AIBOA Raises Concern Over Growing Foreign Control in Indian Banking System

AIBOA has opposed foreign takeovers of Indian banks, warning that such moves threaten India’s financial sovereignty and calling for public support to stop the growing foreign influence in the banking system.

Author: Sruthysh

Published: October 24, 2025

The All India Bank Officers’ Association (AIBOA) has voiced strong opposition to the increasing presence of foreign capital in India’s financial sector. In a recent press statement issued by S. Nagarajan, General Secretary, the association warned that allowing foreign entities to acquire stakes in Indian banks poses serious risks to the country’s financial independence and national sovereignty.

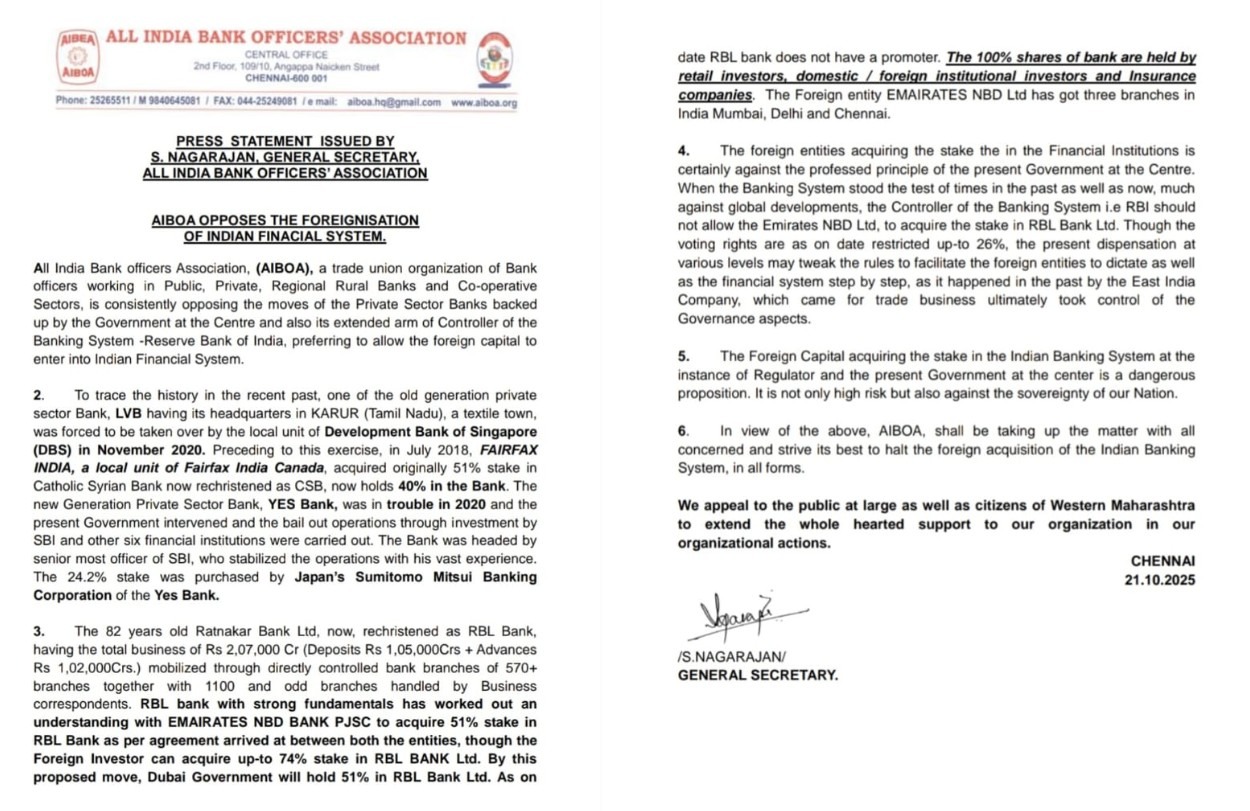

Image- Statement by AIBOA

Opposition to Foreign Entry

AIBOA, which represents officers from public, private, regional rural, and co-operative banks, has consistently criticised the government’s policy of supporting private sector banks backed by foreign investors. The association believes that the Reserve Bank of India (RBI) and the Central Government should protect the Indian financial system from external control rather than promoting it.

Past Examples of Foreign Acquisitions

The statement highlighted several examples of how foreign entities have gradually gained influence in Indian banks.

* In 2020, the Lakshmi Vilas Bank (LVB) was taken over by the Development Bank of Singapore (DBS) after facing financial trouble.

* Earlier, in 2018, Fairfax India, a Canadian investment company, acquired a 51% stake in the Catholic Syrian Bank (now CSB Bank)

* The Yes Bank crisis in 2020 also saw foreign involvement, with Japan’s Sumitomo Mitsui Banking Corporation purchasing a 24.2% stake.

AIBOA noted that these events reflect a worrying trend where Indian banks, once facing financial difficulties, are eventually taken over by foreign investors, reducing domestic ownership and control.

The Case of RBL Bank

The recent example that triggered AIBOA’s statement involves RBL Bank, formerly Ratnakar Bank Ltd. The bank, which has over 1100 branches, is now in talks with Emirates NBD PJSC a Dubai based financial group to sell a 51% stake.

According to reports, the proposed deal could allow the Dubai Government to hold 51% ownership in RBL Bank, with foreign investors permitted to acquire up to 74% of the bank’s shares.

AIBOA expressed alarm that this move could place a significant portion of the Indian banking system under foreign control. As of now, RBL Bank’s entire shareholding is held by retail investors, insurance companies, and both domestic and foreign institutional investors—without a single promoter.

Threat to National Interests

The association pointed out that while the RBI currently restricts foreign voting rights to 26%, there is a possibility that these rules may be relaxed in future, allowing foreign investors to influence India’s financial decisions.

AIBOA compared the current situation to the East India Company’s gradual takeover of India through trade warning that allowing foreign financial institutions to dominate could repeat history in a modern form.

Call for Government Action

Describing the trend as both dangerous and risky, AIBOA urged the government and the RBI to reconsider their stance on foreign investments in the banking sector. The union stressed that financial institutions form the backbone of national security and should remain under Indian control.

Public Appeal

AIBOA called upon the citizens of Western Maharashtra and the general public to support its campaign against foreign acquisition in the banking sector. The organisation plans to take the issue up with all relevant authorities to prevent further foreign intrusion into the Indian financial system.

Looking Ahead

The statement ends with a strong reminder that while foreign investments may bring short term benefits, the long term impact on India’s economic sovereignty could be severe. AIBOA’s stand reflects growing concern among banking professionals about preserving Indian ownership and maintaining the integrity of the national financial system.

Advertisement

No comments yet.