State Bank of India Employees Claim Restriction on NPS Fund Choice Despite PFRDA Circular Implementation

State Bank of India employees have alleged that they are being restricted from exercising their choice of Pension Fund Manager and asset allocation under the National Pension System. The allegation comes despite the Pension Fund Regulatory and Development Authority issuing a circular in September 2025 that allows employees to make such choices.

Author: Kalyani Mali

Published: November 13, 2025

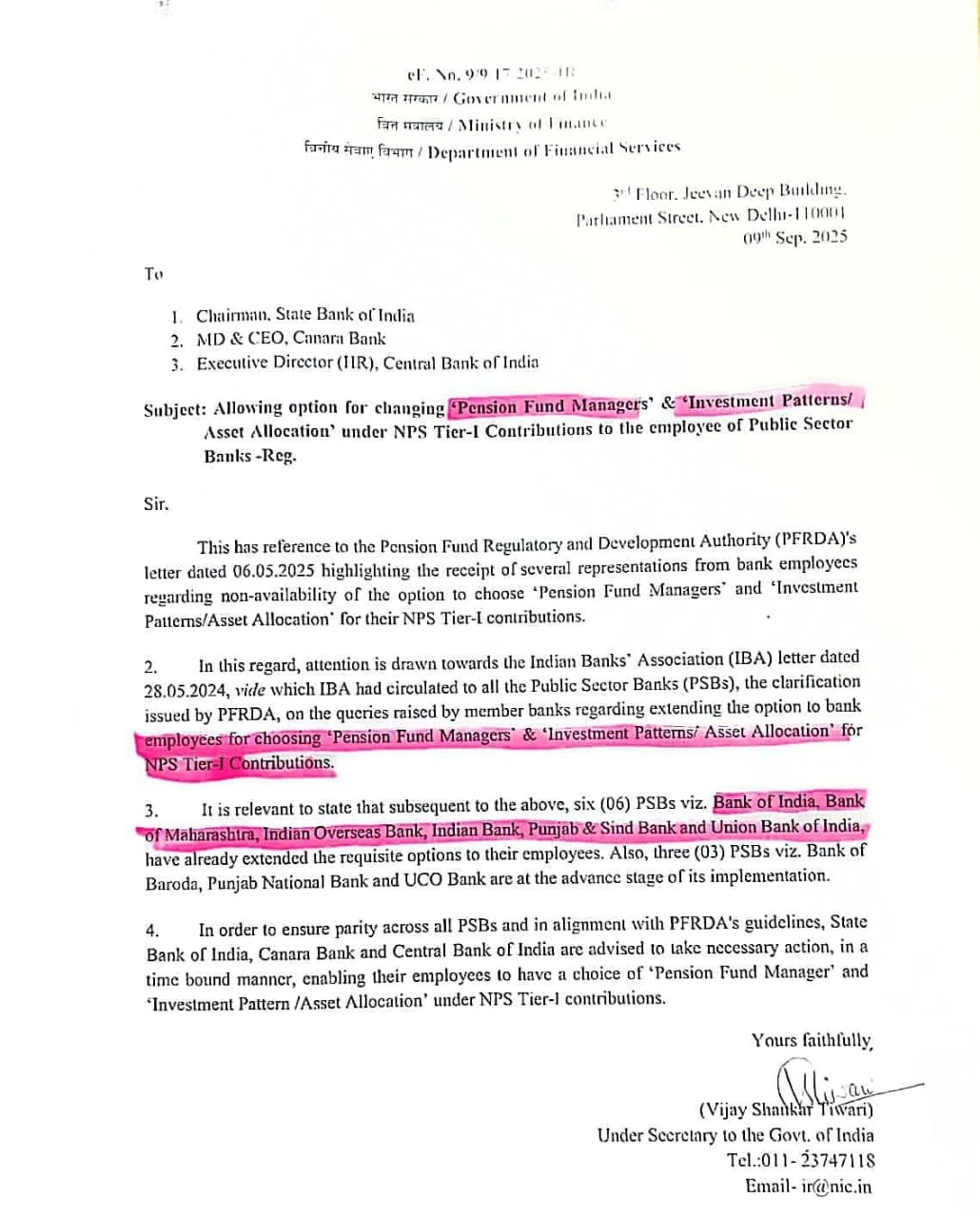

The Ministry of Finance’s Department of Financial Services (DFS), through its letter dated 9 September 2025, advised three Public Sector Banks (PSBs) — State Bank of India (SBI), Canara Bank, and Central Bank of India — to provide employees with the option to change their Pension Fund Manager (PFM) and Investment Pattern/Asset Allocation under the National Pension System (NPS) Tier-I.

Employees’ Perspective:

Several SBI employees, who wished to remain anonymous, told Kanal that they are unable to exercise their right to choose a PFM or investment pattern for their NPS contributions. They said this restriction continues even after the PFRDA circular dated 12 September 2025 and the DFS directive dated 9 September 2025, which instructed allPSBs to implement the choice uniformly.

Advertisement

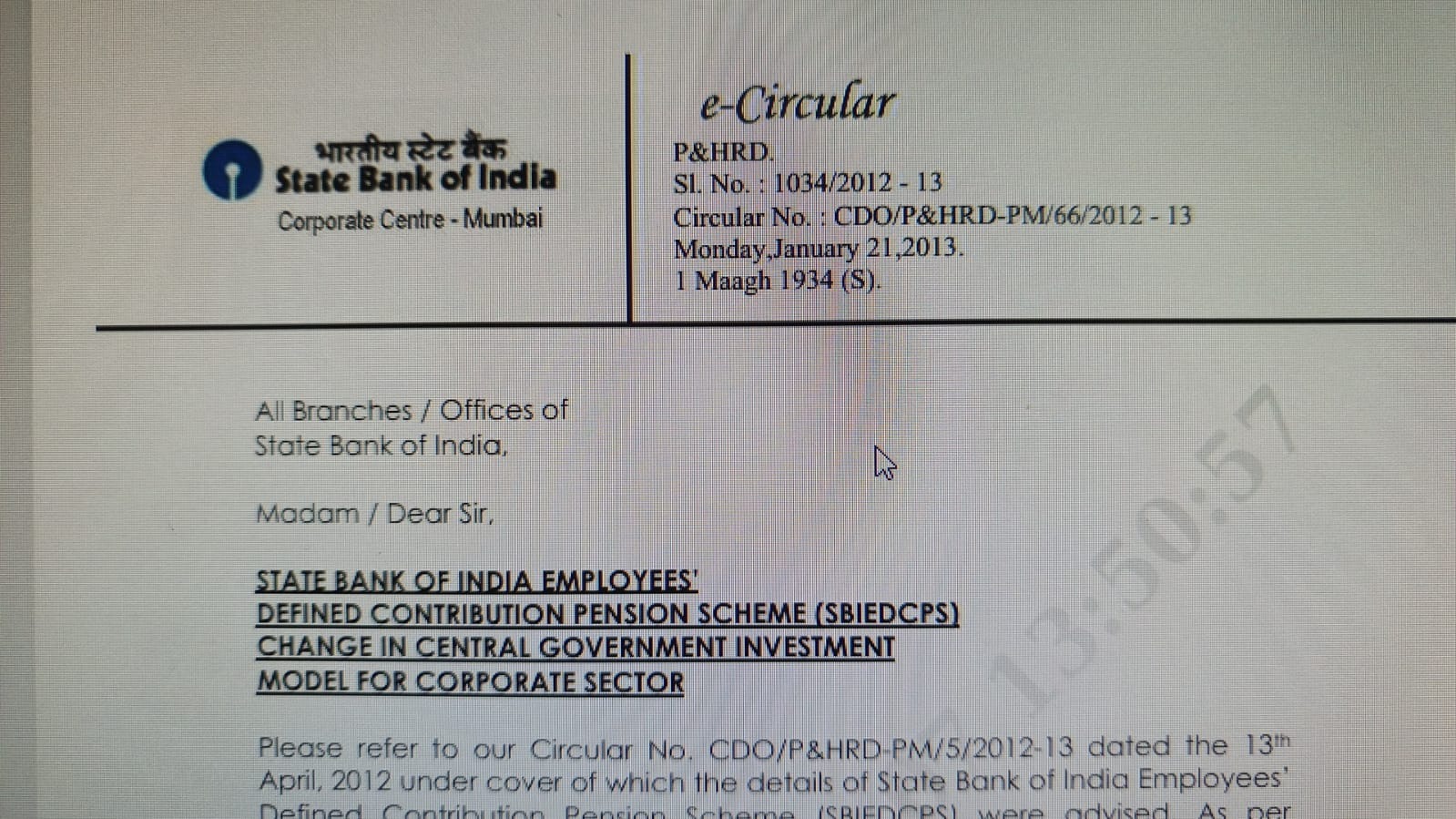

According to these employees, the restriction stems from an internal SBI circular issued on 21 January 2013, where the bank’s Board had selected SBI Pension Funds Private Limited as the corporate PFM after comparing performances of three available PFMs at that time. Employees added that this internal policy has not been reviewed or updated since then to reflect the revised PFRDA guidelines.

Image: Excerpt from SBI’s internal circular dated 21 January 2013 selecting SBI Pension Funds Private Limited as the corporate PFM

They further said that SBI’s internal restrictions are preventing them from making changes despite the PFRDA’s clear instructions, describing the situation as “discriminatory” compared to colleagues in other PSBs.

“We are not able to choose our NPS fund manager. We are losing the opportunity to reap the benefits of the equity market as our bank management is defying the PFRDA circular,” said some SBI employees.

Advertisement

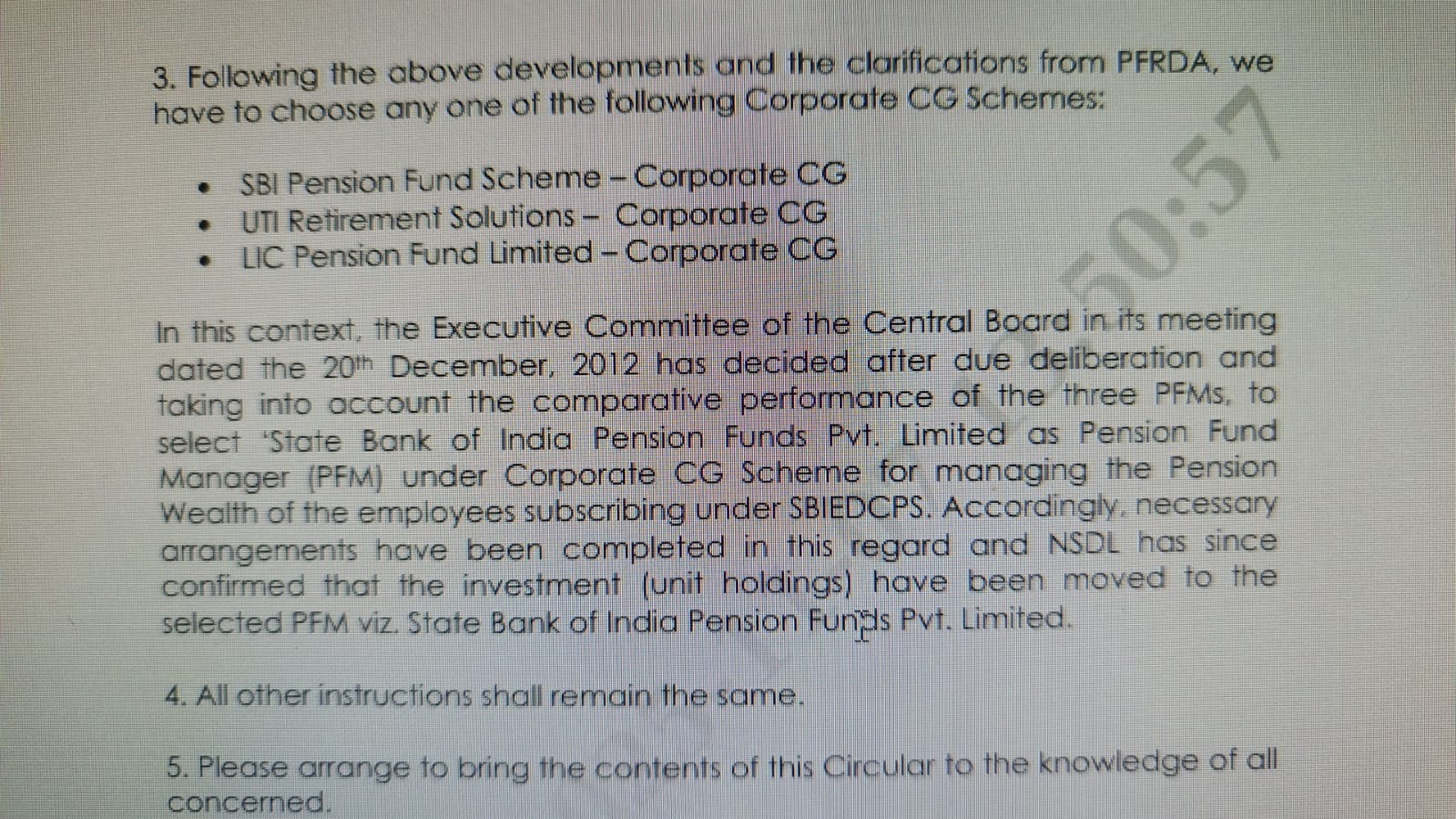

A few employees mentioned that on 31 October 2025, they initially succeeded in switching their PFM through the Protean Central Recordkeeping Agency (CRA) portal in the morning. However, by afternoon, the system displayed an error message — “Scheme Preference request limit reached for the financial year” — indicating that the limit had supposedly been used, even though no prior change was made.

“Strangely, some employees could change their PFM in the morning, but later the system was blocked. Even within SBI, there is discrimination,” one employee said.

Image: Screenshot showing error message ‘Scheme Preference Request limit reached for the financial year’ faced by SBI employees

Core Questions Raised by Employees

Employees expressed concern that they are not only being denied a regulatory right but are also facing potential long-term financial losses.

They highlighted that they are unable to shift towards equity-heavy allocations — such as the E (Equity) or C (Corporate Debt) options — which generally offer higher long-term returns.

For example, even a 1–2% annual difference in fund performance over a 20–25 year period could result in a loss of ₹10–15 lakh or more in the final NPS corpus. Employees said this effectively penalises them for no fault of their own, while their peers in other PSBs can optimise their pension returns.

Policy and Compliance Concerns

Employees also questioned the procedural stance taken by the bank:

- The requirement of separate “Board approval” contradicts the spirit and letter of the PFRDA’s uniform directive.

- As the regulator’s circular applies to all corporates, SBI’s internal delay reflects a compliance lapse rather than a policy ambiguity.

- This raises questions about institutional accountability and the bank’s responsiveness to regulatory reforms.

Broader Implications

The issue, according to employees, underscores a systemic governance gap within the public sector, where internal approvals appear to override regulator-issued subscriber rights.

They also said this affects employee morale, as the SBI — being the largest and most influential PSB — is expected to lead by example in implementing reforms and compliance measures, not lagging behind.

Key Questions Employees Raised

- If the PFRDA circular is binding on all corporates, why does SBI require separate Board approval?

- Should employees bear financial losses due to administrative delays?

- What action will the PFRDA, DFS, and the Ministry of Finance take to ensure compliance and uniformity?

Protean’s Response

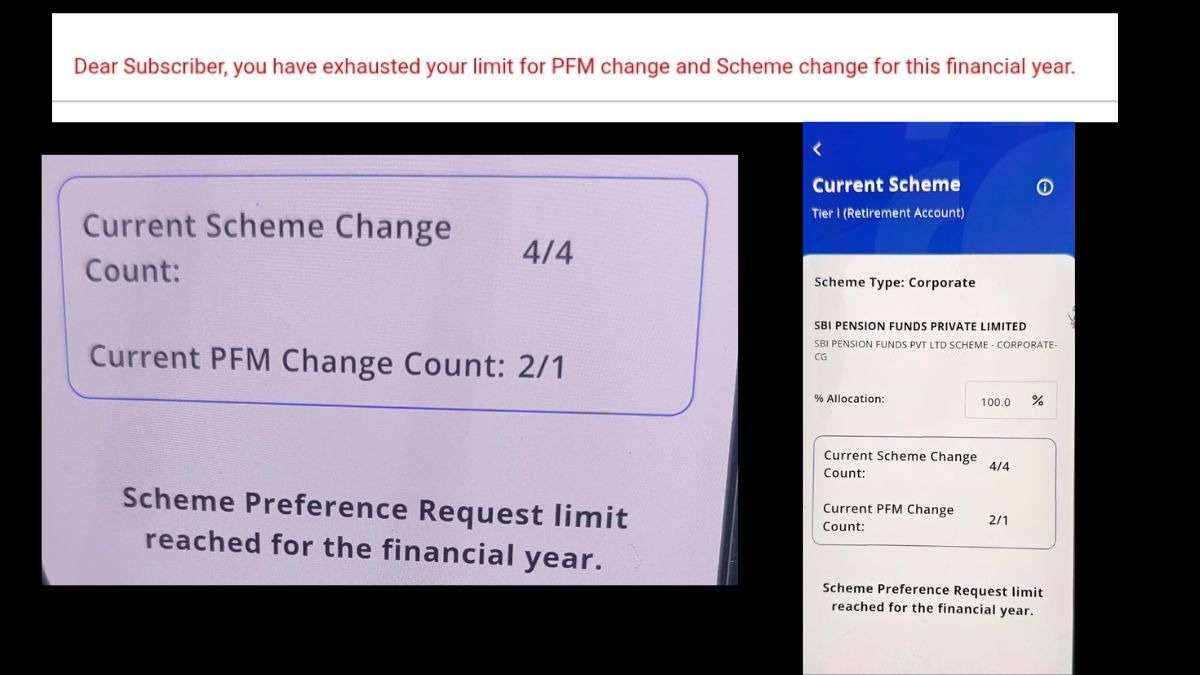

Some employees reached out to Protean eGov Technologies Limited (Protean CRA) to clarify why the option was unavailable. In its reply, Protean stated that the ability to change PFM and asset allocation was “currently unavailable as per the guidance of the appropriate authority” and advised employees to lodge grievances on the Sanjeevani Portal of the SBI.

.

Image: Screenshot of Protean’s response

Regulatory and Background Documents:

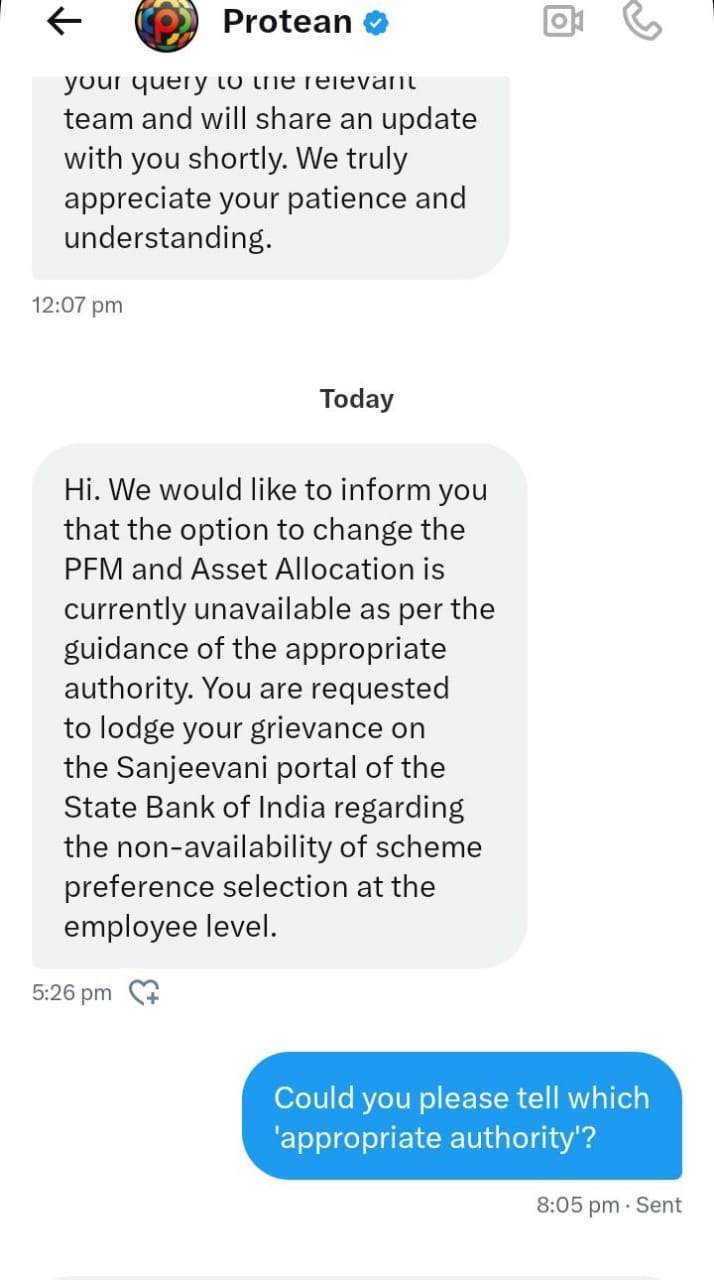

The DFS letter dated 9 September 2025 refers to the PFRDA communication dated 6 May 2025, which had noted employee representations about the non-availability of choice for PFM and asset allocation.

Following this, the Indian Banks’ Association (IBA) circulated the clarification to all PSBs on 28 May 2024. Six PSBs — Bank of India (BoI), Bank of Maharashtra (BoM), Indian Overseas Bank, Indian Bank, Punjab & Sind Bank, and Union Bank of India — have already implemented the facility. Three more — Bank of Baroda (BoB), Punjab National Bank (PNB) , and UCO Bank — were in advanced stages of implementation.

Image: Highlighted section of the DFS letter listing PSBs that had already implemented NPS choice for employees

The letter specifically advised SBI , Canara Bank, and Central Bank of India to “take necessary action in a time-bound manner” to ensure parity with other PSBs.

Developments and Market Context

A few days after the restriction issue surfaced, reports indicated that SBI Funds Management Limited, the asset management company linked to SBI Pension Funds Private Limited, is preparing for an Initial Public Offering (IPO), according to Reuters.

Employees pointed out to Kanal that until recently, almost all public sector bankers’ NPS contributions were invested in SBI’s corporate pension fund. With other PSBs now allowing employees to shift to different PFM, the total Assets Under Management (AUM) of SBI Pension Funds could decline.

As said by the employees, the issue had earlier been raised by the SBI Staff Association as well as by individual employees through the NPS Ombudsman and internal mails to higher authorities. However, the bank has consistently maintained that the matter is governed by its Board’s decision and referred to its internal circular dated 21 January 2013. Both the DFS directive and the PFRDA circular were issued to ensure uniform rights for all NPS subscribers. Employees continue to seek action for compliance and parity within the public banking system.

Read Our Coverage on NPS:

#NPS_Discrimination: X Campaign Highlights Staff Concern Over Pension Inequality in PSBs

₹6 Crore Retirement Loss: Is NPS Fund Choice Denial Costing Bank Employees Their Future?

‘We Were the First to Act’: BOMOO Secures NPS Fund Manager, Investment Choice for Bank of Maharashtra Employees

Advertisement

No comments yet.