ICICI Bank’s Concerns Raised Over Handling of Credit Card Documentation Request

A customer’s son has alleged that ICICI Bank failed to provide basic credit card documents of his late father despite repeated requests made between April and November 2024. The issue, highlighted on social media, raises questions over what documents were collected when the credit card was originally issued and how the bank is processing such requests.

Author: Nimmydev

Published: 18 hours ago

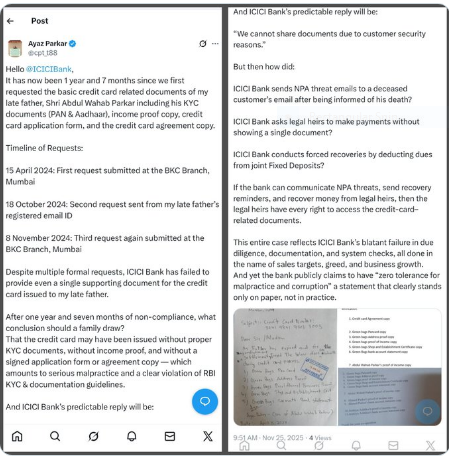

According to the complaint, the ICICI bank has been unable to furnish key records such as PAN, Aadhaar, income proof, the signed application form, and the credit agreement copy. The son of the customer claims that three formal requests were submitted over 1 year and 7 months, but no document has been shared.

Advertisement

Image: Tweet by Vijaya Sharma and Ayaz Parkar

Source - X

Advertisement

He further states that the bank cited “security reasons” for not providing the documents, while simultaneously sending overdue reminders, contacting the family for payments, issuing NPA related messages to the deceased customer, and adjusting funds from a joint fixed deposit.

According to the social media post, these actions have led to questions on whether proper KYC was conducted, whether income proof and application forms were taken, and why recovery actions were possible but document sharing was not.

The matter has prompted concerns about compliance with RBI’s KYC and credit card guidelines. Clarity from ICICI Bank is awaited to understand whether the documentation exists and how the case was handled.

No comments yet.