Canara Bank’s Strong Q2 FY26 Results Bring Optimism for Employees, Investors, and Customers

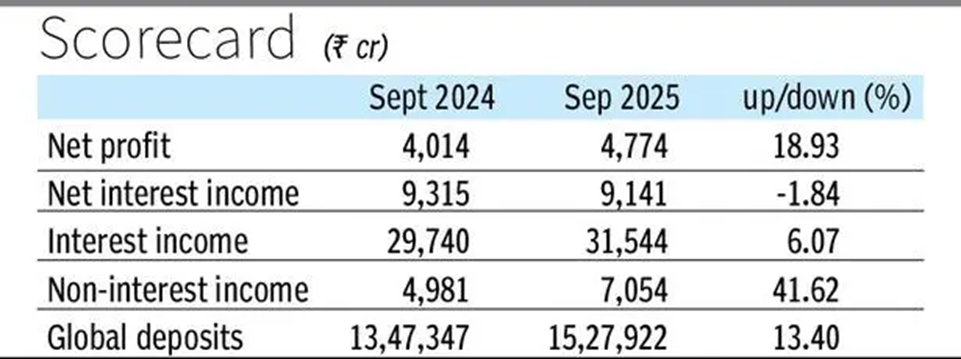

Canara Bank has reported a 19% rise in net profit in Q2 FY26. Despite a decline in net interest income, growth in deposits, advances, and improved asset quality strengthened overall performance.

Author: V.Gayathri

Published: October 31, 2025

Canara Bank has announced a significant year-on-year growth of 19% in its net profit, reaching ₹4,774 crore for Q2 FY26. This performance comes even as the bank experienced a decline in its Net Interest Income (NII), which fell by 1.87% to ₹9,141 crore compared to ₹9,315 crore in the same quarter of the previous year. The bank’s operational strength is reflected in strong growth in domestic deposits and advances, accompanied by improved asset quality indicators, as reported by The Hindu Business Line .

A Boost to Employee Confidence and Morale

Canara Bank’s performance for the quarter showcases positive momentum in key operational metrics. With domestic deposits growing 12.62% year-on-year to ₹13,94,999 crore and domestic advances increasing by 13.34% to ₹10,81,428 crore, the bank’s steady growth reinforces confidence among employees. A rapidly growing lending portfolio, especially in retail, agriculture, and MSME sectors, provides a motivating environment for the workforce.

Advertisement

Image: Canara Bank reports 19% YoY profit growth in Q2 FY26, supported by strong operational performance.

Source: The Hindu Business Line

A Promising Outlook for Investors

Despite the dip in NII, profitability strengthened due to improved asset quality and sustained growth in advances. Gross NPAs declined from ₹29,518 crore to ₹27,040 crore quarter-on-quarter, while Net NPAs improved from ₹6,765.2 crore to ₹6,113.2 crore. Investors may view this as a positive signal of disciplined financial management.

Positive Developments for Customers

The bank’s lending portfolio displayed robust growth across key segments. RAM (Retail, Agriculture, and MSME) credit expanded by 16.94%, while retail credit alone surged by 29.11%. Growth in housing loans (15.25%) and vehicle loans (25.58%) indicates increased accessibility of credit for customers and growing demand across sectors.

Shared Success Across the Organisation

With all core operational metrics moving upward, the bank’s performance demonstrates collective contribution from employees, management, and strategic decision-making. The increase in domestic deposits and advances, along with better asset quality, highlights coordinated efforts across departments.

Future

Canara Bank’s trajectory suggests a stable outlook, supported by consistent growth in its lending segments and declining NPA levels. Continued focus on operational efficiency and customer-centric initiatives may help sustain this positive momentum in upcoming quarters.

Canara Bank’s Q2 FY26 results reflect resilience and strong operational performance. Even with a dip in net interest income, improved asset quality, expansion in lending, and growth in domestic deposits contributed to a 19% increase in profit, reinforcing the bank’s position in the public sector banking landscape.

No comments yet.