Odisha Grameen Bank Directs CSAs to Perform Gold Purity Check Contrary to 12th BPS Guidelines

Odisha Grameen Bank Customer Service Associates flag forced gold-purity checks violating 12th BPS, highlighting rising workload pressure and widening gaps in HR compliance.

Author: Saurav Kumar

Published: 10 hours ago

Customer Service Associates (CSAs) in Odisha Grameen Bank (OGB) have raised serious objections to being compelled to undertake gold purity checks—a responsibility they allege, falls strictly outside their job jurisdiction and directly violates the 12th Bipartite Settlement (BPS).

The discontent intensified after Finacle-generated gold loan documents were found to include a signature field implying that the CSA has “checked the purity” of the pledged gold. Employees argue that this constitutes an unauthorised shift of responsibility onto frontline staff who are neither trained nor legally empowered to certify the purity of gold jewellery.

Violation of 12th BPS Directive

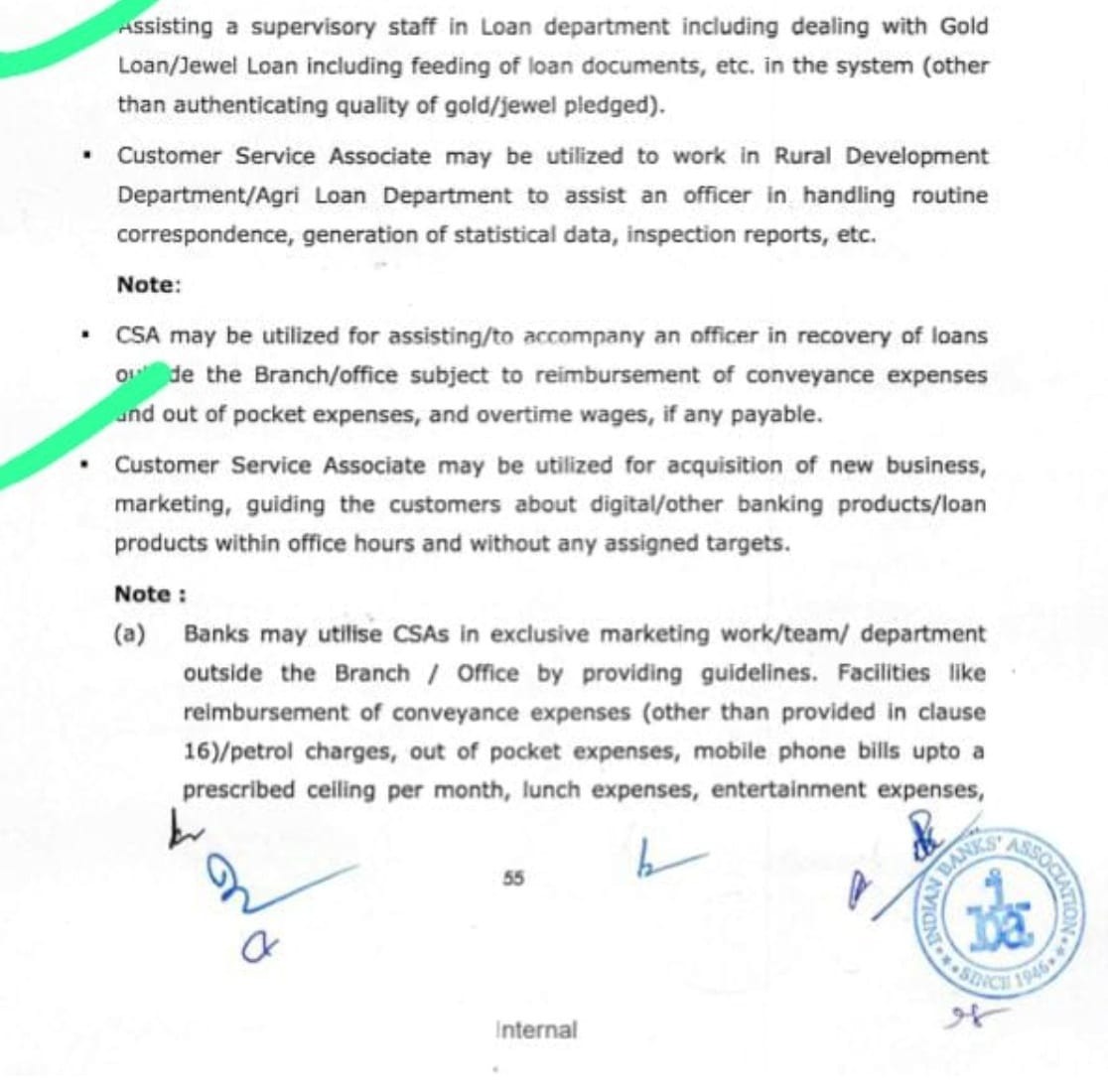

The duties clause of 12th BPS guidelines clearly states that CSAs may assist in routine documentation related to gold loans. It states, “Assisting a supervisory staff in the Loan department including dealing with Gold Loan/Jewel Loan including feeding of loan documents, etc. in the system (other than authenticating the quality of gold/jewel pledged).”

Advertisement

Image: The responsibility of CSA defined in 12th BPS on Gold authentication

Advertisement

One CSA, speaking to Kanal on condition of anonymity, said, “We are being asked to sign off on gold purity checks that we are neither trained nor authorised to perform. It is a clear violation of 12th BPS norms and puts us at unnecessary legal risk. This must stop immediately.”

He further added, “Such disproportionate and forceful assignment of responsibilities—despite explicit rules—only reflects the continuous pressure CSAs are working under.”

There are 1,304 CSAs posted across 980 branches of Odisha Grameen Bank. Staff say that this issue comes on top of persistent concerns—recently, CSAs also reported denial of leave during peak workload periods and mounting pressure to push social-security scheme enrolments. Together, these grievances underscore the widening gap between mandated HR guidelines and the realities faced by CSAs on the ground.

The continued practice of assigning gold-purity responsibilities to CSAs not only formalises a clear violation of the 12th BPS, but also exposes a deeper breakdown in HR discipline — creating compliance risks for employees and serious liability for the bank itself.

No comments yet.