UP Gramin Bank Officer’s Federation Flag Technical Issues After IT Migration, Seek Immediate Resolution

UP Gramin Bank Officer’s Federation has highlighted widespread technical issues post IT migration. The federation has requested urgent action to restore smooth banking operations.

Author: V.Gayathri

Published: November 7, 2025

The Uttar Pradesh Gramin Bank Officer’s Federation (UPGBOF) has written to the bank’s management regarding multiple technical challenges being faced across branches after the recent IT migration. According to the federation, disruptions have affected daily banking operations, customer services, and digital transactions.

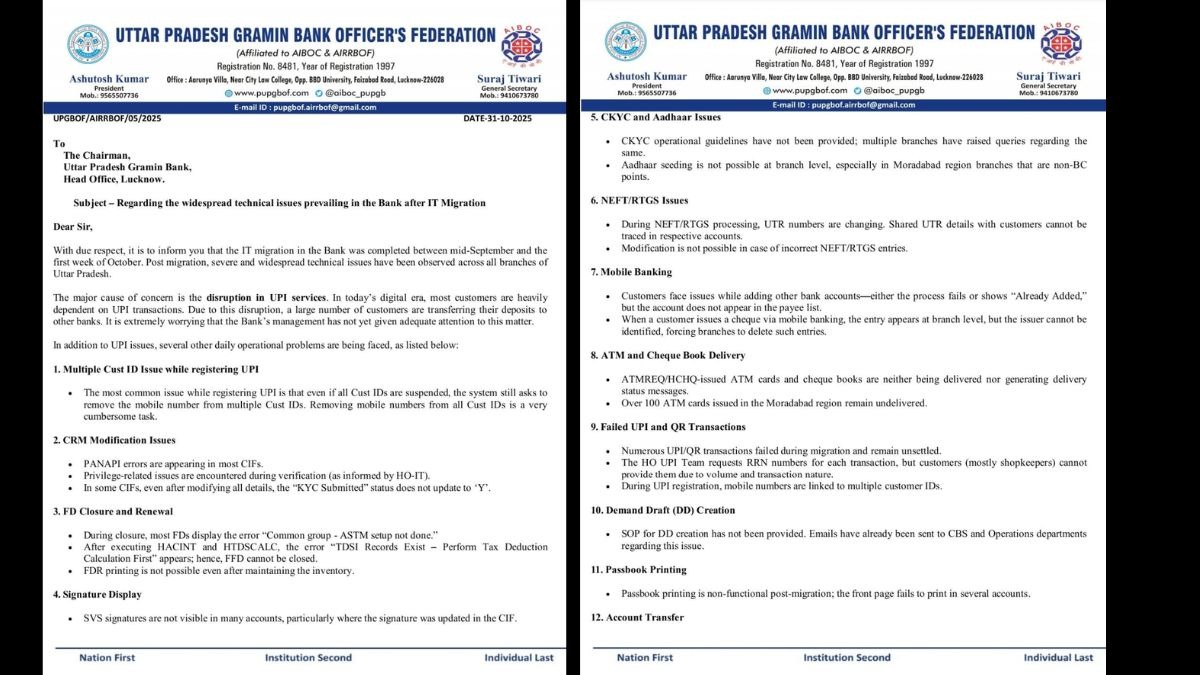

1. Disruption in UPI Services

The federation states that the major issue affecting customers is the disruption in UPI services. Due to these issues, customers are unable to complete UPI transactions smoothly, and some are transferring their deposits to other banks.

Advertisement

Image: Letter submitted by UPGBOF highlighting post-migration issues

2. Multiple Customer ID Issues During UPI Registration

Branches are facing difficulties when mobile numbers are linked to multiple customer IDs. Even after suspension of all customer IDs, the system prompts for mobile number removal from all linked IDs, making the process cumbersome.

3. CRM (Customer Relationship Module) Modification Challenges

Several errors, including PANAPI errors, privilege-related errors, and KYC update issues, are being reported. In some cases, even after editing customer details, the system does not update the KYC status.

4. Issues in FD Renewal and Closure

During FD closure and renewal, the system displays errors related to tax deduction setup and record processes. Some branches are unable to print FDRs even after maintaining inventory.

Advertisement

5. CKYC and Aadhaar Seeding Issues

The federation mentions that branches have not received the CKYC operational guidelines. Aadhaar updates are particularly problematic in some regions where branch-level seeding is not functional.

6. NEFT/RTGS Processing Problems

The federation notes that NEFT/RTGS UTR numbers are changing during processing, creating difficulty in verifying transactions. Modification of incorrect entries is also not possible.

7. Mobile Banking Problems

Branches are facing issues where adding bank accounts or cheque issuance through mobile banking does not reflect properly. In some cases, entries appear at the branch level but not at the issuer’s end.

8. Delay in ATM Cards and Cheque Book Delivery

ATM cards and cheque books are undelivered or lack delivery status updates. Over 100 ATM cards in certain regions remain pending.

9. Failed UPI and QR Transactions

Several QR and UPI transactions remain unsettled after migration. Customers have been asked to provide RRN numbers, which is difficult due to transactional volume.

10. Demand Draft (DD) Creation Issues

Standard operating procedures for DD creation have not been shared with branches, causing delays despite repeated emails to the concerned departments.

11. Passbook Printing & Account Transfer Issues

Passbook printing has become non-functional in various branches. Account transfer processes generate multiple transaction logs, but verification remains incomplete.

12. Loan Against FD and Interest Updation

Branches are unable to unlink collateral for FD loans, and interest is not being applied properly to upgraded or regular accounts.

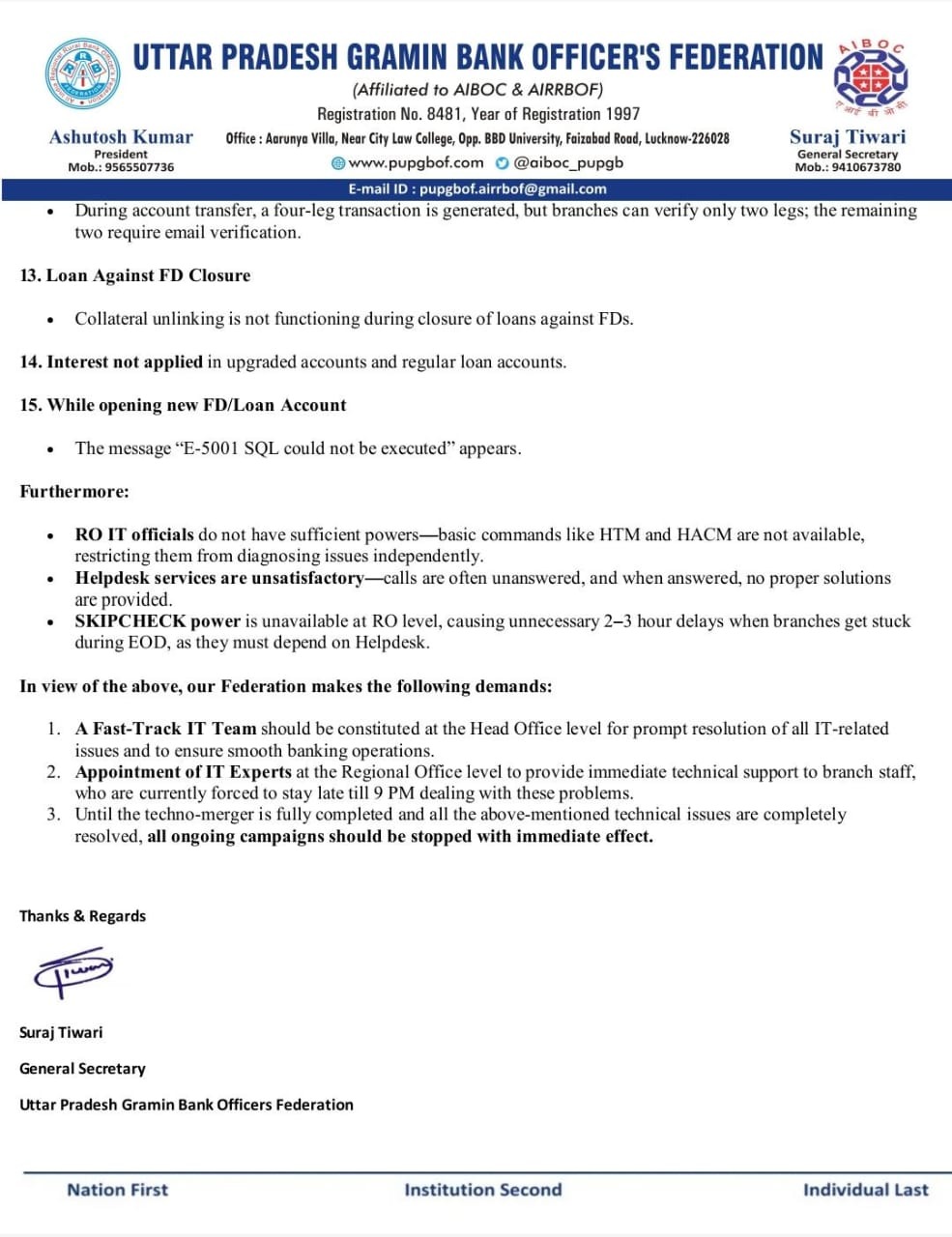

Federation’s Key Demands

The federation has requested:

- Formation of a Fast-Track IT team at Head Office to resolve issues quickly.

- Appointment of IT experts at Regional Offices to assist branch staff.

- Suspension of ongoing campaigns until the technical issues are fully resolved.

UPGBOF has raised concerns regarding operational disruptions after IT migration. The federation has requested immediate intervention from the bank’s management to restore normal functioning and ensure uninterrupted customer services.

Advertisement

No comments yet.