BoB: AIBOBOU Raises Concerns over Work Pressure and WhatsApp Misuse

All India Bank of Baroda Officers’ Union has flagged rising staff concerns in Mumbai North Region. The union’s letter highlights pressure of unrealistic loan targets, forced WhatsApp communication beyond office hours, direct follow-ups bypassing hierarchy, delays in digital gold loans, and customer complaints over missing SMS alerts. It has urged the management to act swiftly in the interest of staff welfare and service quality.

Author: Kalyani Mali

Published: September 16, 2025

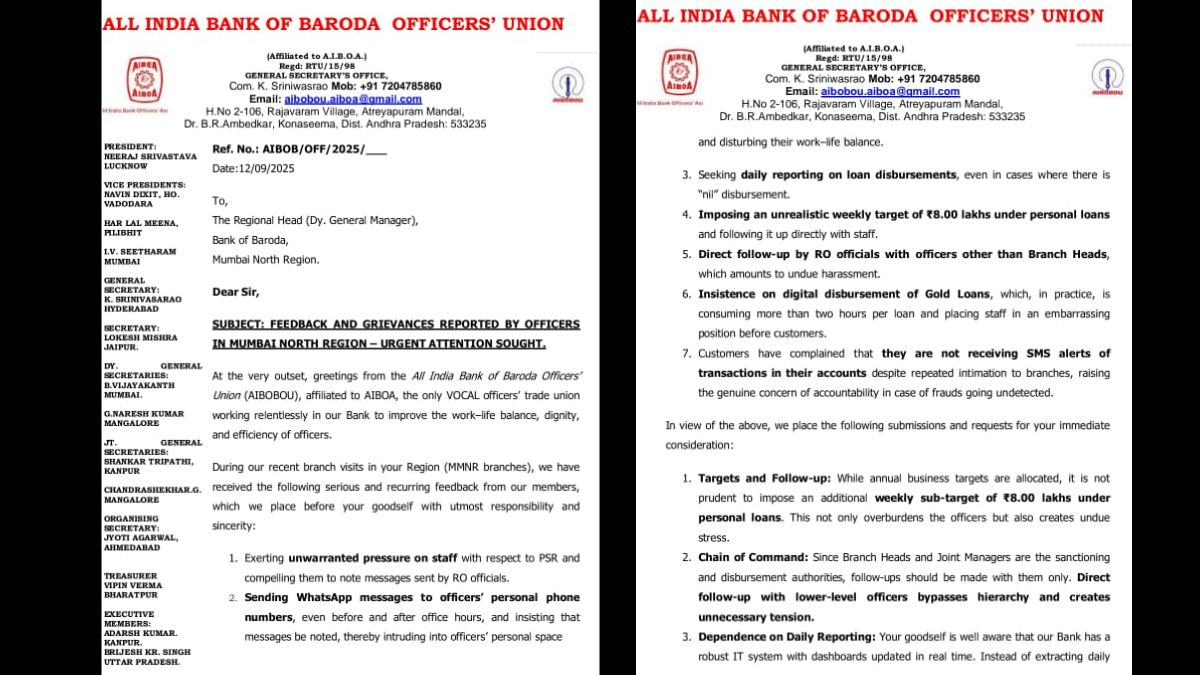

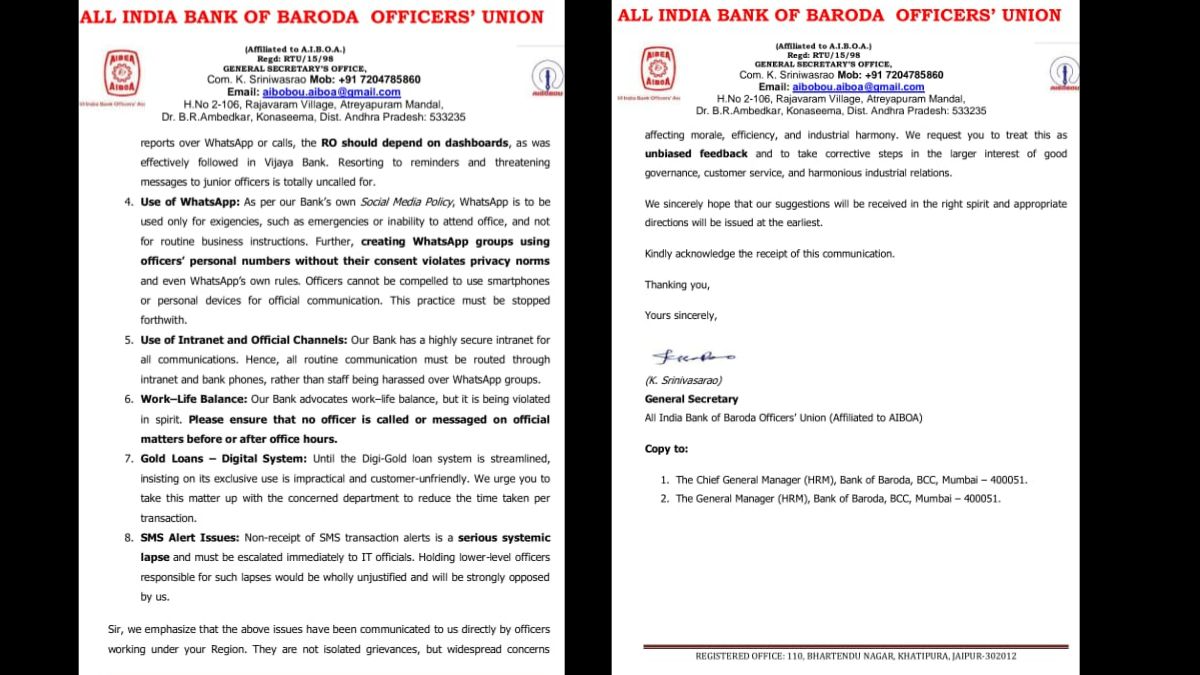

The All India Bank of Baroda Officers’ Union (AIBOBOU), submitted a letter dated 12 September 2025 to the Regional Head of Bank of Baroda’s (BoB) Mumbai North Region. The issues were compiled after union representatives visited MMNR (Mumbai Metro North Region) branches and gathered recurring feedback directly from officers. The union stated that these grievances reflect widespread challenges affecting staff morale and required urgent corrective action.

Key Grievances Reported by Officers

Pressure of Targets and Daily Reporting

The letter highlights that officers are being compelled to meet an additional weekly sub-target of ₹8 lakh in personal loans. Alongside, staff are required to give daily reporting on loan disbursements, even when there is nil activity. According to the union, these practices are creating stress and disrupting officers’ workflow.

Image: AIBOBOU’s letter to BoB management highlighting staff grievances

Courtesy: K. Sriniwasrao

WhatsApp Messages Beyond Office Hours

Officers reported receiving instructions through WhatsApp on their personal phones, both before and after working hours. The union said this intrudes into personal space and violates the bank’s own social media policy, which allows WhatsApp use only in emergencies. It also pointed out that compelling staff to use personal devices for official communication is against norms.

Advertisement

Chain of Command Concerns

The letter stated that Regional Office (RO) officials were directly following up with officers other than Branch Heads or Joint Managers. The union argued this bypasses hierarchy, causes undue harassment, and requested that follow-ups be routed only through sanctioning authorities.

Union’s Stand on WhatsApp Use and Target Pressure

Speaking to Kanal, K. Sriniwasrao, General Secretary of AIBOBOU, said, “The misuse of WhatsApp for official communication has become a widespread issue across almost all regions of BoB. Although the bank’s social media policy allows WhatsApp only for emergencies or sharing limited information, it is now being used indiscriminately for transfers, relieving orders, and routine instructions. Many times, officers receive just a message on their phone that they are transferred and relieved, and are told to immediately join another branch.”

He further said, “During my visits to branches in the Mumbai Metro North Region, a senior manager admitted that he was the one sending messages after 8:00–8:30 p.m. Officers in such groups are often compelled to respond with “noted,” and if they fail to do so, they are threatened with action. Despite the bank having a secure intranet for communication, management continues to rely on WhatsApp messages, which is harming officers’ work–life balance and creating a toxic work culture.”

He concluded, “The growing pressure of unrealistic targets, such as pushing gold loans and car loans irrespective of customer demand, is worsening the situation. Loans are to be taken when people need them, not forced upon them. Yet, officers are being pressed to expand the loan portfolio without regard to ground realities. This has turned into a torturing culture.”

AIBOBOU underlined that these were not isolated complaints but widespread concerns across Mumbai North Region. It stressed that the issues are affecting morale, efficiency, and industrial harmony. The union requested corrective measures to ensure better governance, customer service, and respect for officers’ work–life balance.

Advertisement

No comments yet.