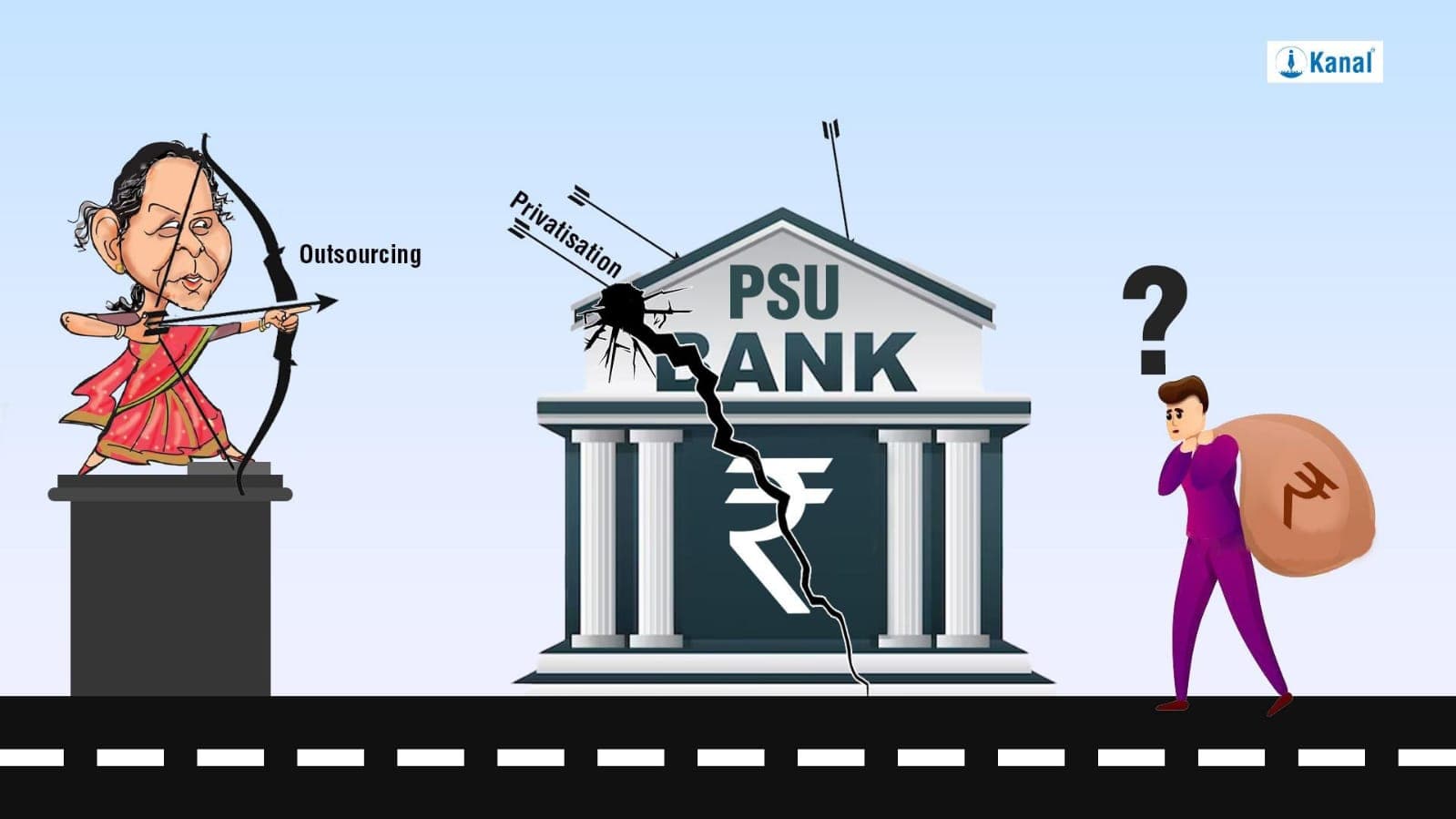

Outsourcing in Public Sector Banks: Privatisation in Disguise

The Indian Government's privatisation push extends to public sector banks, with outsourcing as a central strategy. This move has sparked controversy and resistance within the banking sector. Here are the ways of implementing outsourcing in the banking sector.

Author: Saurav Kumar

Published: October 2, 2023

The Public Sector Undertaking (PSUs) in India are slowly being privatised by the Government of India and Public Sector Banks (PSBs) are the recent to join the league.

PSBs such as State Bank of India and Bank of Baroda are endorsing privatisation in various manners and outsourcing has emerged as the prime measure of introducing privatisation.

What is Outsourcing?

Outsourcing can be defined as any bank's use of a third party (either an affiliated entity within a public sector bank or an entity that is external to the corporate group) to perform activities on a continuing basis that would normally be undertaken by-the bank itself, now or in the future.

Advertisement

In 2006, the Reserve Bank of India (RBI) drafted the ‘Outsourcing Policy’ and guidelines which mentions the usage of third parties in the Indian banking sector.

Aim of Outsourcing

The claims made by banks behind the implementation of outsourcing in the banking sector were enhancement of product quality, lowering costs and developing competitive strategies.

So, after the rules were laid down, public sector banks such as Bank of India started outsourcing with a private firm named Switch Company, whereas the State Bank of India (SBI) outsourced its networking services in 1500 branches and 3000 ATMs to the company named Data Craft.

As per the Bank of India’s 2020 document on outsourcing, multiple risks such as strategic, compliance, reputation, operational, etc were being explained. Although the advantages of outsourcing mentioned in the document could not outnumber the risks.

Advertisement

Fronts of Outsourcing in PSBs

The push to privatise the state run banks have been implemented through different channels like setting up of subsidiary wings that would engage employees in works such as marketing, outsourced work such as Aadhar seeding, Cash withdrawal, etc.

The primary mode of outsourcing in the public sector banks was done via setting up Customer Service Points (CSP) that undertakes few functions of the bank such as aadhar seeding, balance checking, etc.

Advertisement

Kanal visited a CSP unit working in tandem with the Bank of India in the eastern Indian state of Jharkhand.

Image: People in que at a CSP working for Bank of India

Image Credit: Saurav Kumar

The handler of the CSP in Dhanbad district of Jharkhand named Vikas Kumar told Kanal, “I own this Customer Service Point for the Bank of India taking care of issues of customers such as cash withdrawal-deposit, UID seeding, fund transfer. On every transaction I earn a certain amount that runs my livelihood.”

Vikas categorically mentioned that specific works were outsourced to him by the Bank of India which did not include any benefits from the bank.

So, the functioning of the CSP as an outsourcing agency exposes the absence of financial security that a government job provides.

As per official declaration of the SBI, SBOSS undertakes services like providing cash management services, monitoring and reconciliation of cash movements between branches and automated teller machines.

In addition to this move, the SBI in Kerala Circle created a Multi-Purpose Product Sales Force (MPSF) entrusting 1200 clerical staff with marketing duties with huge targets.

However, the establishment of the MPSF has raised concerns among bank employees. The Travancore State Bank Employees’ Association (TSBEA) believes that this initiative could result in staff being reassigned from branch-based transactional roles to marketing activities.

On similar lines, the Bank of Baroda floated a subsidiary named Baroda Global Shared Services.

Opposition to Outsourcing and Marketing Strategy

The State Bank of India (SBI) wholly owned subsidiary State Bank Operations Support Services (SBOSS) functioning came under scrutiny of the bank unions. According to All India State Bank of India Employees’ Association, the establishment of subsidiary State Bank Operations Support Services Private Ltd (SBOSS) would lead to outsourcing of basic banking functions, jobs and consequent risks.

Surprisingly, the SBI’s decision to operate SBOSS got a jolt from India’s premier bank, the Reserve Bank of India. The RBI opposed the responsibilities to be undertaken by the SBOSS refusing any permission for any financial activity to be undertaken by this subsidiary.

The move to float SBOSS was also opposed by the Bank Employees Union alleging the push to normalise outsourcing and contract labour.

Formation of MPSF and diversion of 1200 clerical workforce towards marketing was vehemently opposed by the SBI Employees’ Federation in all district headquarters of Kerala. The union apprehended weakening of bank branches across the state thereby affecting its main operations.

The BEFI representative raised questions on diverting thousands of clerical staff for marketing. He said, “Engaging permanent staff (clerical) creates a vacancy in branches so that outsourced employees can be posted there.”

No comments yet.