TGB’s Cross-Selling Circus: Gift Trips, Pressure Tactics and Ethics in Free Fall

Telangana Grameena Bank’s Wonderla “awareness” event exposes unethical cross-selling pressure, policy violations, and misuse of public bank platforms for private reward tourism.

Author: Neha Bodke

Published: July 29, 2025

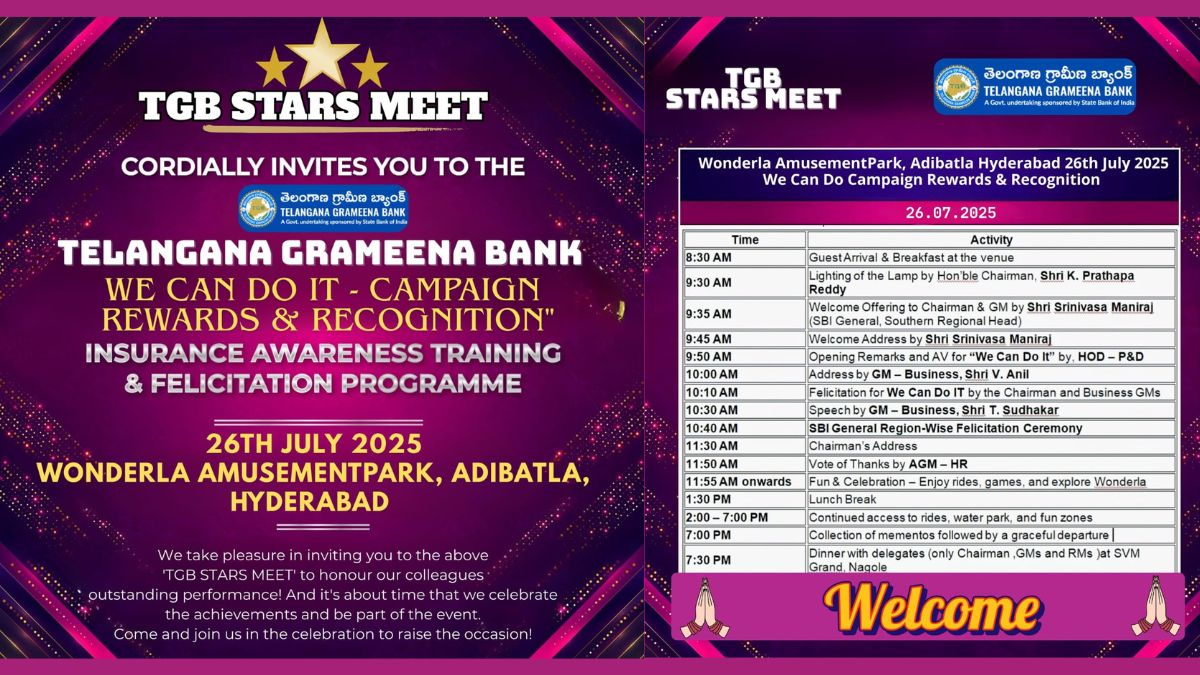

Telangana Grameena Bank (TGB) recently hosted an “awareness event” celebrating employees who topped in selling SBI Insurance products, a move that has drawn sharp criticism from unions. Alleging a growing pattern of unethical cross-selling pressure, union leaders have condemned the gathering as a veiled reward tourism exercise. Rather than promoting genuine financial literacy, they argue, the event reflects the misuse of a public sector rural bank’s platform to serve private commercial interests, undermining the core public service ethos of Regional Rural Banks (RRBs).

While staff across rural branches are facing mounting sales pressure and multitasking beyond roles, TGB organized a reward event at Wonderla with rides, gifts, and dinner under the banner of “insurance awareness”. Image: TGB employees on the stage taking photos with the dignitary.

Image: TGB employees on the stage taking photos with the dignitary.

Image: TGB employees on the stage taking photos with the dignitary.

The Official Push: Insurance Awareness Training & Felicitation Programme.

Organised under the banner of "Insurance Awareness Training & Felicitation Programme," the event featured activities such as gift distribution, podium photo sessions, and amusement park rides. Participation was limited to employees who had recorded high insurance sales, including third-party products. Union representatives have claimed that the programme focused more on recognising top performers in cross-selling than on delivering structured training sessions. Image: The posters of the event.

Image: The posters of the event.

Cross-Selling: The New Curse of Rural Banking

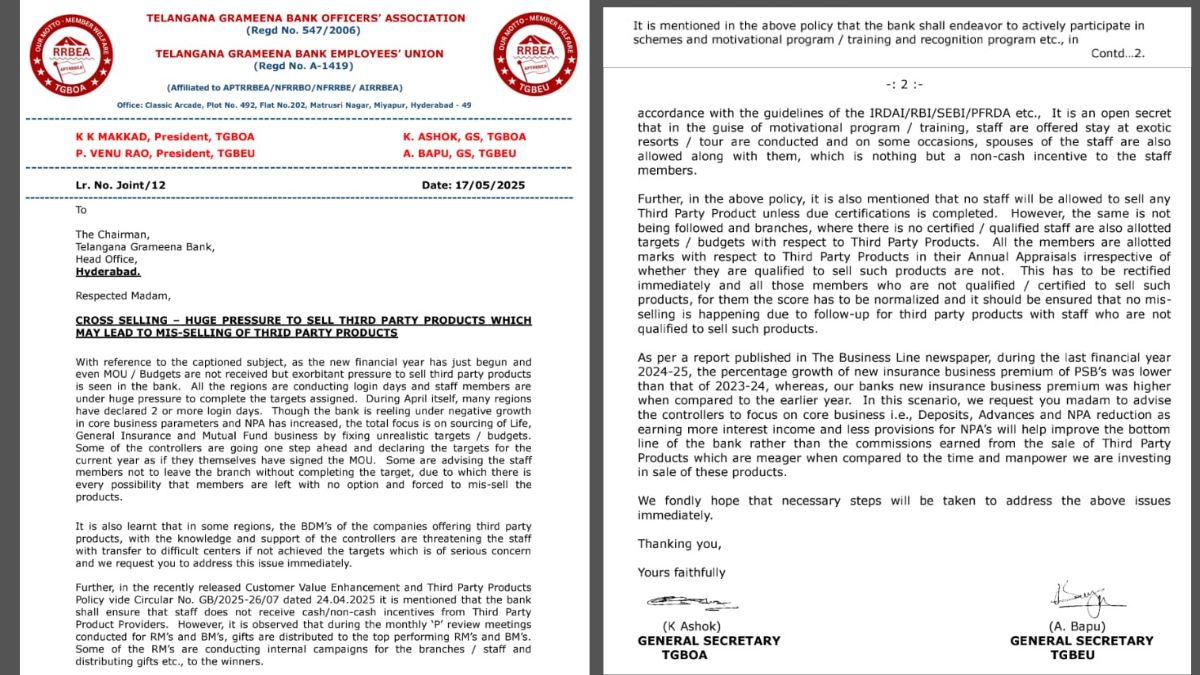

In a scathing joint letter to the Chairman of the bank, the Officers’ Association (TGBOA) and Employees’ Union (TGBEU) have blown the lid off this practice. Their letter dated 17 May 2025, exposes what every rural banker already knows but few dare to say aloud:

Advertisement

- Pressure to sell insurance and mutual funds, even before targets are officially finalised.

- Staff being threatened with transfer to remote branches if sales aren’t achieved.

- Non-certified staff being forced to meet third-party product targets.

- Gift campaigns and exotic resort stays used as backdoor “non-cash incentives”.

- Core banking business like deposits, loans, NPA recovery being neglected in favour of commission chasing.

“Awareness Training” or Incentive Tourism?

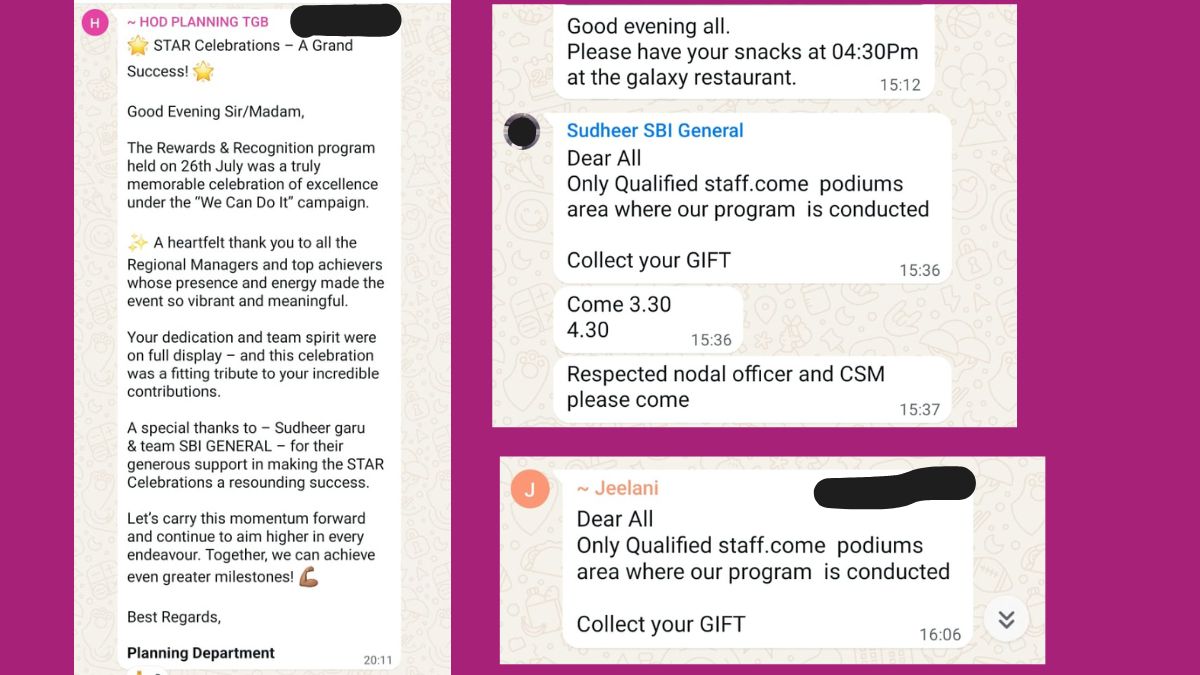

An employee who attended the event, speaking on condition of anonymity, questioned the nature of the programme, asking, “What kind of awareness training is this? What business do public sector rural bankers have in amusement parks while customers stand in queues and branches run on skeletal staff?” Image: The internal WhatsApp messages regarding the event.

Image: The internal WhatsApp messages regarding the event.

According to internal messages circulated among staff and reviewed by union representatives, the full-day schedule at Wonderla included morning speeches, followed by rides, games, gift distribution, and a grand gala dinner. Messages described the event as a “grand success,” with specific mention that gifts were handed only to “qualified” achievers. One such message also extended thanks to SBI General, the insurance partner for the programme.

Policy Violations in Broad Daylight

The bank’s own circular (No. GB/2025-26/07) clearly states:

- No non-cash or cash incentives from third-party product providers

- No third-party sales by non-certified staff

- Training and motivation programs must follow IRDAI/RBI/SEBI norms

In their letter, the unions rightly call it out: “In the guise of training, exotic resorts are booked, spouses included, this is nothing but a non-cash incentive.”

Advertisement

Image: The joint letter from TGBOA and TGBEU unions concerned about miss-selling.

Image: The joint letter from TGBOA and TGBEU unions concerned about miss-selling.

A Public Bank, Not a Private Bazaar

Union representatives and employees say such events are not isolated. They allege that cross-selling has become an informal performance metric across the sector, often outweighing core banking duties. Several staff members report pressure to meet sales targets, which they claim sometimes leads to mis-selling.

While official policy promotes banking for the poor, unions argue that internal targets increasingly prioritise insurance sales over service delivery.

And as the Wonderla event shows, sometimes it’s even rewarded with a party—evidently prioritising cross-selling over core banking services.

Advertisement

No comments yet.