Clerks are Not Redundant: Fight the Silent Outsourcing of Our Work

This opinion piece, written by Tuhin Shubra Samaddar, argues that clerical roles in public sector banks are not redundant but silently outsourced through the Business Correspondent model and casual hiring. It exposes how core banking tasks are shifted away from permanent staff, undermining job security and weakening workers’ bargaining power. Tuhin Shubra Samaddar is a young banker and an activist with All India Union Bank Employees' Federation(AIUBEF).

Author: Tuhin Shubra Samaddar

Published: October 28, 2025

At railway stations, letter writers were once trusted companions for the illiterate, giving voice to feelings on paper. Their stalls bustled with work, and there was little reason to believe it would ever end. But as telephones spread, the letters grew fewer, the benches quieter. Their role faded, not with a sudden blow, but through the slow erosion of relevance. When computers first entered bank branches, many believed the clerk’s desk would soon be obsolete. Screens and software seemed poised to take over every transaction. Yet, even as technology grew, the work did not vanish — it only shifted. Account openings, compliance checks, and customer care still needed a human hand. Far from disappearing, the role simply evolved, though in ways often hidden from view. Banking clerks today stand at a similar crossroads. We are told our work is redundant, that technology has replaced us. But the truth is different: our tasks are being quietly handed over to others.

Advertisement

The business correspondent model emerged in 2006 when the Reserve Bank of India introduced it as an alternative banking channel. While it was primarily mooted to act as a vital tool for financial inclusion and cater to the rural and semi urban population, it was given permission to open such BC points even in metropolitan areas. It has also been reported that over 52 crore AePS transactions are processed monthly, with business correspondents playing a crucial role. Interestingly, the management and the government of India simultaneously peddle the argument that the need for Clerks have decreased primarily due to technological advancements. Is it really the case? Let us look at some of the job roles performed by the Business Correspondents.

• Account Opening • KYC Updation

Advertisement

• Cash Withdrawal/Deposit • Renew TD/RD

• Mini statement / Passbook Printing • Apply for RuPay debit cards

Advertisement

• NEFT/IMPS • New Pension Scheme mobilisation

The BC personnel are authorised to open BSBD accounts through the e-KYC module. While branches also have the authorisation to open the accounts yet sizable pressure is put to bypass this task completely to the BC Points. Similarly, the bulk of the non-transactional work that is undertaken by the banks involves KYC updation for compliance to C-KYC and Re-KYC norms. Outsourcing this task to BCs mean a sizable portion of clerical work is being tactfully shifted to BC counters. BCs are authorised for Cash receipt and Fund Transfer upto Rs.49000/- per day and cash payment up to Rs. 25000/- per day. While the banks have repeatedly stated guidelines that Branches must ensure that BC does not function from the branch premises yet clear violations exist in multiple branches with full knowledge of the regional management. Instances can also be found where to bypass this norm, BC points are set just across the Branches outside their specified area of operation of the BC. This act essentially means that the core banking roles which would otherwise have to be performed by a clerk are now tactfully bypassed to the BC point adjacent to the branch.

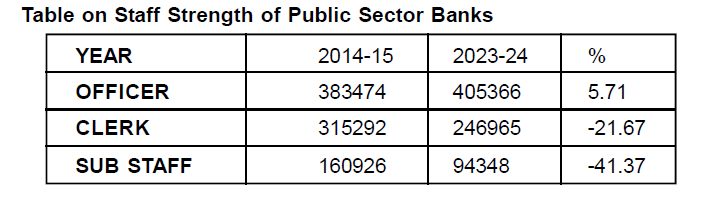

It has been reported in the Jan Dhan Darshak app that 13,98,951 Business Correspondents are functioning in the country as of 31.01.2025. Thus, it shows that the reduction of clerical staff is not solely a result of technological advancement, but a direct result of outsourcing the core clerical tasks to the Business Correspondents.

However there is more to what meets the eye. The slow yet steady decline of Clerical posts is being aided by various newer outlets. Unlike the initial days of computerization, where all the banking works were confined to that of the Core Banking Solution, now it has been diversified. The banks have slowly migrated various modules like that of Account opening, CKYC, Signature Scanning etc. to Tabs and Mobile phones for ease of access.

There are several other tasks like that of feeding of Loan proposal Data, CERSAI which has to be performed outside of the CBS Software. The shortage of manpower has created such a situation that the employees and officers are themselves handing over these non–transactional modules and such tasks are often performed by an apprentice or even a daily wager. The Officer/Clerk shares their Login credentials and occasional One Time Passwords and the other personnel gains access. Thus the task which would have otherwise required Clerical intervention and could have possibly resulted in recruitment is now virtually outsourced with the knowledge and sometimes consent of the overburdened clerks themselves.

While the Banks have a formally recognized relationship with the BC’s and apprentices, yet the huge number of casual workers/ daily wagers working in banks are working without any fixed contract and are thus not governed by any benefits enjoyed by the permanent employees. The casual workers are hired mostly to tend to housekeeping and other activities which were to be actually performed by the Subordinate Staffs. But the lack of recruitment in this cadre has resulted in almost all branches to hire such casual workers.

But to think that this section is only performing the duties of the subordinate cadre would be a wrong assumption. The inconvenient truth is that all such duties that can be performed outside CBS setup are also handed over to the casual staff. The workload becomes such that while the permanent employees themselves work on the Live Server; they often give access to the dummy server to the casual employee who performs non-transactional tasks of Passbook printing and balance enquiry from that counter. While the 12th Bipartite mandates that Clerks might have to accompany officers to Loan Recovery or marketing yet it becomes unfeasible and so this is also where casual staff perform clerical duties.

Since there is no official data on this large manpower thus it becomes easy for management and policy makers to statistically camouflage the situation. The fact lies that a huge percentage of jobs which could have been performed using clerical manpower have been already outsourced to various non-technological alternative channels i.e. the same tasks are not being done digitally but by another human being.

Secretly and silently this transition is going on not only in our sector but other sectors as well where the jobs to be performed by permanent workmen are being shifted. This in turn reduces the management's dependency on us and reduces our bargaining power. It has been recently witnessed that when the Bank Employees went on strike on 9th July 2025 the management had taken full provisions to keep the BC points and other channels active and had appealed to the customers also to use their services. Thus with rapidly changing job roles within the banking sector it falls upon all of us to be aware of the reality and combat our own redundancy.

[Disclaimer: The above article is republished by Kanal from BEFI NEWS Issue No. 72(New Series) October, 2025. The views expressed in this article are those of the author and do not necessarily reflect the editorial stance of Kanal.]

Comments

- Amit Kumar Das

This a thought provoking article by comrade Tuhin which not only address the glaring issue of the diminishing number of clerks due to various factors but it also highlights the need to remain strong and bonded and not fall for the lure of money by taking promotions as officers. I assume that we will be quite shocked if we could find out the data which shows the number of clerks who became officers and thus reduced our strength and bargaining power along with respective governments who tried to benefit from banks by giving loans to their chosen people without even thinking of these large financial institutions and their respective employees. Outsourcing is a big headache for the strength of our clerical union and we know it is a slow poison for us and I agree with comrade Tuhin that we need to take these casual employees under our wings if we want to survive the onslaught by the government. It is also to be noted that if we could somehow prevent our clerks in taking up promotions would be truly the icing on cake. Want to thank comrade Tuhin in bringing to light this issue because a capitalist government won't stop to topple us but we can be a force to reckon with if we stay bonded .

Posted on October 29, 2025