UP Gramin Bank Officers Seek Perquisite Tax Absorption for Staff Relief

Uttar Pradesh Gramin Bank Officers Federation urges the bank to absorb perquisite tax. The request follows reduced take-home salary and comparisons with Scheduled Commercial Banks.

Author: V.Gayathri

Published: November 14, 2025

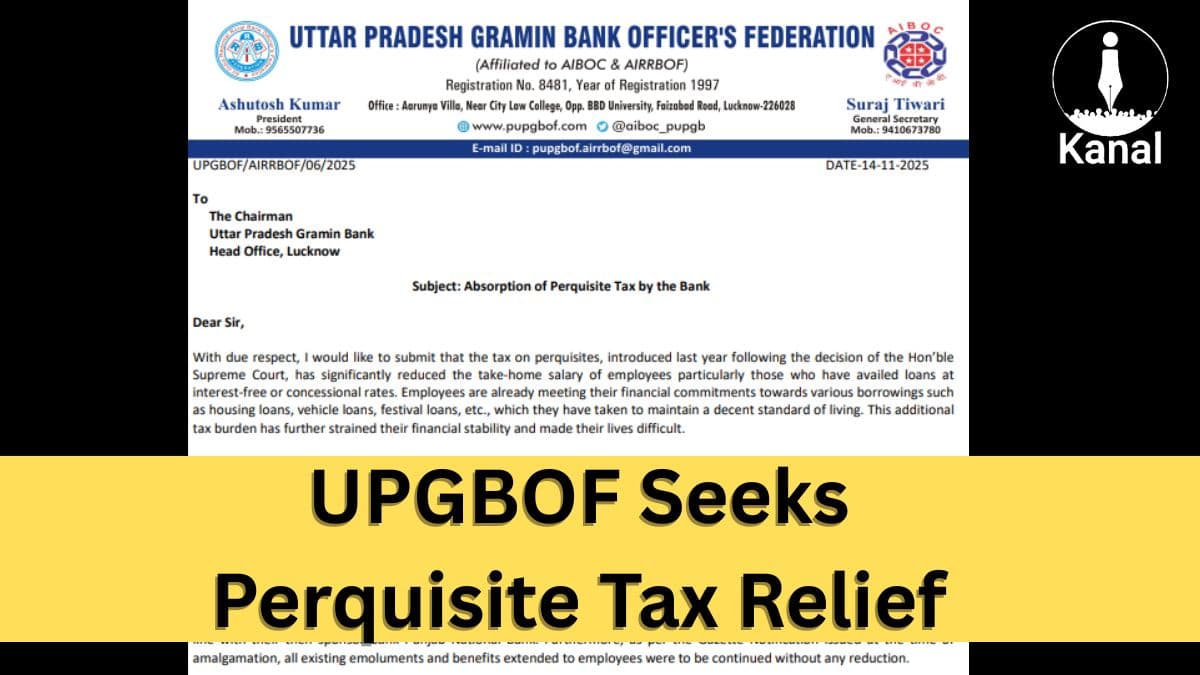

The Uttar Pradesh Gramin Bank Officers Federation (UPGBOF) has formally written to the Chairman of Uttar Pradesh Gramin Bank requesting the absorption of perquisite tax by the bank. The federation highlights that the tax has significantly reduced employees’ take-home pay, especially for those availing staff loans on concessional or interest-free rates. The letter emphasises employee welfare, financial stability, and parity with other banks.

Advertisement

Impact of Perquisite Tax on Employees

According to the federation, employees already managing financial commitments have been further burdened by the perquisite tax. Many officers who depend on housing, vehicle, festival, and education loans now face increased deductions, which has affected their financial stability and standard of living.

Image: UPGBOF letter submitted to UP Gramin Bank requesting perquisite tax absorption

Advertisement

Comparison with Scheduled Commercial Banks

The federation mentions that most Scheduled Commercial Banks, including the sponsor bank Bank of Baroda, have already absorbed 100% of the perquisite tax for their staff. The difference in treatment, according to the letter, has become a major concern among employees seeking parity.

Reference to Past Practices and Amalgamation Norms

UPGBOF cites that in the erstwhile e-Prathama UP Gramin Bank, perquisite tax was absorbed in line with sponsor bank Punjab National Bank. The representatives also refer to Gazette Notification guidelines issued at the time of amalgamation, which state that all existing benefits extended to employees should continue without reduction.

Advertisement

Federation’s Request to the Bank

The federation has urged Uttar Pradesh Gramin Bank to absorb 100% of the perquisite tax, aligning with the sponsor bank and other Scheduled Commercial Banks. The letter states that such a step would support employee morale and strengthen their commitment to organisational goals.

The request placed by the Uttar Pradesh Gramin Bank Officers Federation aims at ensuring financial relief and maintaining parity with other banking institutions. The federation stresses that absorbing the perquisite tax will help restore employee confidence and welfare.

No comments yet.