UFBU Strongly Opposes Opening Top PSB & LIC Leadership to Private Sector

The United Forum of Bank Unions (UFBU) has strongly opposed the government’s move to open top leadership posts in public sector banks, LIC, and insurance companies to private candidates, calling it a threat to public accountability, employee morale, and the statutory character of these institutions.

Author: Ishna

Published: October 10, 2025

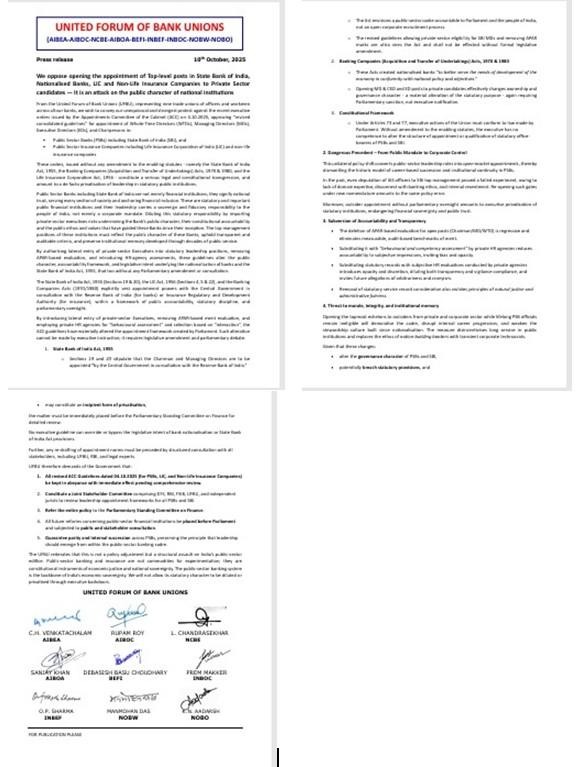

The United Forum of Bank Unions (UFBU), representing nine major trade unions of bank officers and workmen, has issued a strong statement opposing the Government of India’s recent move to allow private-sector candidates to be appointed to top leadership positions in public financial institutions such as the State Bank of India (SBI), nationalised banks, Life Insurance Corporation of India (LIC), and non-life insurance companies.

Image - Statement by UFBU

On 4 October 2025, the Appointments Committee of the Cabinet (ACC) approved revised consolidated guidelines for appointing Whole-Time Directors (WTDs), Managing Directors (MDs), Executive Directors (EDs), and Chairpersons in these institutions. For the first time, these positions will be opened to private-sector executives.

Advertisement

UFBU’s Key Concerns

Advertisement

- Violation of Statutory Provisions

- UFBU argues that the move bypasses the State Bank of India Act, 1955, the Banking Companies (Acquisition and Transfer of Undertakings) Acts, 1970 & 1980, and the LIC Act, 1956, which vest appointment powers with the central government in consultation with the RBI or IRDAI.

- Any such major change, UFBU stresses, requires Parliamentary amendment, not an executive order.

- Attack on the Public Character of Institutions

- Public sector banks and insurance companies are seen as national institutions of trust serving financial inclusion and development. UFBU believes bringing in private executives risks eroding their sovereign accountability and public ethos.

- Dilution of Transparency and Accountability

- The removal of APAR (Annual Performance Appraisal Report)-based evaluations and the introduction of behavioural assessments by private HR agencies are viewed as regressive. UFBU warns that this will introduce bias, reduce transparency, and open doors to cronyism.

- Demoralisation of Public Sector Workforce

- Allowing outsiders to occupy the highest posts while lifelong PSB officials remain ineligible is likely to hurt morale, career progression, and institutional memory. UFBU fears that this could weaken the stewardship culture built over decades.

- A Step Towards Privatisation

- According to UFBU, this decision is not a simple policy change but a structural shift towards privatisation of leadership in India’s financial sector, carried out through executive backdoors without legislative debate.

UFBU’s Demands

The UFBU has called on the government to:

Advertisement

- Keep the revised ACC guidelines of 4 October 2025 in abeyance.

- Form a Joint Stakeholder Committee with the Ministry of Finance, RBI, Financial Services Institutions Bureau (FSIB), UFBU, and legal experts to review the framework.

- Refer the policy to the Parliamentary Standing Committee on Finance.

- Ensure future reforms in public-sector financial institutions are first debated in Parliament and subjected to stakeholder consultation.

- Preserve internal succession in PSBs, ensuring leadership continues to emerge from within the public-sector cadre.

Unions Warn of Grave Risks

The UFBU has framed this development as a direct assault on India’s public-sector edifice. By opening top-level posts in PSBs and LIC to private executives, the government is seen to be undermining the statutory character and sovereignty of public financial institutions. The unions warn that such measures could endanger financial sovereignty, weaken employee morale, and compromise the institutions’ long-standing role in promoting economic justice.

UFBU has declared its determination to resist what it calls the “executive privatisation of statutory institutions” and urged immediate parliamentary scrutiny of the policy.

No comments yet.