Private Hands for Public Banks: Reform or Road to Privatisation?

The government’s decision to open top public sector bank posts to private sector professionals has drawn sharp opposition from banking unions and experts, who fear it marks the start of privatisation. On the issue, Kanal speaks to Soumya Datta and Devidas Tuljapurkar, two renowned figures among the banking fraternity.

Author: Abhivad

Published: October 11, 2025

The government has revised appointment rules to allow private sector professionals to compete for top posts such as Managing Director (MD), Executive Director (ED), and Whole-Time Director (WTD) in public sector banks(PSBs) and insurers, including SBI. According to the government, the move, approved on 04 October 2025, aims to enhance expertise, governance, and meritocracy in public financial institutions.

Advertisement

Read more : Govt Opens Top Public Bank Jobs to Private Sector Talent

However, the policy has met with strong resistance from banking unions and experts, who fear it signals the beginning of privatisation through the backdoor.

Advertisement

“Blueprint for Privatisation”: Soumya Datta

Soumya Datta, former General Secretary of the All India Bank Officers’ Confederation (AIBOC) and Joint Convenor of the Bank Bachao Desh Bachao Manch(BBDBM), criticised the move, describing it as “laying the blueprint for privatisation.”

Advertisement

“Through this latest move, the Government has made it clear that they are laying the blueprint for privatisation. State Bank has a rich legacy of internal recruitment of Chairmen. Except on two occasions, all the Chairmen were from the in-house talent pool. Now they have opened up one among the four MD positions for external recruitment, including those from the private sector. I think, there must be someone who is close to the present ruling dispensation to become the MD. The new eligibility criteria must have been laid out in accordance. If such a person from outside the bank is appointed, that person will also be eligible to become the next Chairman of SBI. This clearly indicates a move towards privatisation in the near future”, Datta, who retired from the State Bank of India, told Kanal.

Datta suggested that the policy change could set a precedent for lateral entry into top PSB roles, bypassing established norms of internal promotion and cadre succession.

“Privatisation Through the Backdoor,” Says AIBEA Leader

Echoing similar concerns, Devidas Tuljapurkar, Joint Secretary of the All India Bank Employees’ Association (AIBEA), termed the move a “conscious attempt towards privatisation.” “This is a conscious attempt from the government towards privatisation. There were reports that the government was considering further consolidation of PSBs into three mega banks, but nothing has been stated officially. This new move seems to be part of a strategy to privatise through the backdoor. Ownership may not change immediately, but the business model will begin to resemble that of private commercial banks” he told Kanal.

Tuljapurkar pointed to a similar instance at Bank of Baroda, where the induction of an external executive allegedly led to a shift “from social banking to profit-oriented banking.” He warned that a similar outcome could emerge in the case of SBI — the largest public sector lender — if the leadership model changes.

UFBU Opposes Move, Terms It “Attack on Public Character”

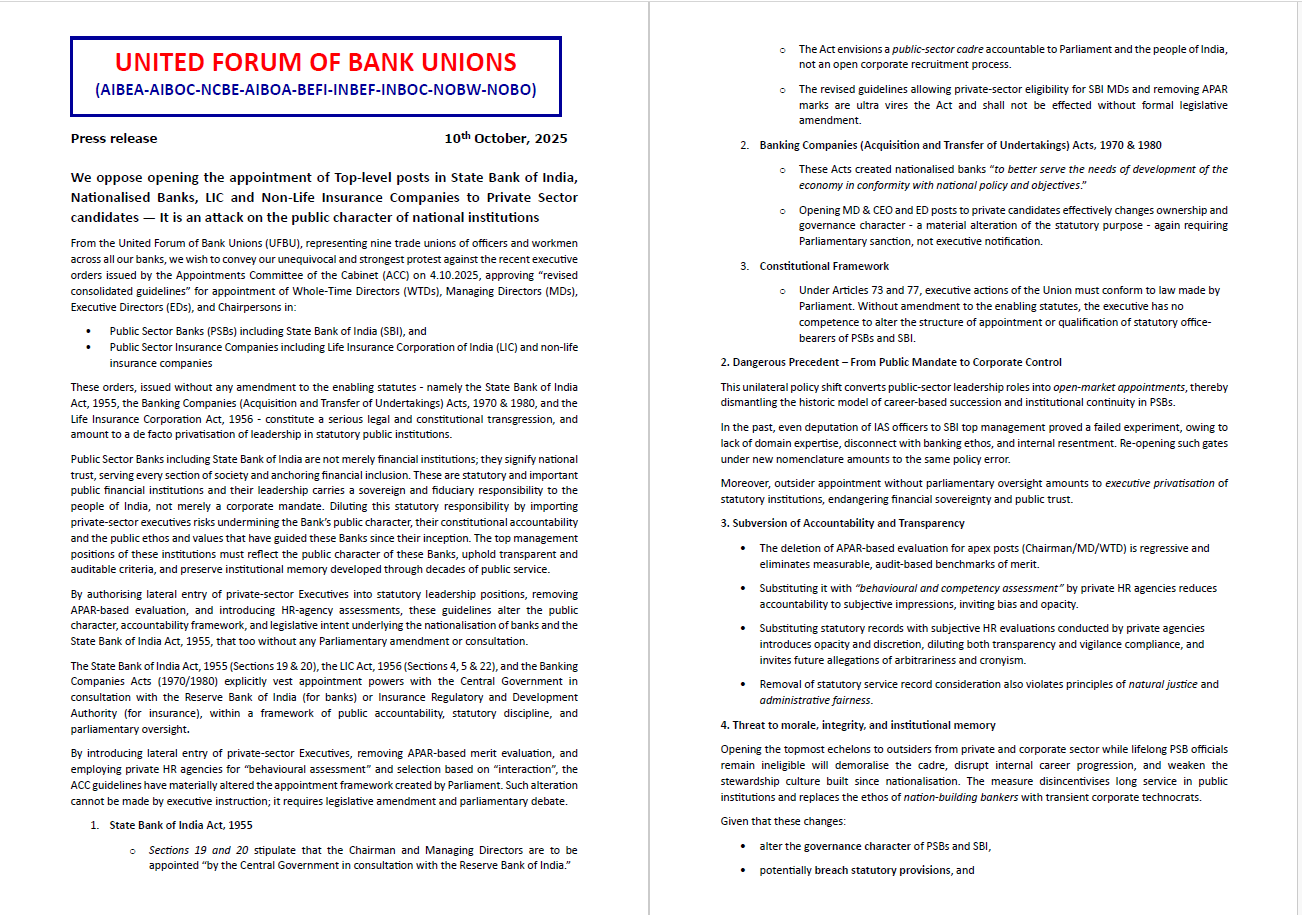

In its 10 October 2025 statement, the United Forum of Bank Unions (UFBU) strongly opposed the government’s revised ACC guidelines allowing private sector executives to hold top posts in PSBs and insurance companies. It termed the move a “legal and constitutional transgression” amounting to “de facto privatisation” of leadership. The UFBU also objected to replacing the APAR-based evaluation system with private HR assessments, calling it a threat to transparency and accountability, and urged that the policy be suspended pending Parliamentary review.

Image: UFBU’s press release opposing the move to open PSB leadership positions to the private sector.

Read More : UFBU Strongly Opposes Opening Top PSB & LIC Leadership to Private Sector

While the government maintains that the reforms are aimed at professionalising the management of public banks and aligning them with global best practices, the unions argue that such lateral entry threatens the statutory character, internal morale, and public accountability of these institutions. With both sides firm in their stance, the debate reflects a deeper question about the future of India’s public sector banking — whether it remains a pillar of social responsibility or transitions towards a market-driven model.

No comments yet.