Govt Clarifies Status of IDBI Bank Privatisation in Lok Sabha Reply

The Union Government has outlined the current status of IDBI Bank’s privatisation. The reply addresses timelines, bidder interest, profit details, merger queries, and employee impact.

Author: V.Gayathri

Published: 18 hours ago

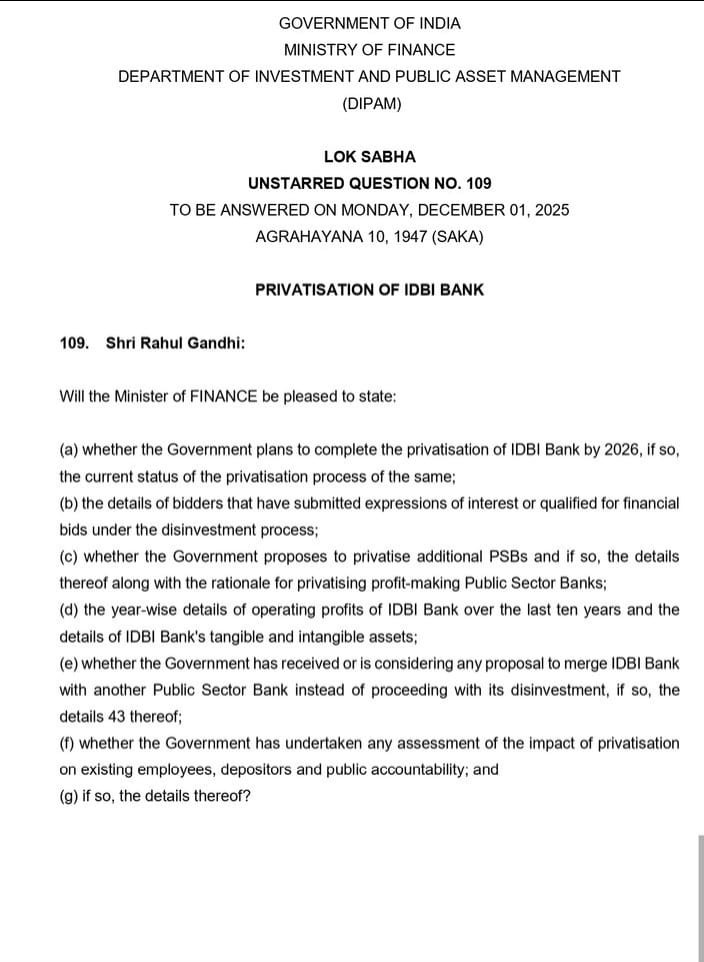

A recent Lok Sabha reply by the Ministry of Finance has shed light on the ongoing privatisation process of IDBI Bank. The written response, provided to an unstarred question, details approvals, bidder interest, asset position, profitability trends, and the Government’s stance on merger and employee-related concerns. The clarification offers an updated picture of the strategic disinvestment process currently underway.

Government’s Approval for Strategic Disinvestment

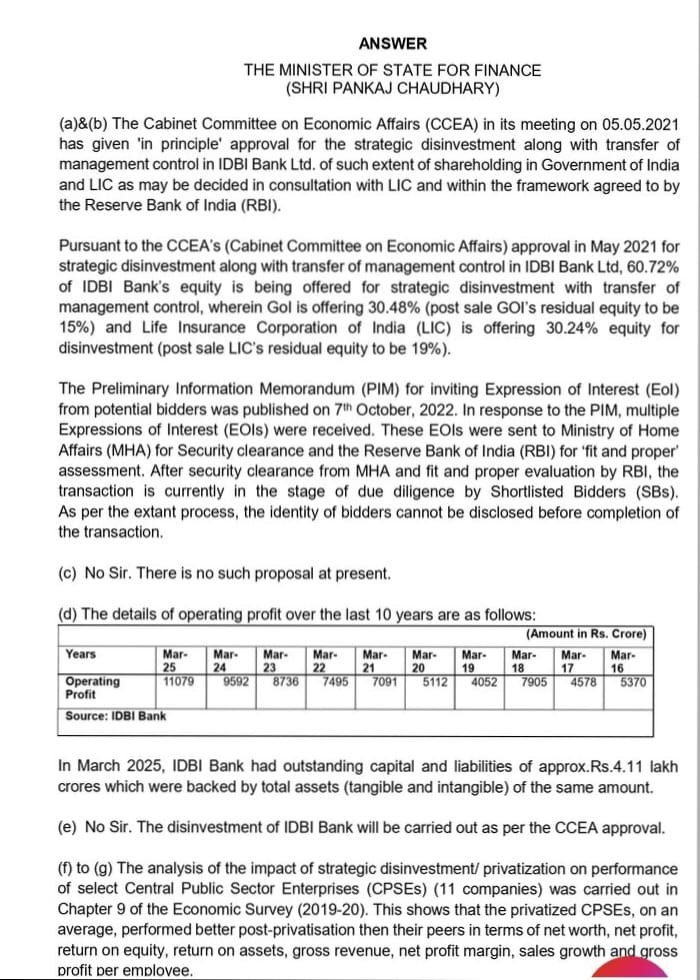

The Ministry highlighted that the Cabinet Committee on Economic Affairs (CCEA) had granted in-principle approval in May 2021 for the strategic disinvestment of IDBI Bank.

According to the reply, 60.72% of IDBI Bank’s equity is being offered for sale, including management control. This comprises 30.48% from the Government of India and 30.24% from LIC, with both retaining residual stakes post-sale.

Advertisement

Image: Lok Sabha unstarred question document on IDBI Bank privatisation

Image: Lok Sabha unstarred question document on IDBI Bank privatisation

Source - Krishna Kumar

Expressions of Interest and Current Stage of the Process

The Government stated that the Preliminary Information Memorandum (PIM) was issued on 7 October 2022. Multiple Expressions of Interest (EoIs) were received from potential bidders.

The evaluation process includes security clearance by the Ministry of Home Affairs and “fit and proper” assessment by the RBI. The shortlisted bidders are currently in the due diligence stage.

The identity of bidders cannot be disclosed until the transaction is completed, as per extant norms.

No Proposal for Privatising Additional PSBs

Responding to whether more Public Sector Banks (PSBs) are being considered for privatisation, the Government clarified that no such proposal exists at present.

Operating Profits of IDBI Bank Over the Last Ten Years

The reply includes year-wise operating profit data for the past decade. Profits remained positive throughout, with fluctuations that reflect broader operational performance trends.

In March 2025, IDBI Bank had capital and liabilities amounting to approximately ₹4.11 lakh crore, supported equally by tangible and intangible assets.

Merger Proposal Not Under Consideration

The Government confirmed that no proposal is under consideration to merge IDBI Bank with any other PSBs instead of pursuing privatisation.

Assessment of Employee and Public Impact

The reply refers to an analysis conducted earlier on other Central Public Sector Enterprises (CPSEs). The study concluded that post-disinvestment entities generally recorded better performance across parameters such as net worth, profit, turnover, and productivity.

The Ministry stated that the disinvestment of IDBI Bank will continue as per the original approval granted by the CCEA.

The Lok Sabha reply provides a comprehensive update on the ongoing privatisation of IDBI Bank. With approvals in place and due diligence in progress, the process is moving forward within the established framework. The Government clarified concerns related to mergers, employee impact, and future privatisation plans while presenting detailed profitability and asset data for transparency.

Advertisement

No comments yet.