PMJJBY & PMSBY Enrollment Pressure Rises Across Banks: Officers Raise Concerns over Targets, Duplication, and Staff Diversion

Pressure on Pradhan Mantri Jeevan Jyoti Bima Yojana and Pradhan Mantri Suraksha Bima Yojana enrollments has become a routine across banks. A source indicated that this push is being directed from the Department of Financial Services and is not limited to any single circle or bank.

Author: Kalyani Mali

Published: September 12, 2025

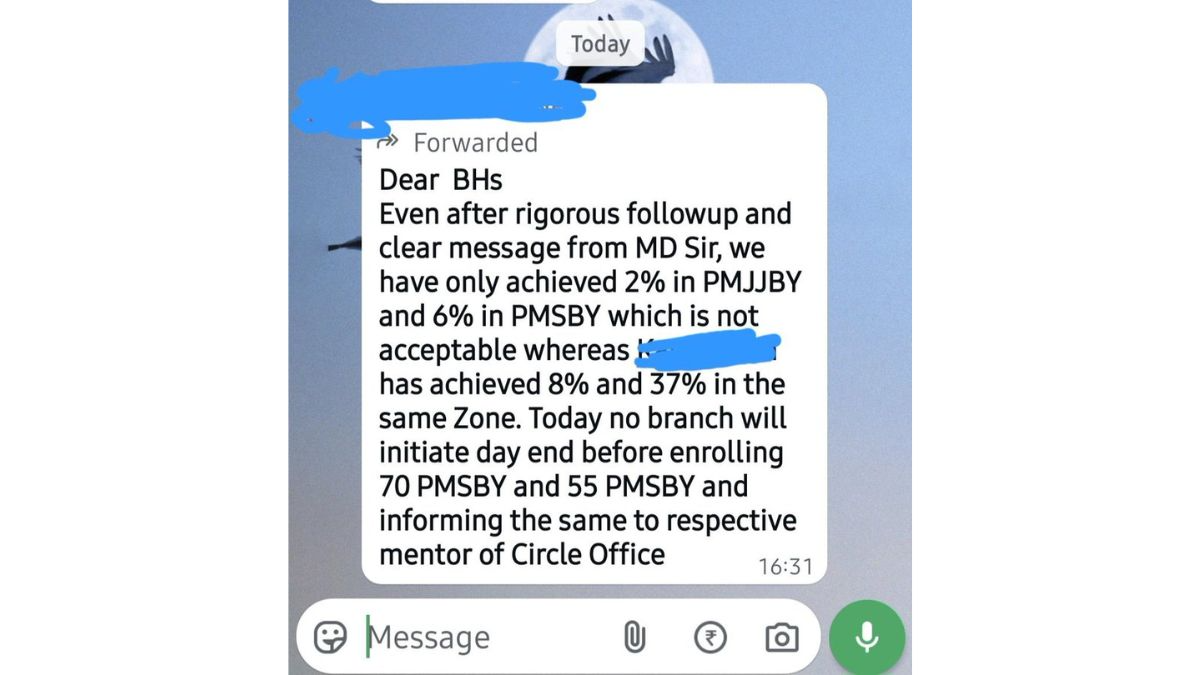

A recent internal communication shows how branches across several banks are being asked to aggressively push enrollments for Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) and Pradhan Mantri Suraksha Bima Yojana (PMSBY). These messages, circulated among branch heads, direct that no branch should close the day without enrolling a fixed number of customers under these schemes.

Advertisement

Speaking to Kanal anonymously, a banker said this has nothing to do with any circle or bank, as the pressure is coming from the Department of Financial Services (DFS). The officer further raised questions about how much profit banks actually make from these schemes and why manpower is being diverted if not for profit. He also questioned whether the same customer could be enrolled multiple times in different banks. In addition, he asked if loan and recovery work may get ignored due to such drives.

PNB Example of Target Enforcement

A recent internal message from Punjab National Bank (PNB) directed branches to step up enrollments under PMJJBY and PMSBY. The PNB circular instructed branch heads that no branch should close the day without enrolling a fixed number of customers under these schemes.

Image: Internal PNB message directing branches to ensure mandatory daily PMJJBY and PMSBY enrollments

Courtesy: Nitin Tyagi

Advertisement

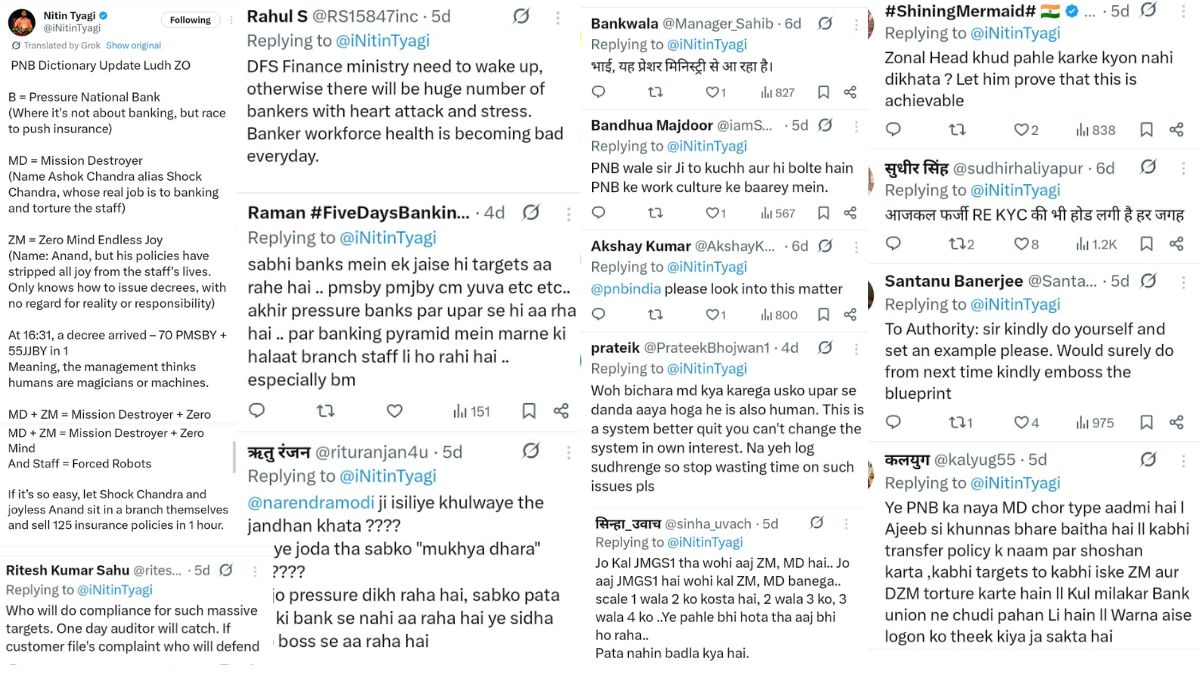

Responses from Bankers

The screenshot captures social media reactions where users voice frustration over increasing pressure on employees to meet unrealistic targets. Comments highlight stress, declining health, and a toxic work environment, with many pointing to management’s insensitivity and overdependence on targets. One user directly pointed out that the DFS needs to wake up, otherwise this could lead to rising health issues like stress and heart attacks among employees, with overall workforce well-being deteriorating every day. Image: Reactions on X

Image: Reactions on X

Manpower Concerns

High enrollment targets, according to the officer, risk diverting staff away from core activities like lending, recovery, and customer service. This shift, he warned, could weaken the banking system in the long run.

Advertisement

Duplicate Enrollments

The officer raised the issue of duplication, asking why suddenly every bank is being forced to push these enrollments and who is directing it. He questioned whether any system exists to check if a customer already holds insurance in another bank. Without such checks, the same scheme could be taken in two or three banks, with premiums collected each time.

Growing Concerns Over Target Pressure Banks

From frontline staff facing sales demands during floods to rising CASA and insurance targets, several recent reports highlight that already there is an increasing pressure on Public Sector Bank employees.

Read More:

SBI employee concerns amid floods

UCO Bank’s zero sanction show-cause

Central Bank’s CASA target pressure

SBI’s silent shift towards privatisation

SBI Life target pressure on bankers

As indicated by the concerns from different bankers, the push for PMJJBY and PMSBY enrollments originates from the DFS and covers multiple banks. Internal communications, such as the PNB message, show instructions to branches to meet daily enrollment targets. Concerns raised by bank officers include manpower diversion from core activities and the possibility of duplicate enrollments across banks.

No comments yet.