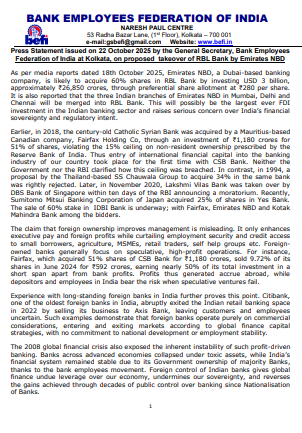

BEFI Opposes Foreign Takeover of RBL Bank by Emirates NBD

The Bank Employees Federation of India has strongly opposed the proposed acquisition of a majority stake in RBL Bank by Dubai-based Emirates NBD, warning that the move threatens India’s financial sovereignty and job security in the banking sector

Author: Nimmydev

Published: October 25, 2025

The Bank Employees Federation of India (BEFI) has raised serious concerns over reports that Emirates NBD, a major Dubai based bank, plans to acquire 60% of RBL Bank through a USD 3 billion (₹26,850 crore) investment. The federation argues that such foreign takeovers weaken India’s control over its banking system and could harm national financial interests.

Advertisement

Image - statement by BEFI

According to BEFI letter, Emirates NBD intends to buy a 60% stake in RBL Bank at ₹280 per share through a preferential allotment. The bank’s Indian branches in Mumbai, Delhi, and Chennai are also expected to merge with RBL Bank. BEFI described this as potentially the largest foreign direct investment (FDI) in India’s banking sector and a serious challenge to India’s financial independence.

Advertisement

The federation recalled previous foreign acquisitions in the Indian banking sector such as the takeover of Catholic Syrian Bank by Fairfax Holding in 2018, Lakshmi Vilas Bank by DBS Bank of Singapore in 2020, and a 25% stake in Yes Bank acquired by Japan’s Sumitomo Mitsui. It questioned the Reserve Bank of India’s (RBI) regulatory stance in allowing such deals that exceed foreign ownership limits.

BEFI stated that claims of better management under foreign ownership are misleading. Instead, such ownership often results in higher executive pay, reduced job security, and limited access to credit for small borrowers, farmers, and small businesses. The federation cited examples like Citibank’s exit from India’s retail banking in 2022, which left employees and customers uncertain.

Advertisement

The statement also warned that foreign banks prioritise profit-driven and speculative activities over inclusive financial growth. It noted that during the 2008 global financial crisis, Indian public sector banks remained stable, unlike many foreign banks that collapsed due to risky operations.

BEFI further criticised neoliberal policies that divert bank credit from small borrowers to big corporations and non-banking financial companies (NBFCs). It said foreign takeovers would worsen this imbalance and make Indian banks dependent on global finance.

The federation has urged the Government of India and the RBI to reject the proposed Emirates NBD takeover of RBL Bank. It also appealed to citizens to support the ongoing movement of bank employees to ensure that Indian banks remain under domestic ownership, serving the country’s development goals rather than foreign profit motives.

No comments yet.