Karnataka Grameena Bank Federations Raise Objection to AOD/LOR/AOS Guidelines, Seek Uniform Policy

Karnataka Grameena Bank officers’ and employees’ federations have raised objections to recent circulars on AOD/LOR/AOS procedures. They allege inconsistency, discrimination, and non-compliance with the Limitation Act.

Author: V.Gayathri

Published: November 5, 2025

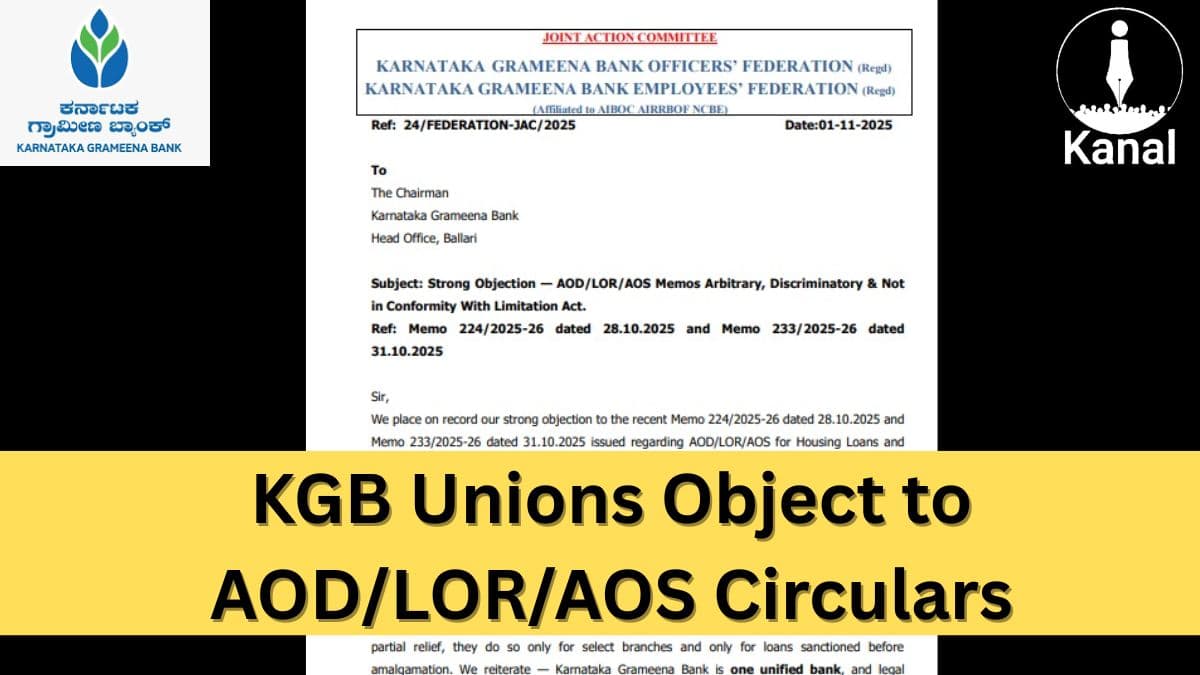

The Joint Action Committee of the Karnataka Grameena Bank Officers’ Federation (KGBOF) and Karnataka Grameena Bank Employees’ Federation (KGBEF) has expressed strong opposition to two recent memos issued by the bank concerning Acknowledgement of Debt (AOD), Letter of Revival (LOR), and Acknowledgement of Security (AOS) for Housing and Term Loans. The federations claim that the memos are arbitrary, discriminatory, and not in conformity with the Limitation Act.

Federations Object to New Circulars

The federations refer to recent memos that introduce AOD/LOR/AOS requirements for certain loan accounts. The document states that these instructions involve legal ambiguity, operational impracticality, and selective application. The unions emphasise that guidelines should be uniformly applied across all branches of the bank, without exceptions based on branch history.

Advertisement

Advertisement

Image: Joint Action Committee expresses objection to AOD/LOR/AOS memos issued to branches.

Claims of Selective Application Between Branches

The objection highlights that the instructions apply differently to branches that belonged to former banks before amalgamation. The federations state that such differentiation contradicts uniform banking governance and may create confusion among staff and customers.

Concerns Raised by Branches

Advertisement

The document lists operational challenges that branches may face, including:

- How to regularise overdue installments over many years

- Tracking AOD/LOR/AOS requirements for earlier years

- Handling cases where borrowers or guarantors are no longer available

- Situations where loan instruments lack date stamping

The federations state that due to such uncertainties, branches could face compliance risks.

Objection to exclusion of rescheduled loans

According to the federations, excluding rescheduled accounts from documentation requirements may lead to compliance gaps. They argue that all legally enforceable debts must be treated equally, as branches may not always have system-level visibility of restructuring done earlier.

Demand for a Clear and Uniform Master Circular

The federations demand:

- One bank–one policy–one legal standard

- No selective applicability between branches

- A comprehensive and unambiguous master circular with illustrations

- Alignment of procedures with the Limitation Act

They also state that relief or modification should not be partial or selective.

Agitation to Continue Until Policy Is Uniform

The federations indicate that their agitation program will continue until a single, clear, legally aligned, and uniformly applicable policy is issued. The statement adds that staff should not be placed under dual standards or operational uncertainty.

KGBOF and KGBEF seek a uniform and legally compliant policy regarding AOD/LOR/AOS procedures. Their objection emphasises clarity, fairness, and alignment with legal requirements while ensuring operational ease for all branches.

No comments yet.