AIBEA Questions Privatisation Push as PSBs Post ₹49,455 Crore Q2 Profit

Despite Public Sector Banks earning ₹49,455 crore profit in the July-September quarter, All India Bank Employees Association questions why the government is still pushing for bank privatisation. The strong results highlight the growing stability and profitability of state-owned lenders.

Author: Meera

Published: 1 hour ago

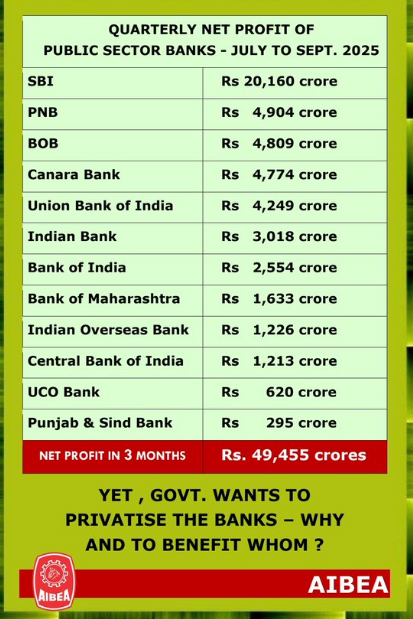

India’s public sector banks have reported a combined net profit of ₹49,455 crore for the July–September 2025 quarter, according to data shared by the All India Bank Employees’ Association (AIBEA). The figures highlight strong performances by major lenders such as the State Bank of India (SBI), Punjab National Bank (PNB), Bank of Baroda (BOB), and Canara Bank, reflecting improved asset quality and steady growth across the sector.

State Bank of India (SBI) led the list with a profit of ₹20,160 crore, followed by Punjab National Bank (₹4,904 crore), Bank of Baroda (₹4,809 crore), Canara Bank (₹4,774 crore), and Union Bank of India (₹4,249 crore). Other major contributors included Indian Bank (₹3,018 crore), Bank of India (₹2,554 crore), and Bank of Maharashtra (₹1,633 crore). Smaller banks such as Indian Overseas Bank, Central Bank of India, UCO Bank, and Punjab & Sind Bank also reported steady profits.

.

Image: Poster shared by AIBEA on X

The All India Bank Employees’ Association (AIBEA) shared this data, highlighting the collective performance of state-owned lenders. The figures indicate consistent growth across major PSBs, supported by improved asset quality, higher credit demand, and better operational efficiency.

Despite the strong financial results, discussions on the government’s proposal to privatise some public sector banks continue. AIBEA has questioned the rationale behind such plans when PSBs are performing well and contributing significantly to the national economy.

Public sector banks remain crucial to India’s financial system, with a vast network serving rural and urban customers alike. The recent quarterly performance underlines their stability and growing profitability in a competitive banking environment.

Advertisement

No comments yet.