Jammu and Kashmir Grameen Bank Lags in Digital Shift as J&K Bank Digitises KCC Review Process

J&K Bank enables digital KCC reviews, while Jammu & Kashmir Grameen Bank customers still visit branches, raising questions on digital disparity.

Author: Saurav Kumar

Published: November 11, 2025

The J&K Bank announced that farmers can now complete their Kisan Credit Card (KCC) annual review online or through a simple SMS reply, the development has stirred disquiet among employees of Jammu and Kashmir Grameen Bank, the Regional Rural Bank sponsored by J&K Bank. The RRB continues to require physical branch visits and manual paperwork for the same process, despite serving a large rural customer base primarily dependent on KCC credit access.

Advertisement

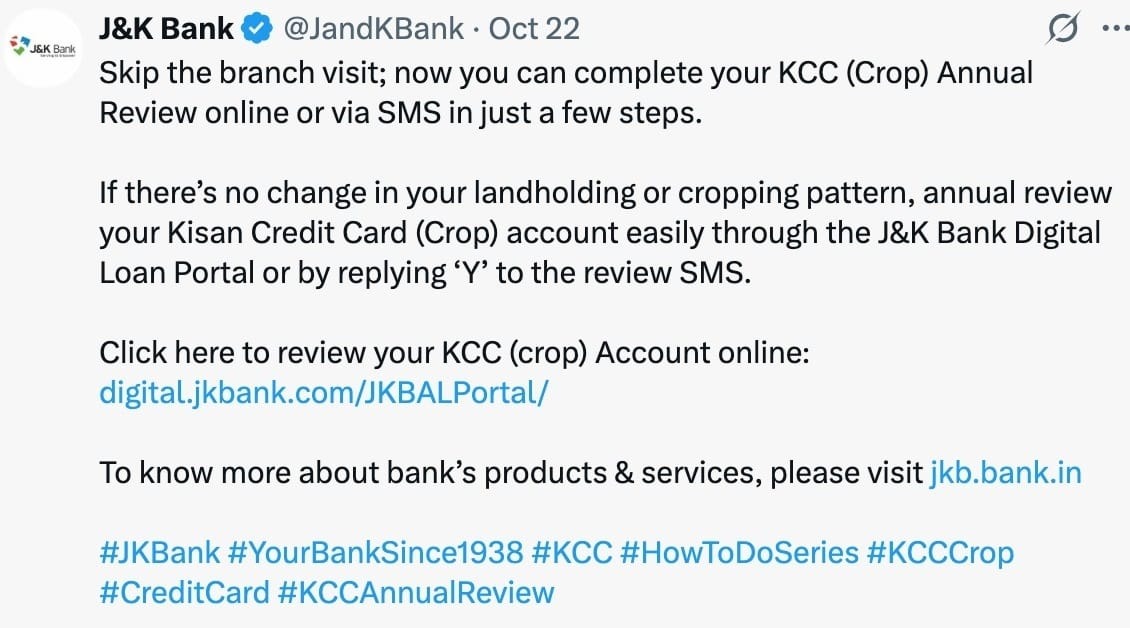

J&K Bank’s digital upgrade, showcased in its recent announcement on social media, allows KCC borrowers to review their accounts by replying ‘Y’ to a system-generated SMS if there are no changes in landholding or crop pattern. This eliminates the need for physical branch visits.

Image: Social media announcement of J&K Bank on digital KCC review

Image: Social media announcement of J&K Bank on digital KCC review

Advertisement

However, Jammu and Kashmir Grameen Bank customers still need to submit renewal forms in person, leading to heavy branch footfall and administrative burden during review season.

Digital Gap Between RRB and Sponsor Bank

Post-Amalgamation of Jammu & Kashmir Grameen Bank has the second-largest branch network across the Union Territory, yet its business scale and service penetration remain far below that of J&K Bank. Employees say the technological gap is a major factor.

“J&K Bank has upgraded its digital ecosystem multiple times—mobile banking, internet banking, POS, UPI QR, everything. But those upgrades never reach Grameen Bank,” said a Jammu and Kashmir Grameen Bank officer who spoke to Kanal on condition of anonymity. “Sponsor banks are supposed to extend technology to RRBs. Instead, the disparity is widening.”

This gap runs contrary to repeated appeals from the Union Finance Ministry, which has urged sponsor banks to modernise RRBs to improve service quality in rural credit delivery.

Impact on Customer Base

Jammu and Kashmir Grameen Bank caters largely to farmers, artisans, small entrepreneurs and rural households. Many of whom rely on KCC credit lines for seasonal crop expenses. The manual review system forces them to make repeated trips to branches, often from remote villages.

“When J&K Bank customers can complete KCC review using just an SMS, why are Grameen Bank customers still standing in queues with forms?” another employee said. “This is not just a service gap. It affects the dignity and convenience of the rural customer.”

Staff also fear that delays in implementing modern digital review systems could push farmers to migrate their accounts to J&K Bank over time.

“The risk is real. If J&K Bank can offer effortless renewal and we cannot, many customers will shift. “This is why we are demanding autonomy and reduced interference from the sponsor bank.” the employee added.

Concern on Digital Disparity

Employees argue that extending SMS-based KCC review to Jammu and Kashmir Grameen Bank would significantly reduce workload at branches and streamline credit delivery.

“If the sponsor bank truly wants to strengthen us, it should share technology, not just directives,” said a third employee.

The issue, they say, is no longer only operational but structural: Should an RRB remain technologically dependent on its sponsor bank, or should it move toward greater digital autonomy to serve its rural mandate effectively? A similar challenge of 17 RRBs still functioning without independent branch-level IFSC codes.

For now, the digital divide remains visible—one bank encouraging farmers to skip the branch visit, and another continuing to rely on manual processes for the same rural customers.

Advertisement

No comments yet.