Advertisement

PFRDA Revises Corporate NPS Rules: Employees Now Free to Choose Pension Fund Manager and Asset Allocation

PFRDA has revised rules for corporate employees under the National Pension System. The update ensures employees can freely choose their Pension Fund Manager and asset allocation.

Author: Kalyani Mali

Published: September 18, 2025

Advertisement

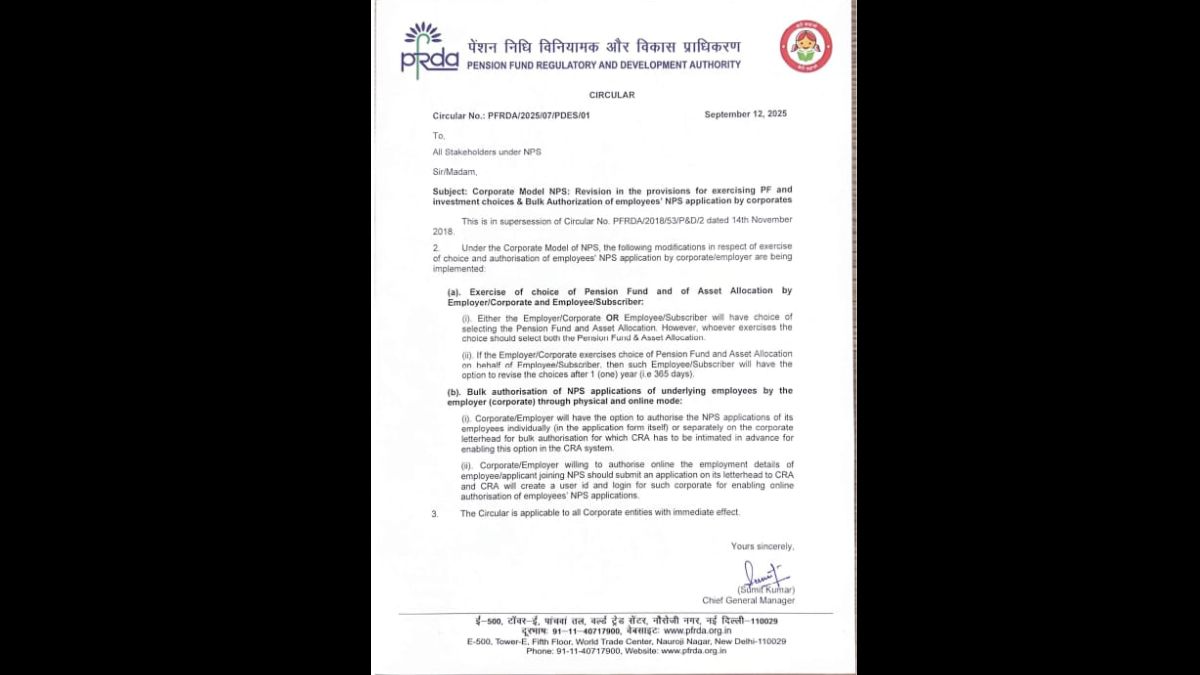

The Pension Fund Regulatory and Development Authority (PFRDA) issued a circular on September 12, 2025, revising the provisions under the Corporate Model of the National Pension System (NPS). The move addresses a long-standing demand from employees for greater autonomy in managing their retirement savings. With this revision, employees will have the right to decide their Pension Fund Manager (PFM) and asset allocation based on their risk profile, irrespective of their employer’s earlier control.

PF Choice With Revision Option

The circular provides that either the employer/corporate or the employee/subscriber can exercise the choice of selecting the Pension Fund and Asset Allocation. The entity exercising the choice must select both Pension Fund and Asset Allocation.

If the employer or corporate exercises this choice on behalf of the employee/subscriber, then the employee/subscriber will have the option to revise the choices after one year (365 days).

Image: PFRDA circular on Corporate Model NPS revised provisions

Bulk Authorisation of NPS Applications

Employers under the Corporate Model NPS can authorise employee applications either physically or online. In physical mode, authorisation may be done individually in the form or on corporate letterhead for bulk approval with prior intimation to CRA. In online mode, details must be submitted on corporate letterhead to CRA, which will create a user ID and login for enabling bulk authorisation.

Applicability

The circular specifies that these provisions are applicable to all corporate entities with immediate effect.

‘Freedom to Choose PFM and Asset Allocation Welcomed’

Speaking to Kanal, employees highlighted that under the earlier 2018 circular, only those who joined NPS after 14.11.2018 were allowed to choose their PFM and asset allocation after 365 days, even if the employer had retained this option. Employees who had joined before this date remained excluded.

Advertisement

They pointed out that many employers, including public sector banks such as SBI and Canara Bank, were reluctant to extend this facility. As a result, lakhs of employees were unable to select their PFM and asset allocation in line with their age and risk profile.

“Employees have been requesting PFRDA to review these guidelines in the interest of subscribers. We are thankful for the revision, as it now ensures freedom to choose PFM and asset allocation as per one’s risk profile,” an employee representative said.

The latest circular on Corporate Model NPS removes long-standing disparities by revising the provisions for Pension Fund and asset allocation choices. With clear guidelines for both employers and employees, and the introduction of bulk authorisation measures, the framework brings uniformity and transparency. Importantly, it empowers employees with the long-awaited freedom to make investment decisions aligned to their own risk profile.

No comments yet.