Golden Jubilee of Regional Rural Banks: Analysing the New Era for Madhya Pradesh Gramin Bank

2025 marks 50 years of Regional Rural Banks (RRBs) in India, with the newly formed Madhya Pradesh Gramin Bank (MPGB) emerging as a major force after consolidation. With over 1,300 branches, MPGB now faces the challenge of balancing digital transformation and growth while upholding its core mandate of rural financial inclusion.

Author: S Nila

Published: October 1, 2025

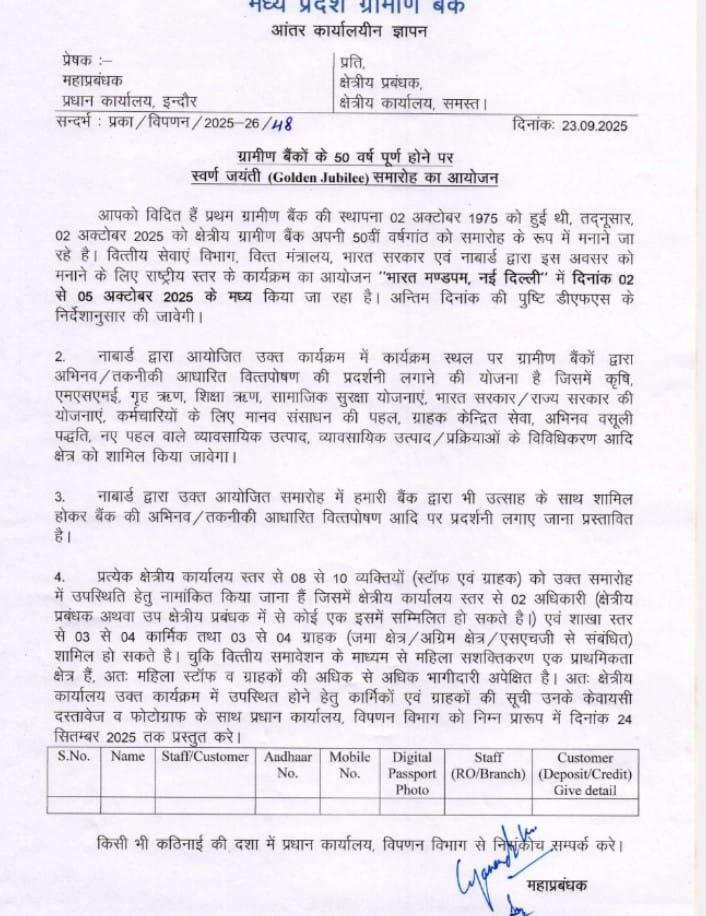

2025 marks the Golden Jubilee of India's Regional Rural Banks (RRBs), a pivotal moment that finds the sector—and specifically institutions like the newly consolidated Madhya Pradesh Gramin Bank (MPGB)—at a critical juncture of transformation. Established in 1975 to extend the reach of formal banking to underserved rural populations, the RRBs are now being fundamentally reshaped to meet the demands of a modern, digital economy. The notification from the bank outlines various aspects in this context.

Advertisement

Image - Official notification from MPGB

50 Years of Rural Mandate: From Foundation to Consolidation

Regional Rural Banks were conceptualised on the recommendations of the Narasimhan Working Group to combine the local knowledge of cooperative banks with the professional management of commercial banks. Their core mission was, and remains, to provide credit and banking facilities for agriculture and other productive activities in rural areas, particularly to small and marginal farmers, agricultural labourers, and artisans.

The year 2025, however, highlights the most significant structural change since their inception: a major wave of amalgamation.

The Birth of the New MPGB

The new Madhya Pradesh Gramin Bank (MPGB) is a direct result of the Government of India's "One State, One RRB" policy, aimed at creating larger, more financially robust, and technologically efficient rural banking entities.

Formation: MPGB was recently established (effective May 1, 2025) through the merger of two existing banks: the erstwhile Madhya Pradesh Gramin Bank and Madhyanchal Grameen Bank.

Scale and Reach: This consolidation, sponsored by the Bank of India, has created a powerhouse with over 1,300 branches, vastly expanding its operational territory and customer base across Madhya Pradesh.

The strategic rationale behind this move is to reduce administrative overheads, achieve economies of scale, and significantly enhance the capital base, allowing the bank to invest heavily in technology and offer a wider range of products.

The Path Forward: Challenges and Opportunities

The Golden Jubilee serves as a backdrop against which the new MPGB must reconcile its original social mandate with the modern imperatives of banking efficiency.

1. Leveraging Digital Transformation

The single largest opportunity lies in digital financial inclusion. Consolidated banks like MPGB are better positioned to adopt high-level technology standards, operationalize mobile banking services, and integrate with national digital platforms like UPI. The focus is on moving beyond basic credit to offering:

Technology-driven services: Mobile banking, digital loan applications, and enhanced security.

Financial Literacy: Utilizing its expanded network to educate rural customers on digital payments and formal credit products.

2. Upholding the Rural Mandate

The consolidation has sparked debate, with stakeholders urging policymakers to safeguard the original spirit of the RRBs. The fear is that a drive for commercial profitability could dilute the focus on micro-credit and essential services for the poorest segments. The MPGB's challenge will be to maintain a low-cost service model while targeting increased business growth and asset quality. Its success will be measured not just by its profit margin, but by its commitment to development in areas like:

Self-Help Group (SHG) Linkage: Continuing to be a leading player in micro-financing women's groups.

Support for FPOs: Financing Farmer Producer Organizations to boost agricultural value chains.

Government Scheme Disbursal: Efficiently delivering wages, pensions, and subsidies under various Central and State schemes.

3. Building a Unified Brand Identity

The simultaneous initiative by NABARD to introduce a common, unified logo for all amalgamated RRBs (a move dubbed 'One RRB One Logo') is vital. For a merged entity like MPGB, creating a strong, recognizable, and trustworthy brand is crucial for customer confidence and market visibility, symbolizing symmetry, stability, and growth in the rural financial ecosystem.

In conclusion, according to the notification, the Golden Jubilee of Regional Rural Banks is not merely a commemoration of the past but a launchpad for the future. For the Madhya Pradesh Gramin Bank, the amalgamation represents a clear direction: leveraging scale and technology to create a financially strong institution that can sustainably serve the rural masses and become a key pillar in the country's vision for a 'Viksit Bharat' (Developed India) by 2047.

Advertisement

No comments yet.