Are RRBs Sidelined by State Govts Over Govt Business?

Despite vast rural networks and state ownership, Regional Rural Banks (RRBs) remain excluded from government salary accounts across India.

Author: Saurav Kumar

Published: October 31, 2025

Regional Rural Banks (RRBs), though established as government-owned institutions comparable to commercial banks, continue to remain outside the purview of state government salary and pension account operations. This lack of inclusion limits their access to government business and weakens their brand visibility and customer trust within their own service areas.

Advertisement

Following the One State, One RRB amalgamation policy, institutions such as Uttar Pradesh Gramin Bank (UPGB), Odisha Grameen Bank (OGB), and Andhra Pradesh Grameena (APGB) have emerged as some of the largest banking networks in their respective states — equalling to the State Bank of India (SBI). Yet, despite their vast reach and rural presence, they remain excluded from key government-linked accounts.

Advertisement

No Access to Govt Business Despite Largest Network

An employee of Odisha Grameen Bank (OGB), speaking to Kanal on condition of anonymity, remarked, “Despite having the largest branch network in the state — even surpassing both the State Bank of India (SBI) and our sponsor bank, Indian Overseas Bank (IOB) — Odisha Grameen Bank is not entrusted with salary accounts, pension transfers, or welfare scheme disbursements. These functions continue to remain with sponsors or other nationalised banks.”

He further added, “If government salary accounts were allotted to RRBs like ours, it would provide a substantial boost to our Current Account and Savings Account (CASA) base.”

Advertisement

In fact, OGB operates 979 branches across Odisha — more than its sponsor bank — highlighting its capacity to manage state-level financial responsibilities. Similarly, an employee of Uttar Pradesh Gramin Bank (UPGB) noted that only a negligible portion of government salary accounts are maintained with the bank.

Another staff member from Andhra Pradesh Grameena Bank (APGB) pointed out that despite having more branches than its sponsor bank, Union Bank of India, APGB does not receive state government salary accounts. “After amalgamation, RRBs like APGB have become network-wise strong enough to be the first choice of state governments for fund handling, yet they remain overlooked,” the employee observed.

“Regional Rural Banks continue to be deprived of low-cost government deposits,” said an employee of Telangana Grameena Bank (TGB), noting that commercial banks such as SBI, Union Bank of India, and Canara Bank—which serve as sponsor banks for RRBs in Telangana, Andhra Pradesh, and Karnataka—retain most of the state government funds. “As lead banks in their respective states, they manage nearly all government salary and welfare accounts, leaving RRBs without access to these stable, low-cost resources,” the employee added.

The case of Telangana Grameena Bank further underlines this disparity. With 923 operational branches, TGB has surpassed 11 commercial banks in branch strength, positioning it as the second-largest government bank in the state after SBI, which has 1,215 branches.

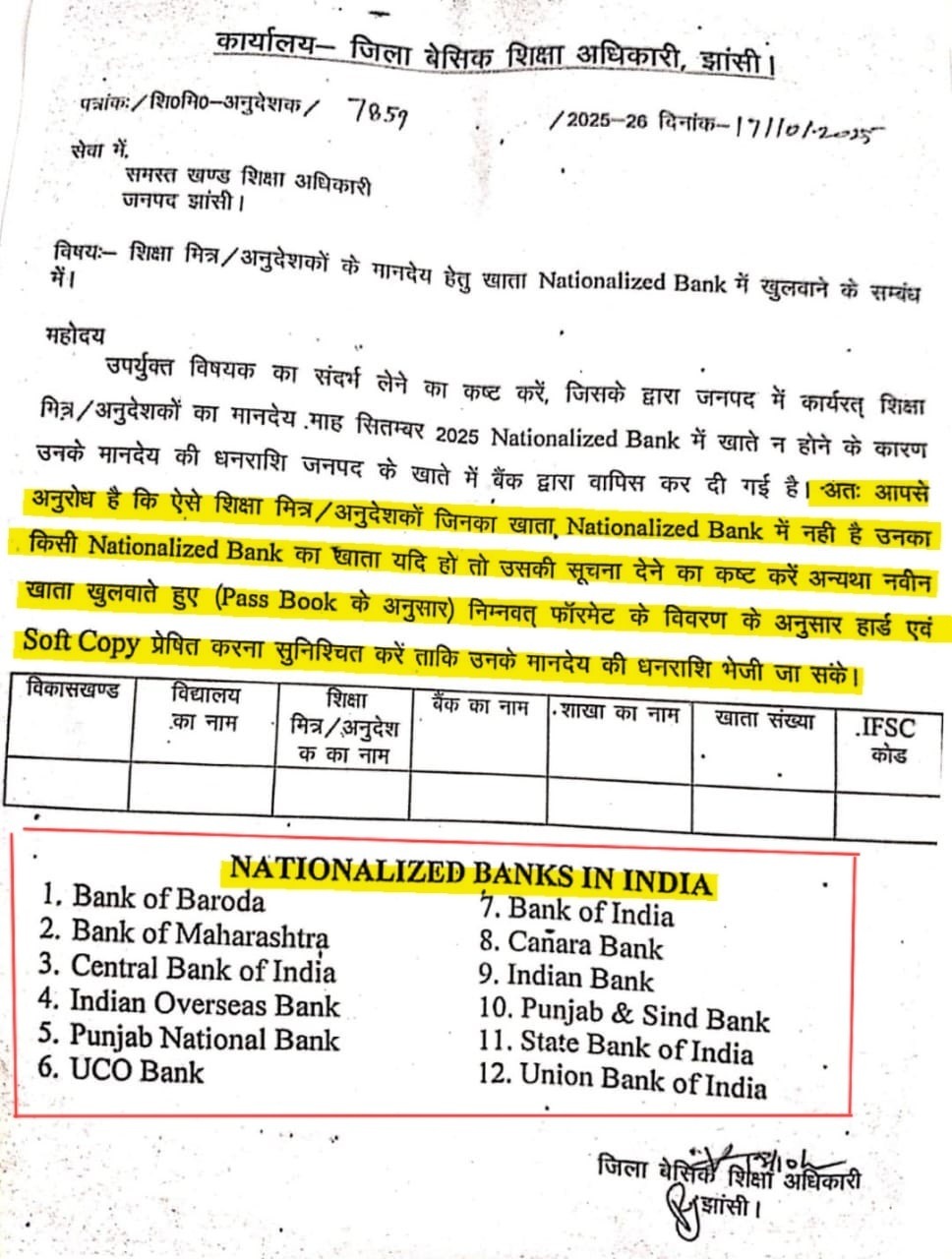

A similar pattern is visible in Uttar Pradesh, where the Education Department in Jhansi recently issued an official directive instructing teachers and Shiksha Mitras to open their salary accounts only in nationalised banks.

Image: Official directive of education department of Uttar Pradesh endorsing Commercial banks.

Image: Official directive of education department of Uttar Pradesh endorsing Commercial banks.

While the instruction was framed as a step to streamline payment processes, it has inadvertently highlighted a larger institutional concern—the persistent exclusion of RRBs from state-level financial operations, even though they hold government ownership and comparable infrastructure to their sponsor banks.

Tripura Gramin Bank: The Sole Exception

Amid the broader trend of RRBs being excluded from state government salary and pension accounts, Tripura Gramin Bank (TGB) stands out as the only RRB in India with complete inclusion in state government salary disbursements. The bank’s position is a rare example of effective integration of a rural banking institution within a state’s financial ecosystem.

A Tripura Gramin Bank employee told Kanal, “Most of our advances are extended to salaried government employees. It’s a major advantage for the bank, as these customers represent a stable and secure credit base. The loan portfolio carries minimal NPAs, which enhances the bank’s credibility and strengthens customer trust.”

As of March 2025, India’s 28 Regional Rural Banks collectively handle a business volume exceeding ₹12 lakh crore, operate over 22,500 branches, and serve 40 crore customers — making them the second-largest banking network after the State Bank of India.

A Question of Policy and Priority

Under the Regional Rural Banks Act, 1976, RRB ownership is divided among the Central Government (50%), the Sponsor Bank (35%), and the respective State Government (15%). Yet, despite holding a significant ownership stake, most state governments continue to bypass RRBs for their financial operations.

Rural bankers now ask a larger question — Why are Regional Rural Banks, co-owned by state governments, still treated as secondary players in public financial systems despite their proven outreach and operational capability?

No comments yet.