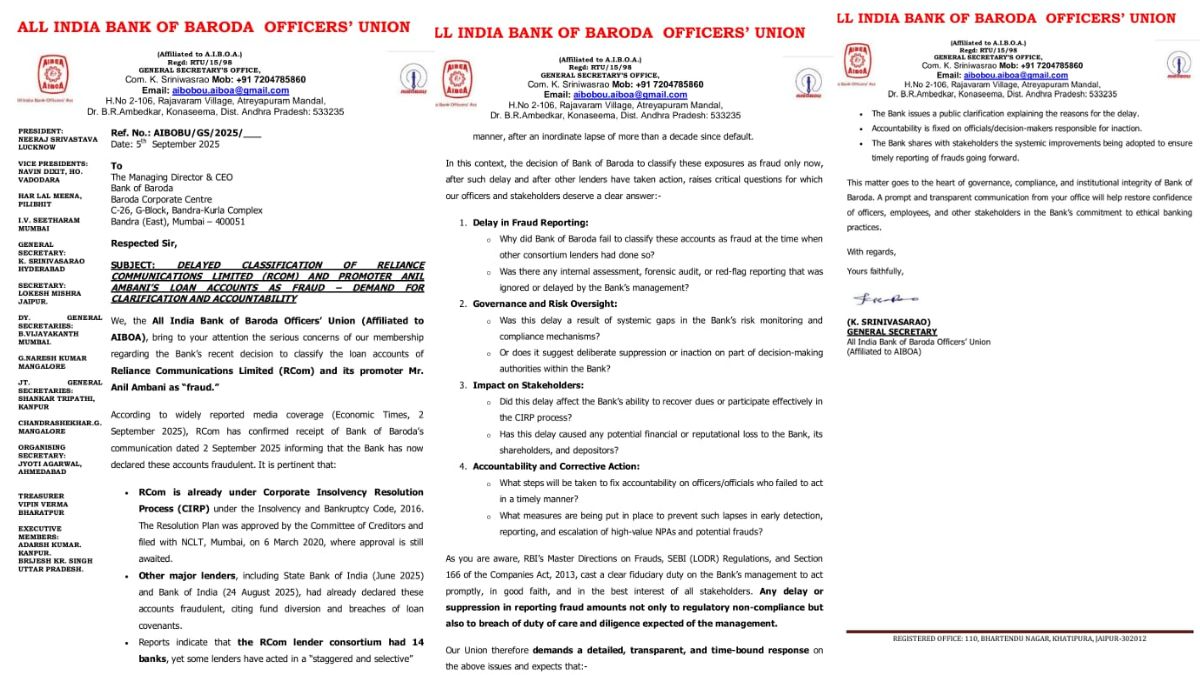

Image: AIBOBOU letter raising concerns on delayed fraud classification of RCom accounts

Courtesy: K. Sriniwasrao

Concerns Over Delay in Action

The union highlighted that the consortium of lenders included 14 banks, but actions were taken in a staggered manner. It questioned why BoB did not act earlier when others did. The union also raised the possibility of ignored audits, internal assessments, or delayed red-flag reporting.

Questions on Governance and Oversight

AIBOBOU sought clarity on whether the delay was due to systemic gaps in the Bank’s monitoring and compliance framework, or whether it reflected deliberate suppression by decision-making authorities. The union expressed concern that such lapses could compromise recovery efforts and harm the interests of shareholders, depositors, and employees.

Advertisement

Union seeks transparency and accountability

The union has demanded a detailed, transparent, and time-bound response from the Bank. It has called for a public clarification on the reasons behind the delay, fixing of accountability on officials responsible for inaction, and disclosure of systemic improvements being adopted to ensure timely fraud reporting in the future.

‘Staggered and selective manner’

Speaking to Kanal, K. Sriniwasrao, General Secretary of AIBOBOU, said “The delay raised questions of governance and integrity, especially since other lenders had already cited fund diversion and breaches of loan covenants.”

He further said, “The RCom lender consortium had 14 banks, yet some lenders have acted in a staggered and selective manner after an inordinate lapse of more than a decade since default, adding that RBI’s Master Directions on Frauds, SEBI (LODR) Regulations, and Section 166 of the Companies Act, 2013 cast a clear fiduciary duty on the Bank’s management to act promptly, in good faith, and in the best interest of all stakeholders.”

He concluded, “This matter goes to the heart of governance, compliance, and institutional integrity of Bank of Baroda, and only a prompt and transparent communication can help restore the confidence of officers, employees, and other stakeholders in the Bank’s commitment to ethical banking practices.”

No comments yet.