MoS MSME Shobha Karandlaje Endorses AIRRBEA Concerns, Urges Finance Minister to Protect Objectives of Rural Banking

Union Minister of State for MSME and Labour & Employment Shobha Karandlaje backs AIRRBEA, urges FM to strengthen rural banking objectives.

Author: Saurav Kumar

Published: September 1, 2025

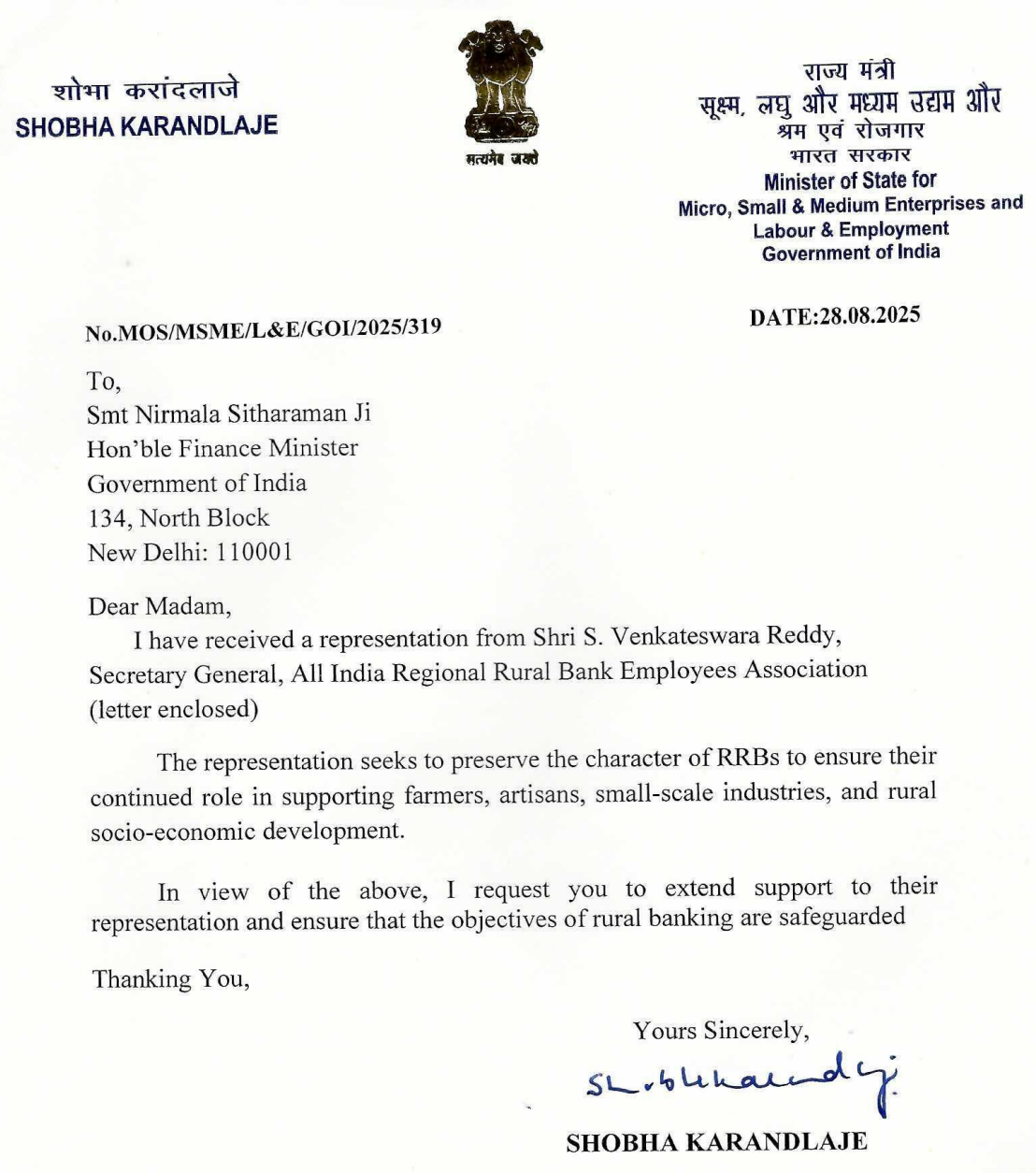

In a recent development, Union Minister of State for MSME and Labour & Employment, Shobha Karandlaje, has written to Finance Minister Nirmala Sitharaman, backing the All India Regional Rural Bank Employees Association (AIRRBEA) in its appeal to safeguard Regional Rural Banks (RRBs) from privatisation through Initial Public Offering (IPO).

Advertisement

Image: Letter of MoS Shobha Karandlaje requesting the Finance Minister to back RRBs.

Image: Letter of MoS Shobha Karandlaje requesting the Finance Minister to back RRBs.

The MoS in the letter to FM openly endorsed the concerns cited by AIRRBEA and appealed to her to extend support to RRBs safeguarding objectives of rural banking.

Advertisement

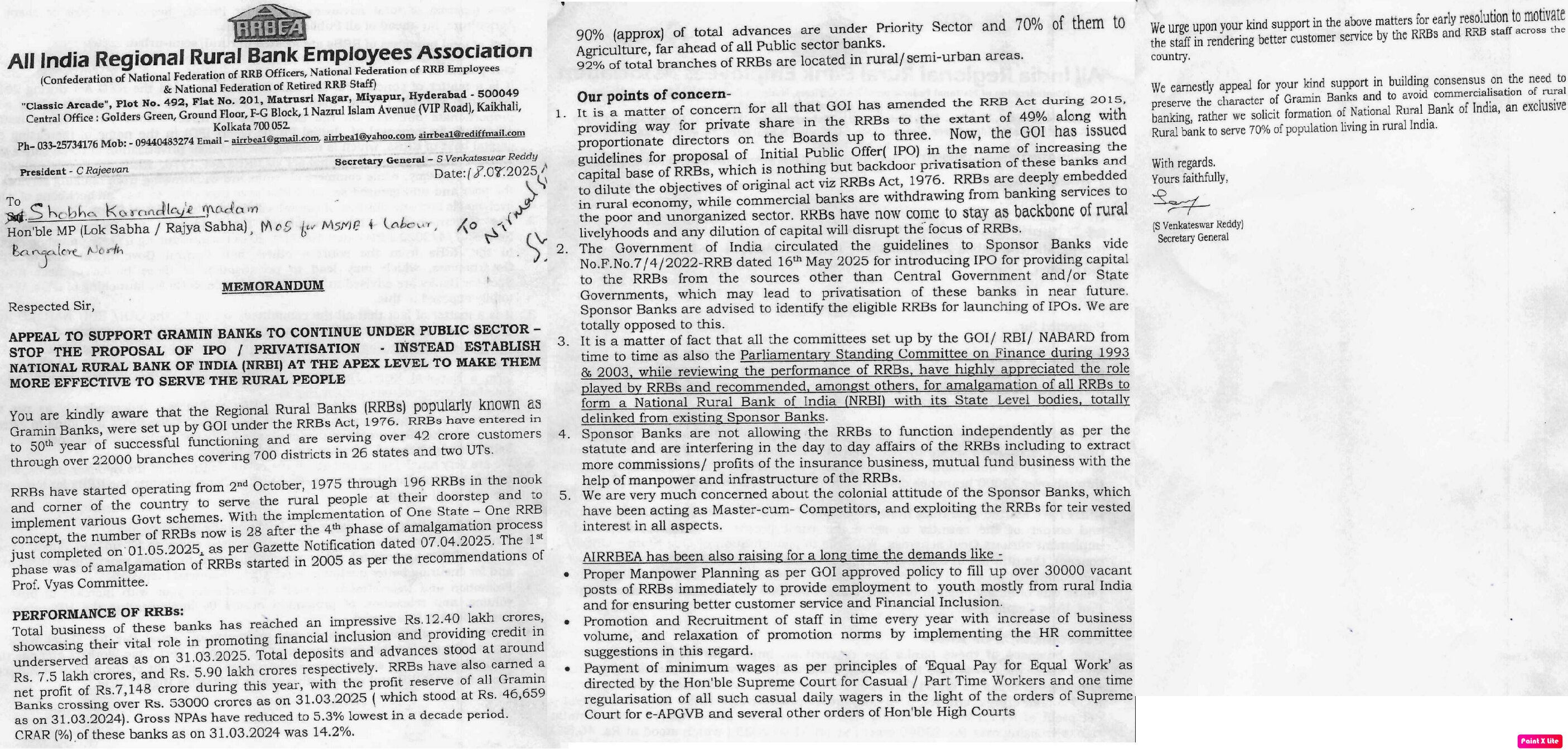

Forwarding a detailed memorandum submitted by AIRRBEA Secretary General S. Venkateswar Reddy, Karandlaje underlined the crucial role of RRBs in supporting farmers, artisans, small industries, and driving rural development. The memorandum strongly opposed IPO plans and instead called for the creation of a National Rural Bank of India (NRBI) as an apex body.

Image: AIRRBEA letter to MoS Shobha Karandlaje detailing performance and significance of RRBs, citing threat of IPO in RRBs

Advertisement

AIRRBEA’s representation listed five major concerns:

- Backdoor Privatisation via IPOs — Amendments to the RRB Act and IPO proposals risk diluting the original mandate of RRBs, undermining their rural development focus.

- Guidelines Leading to Privatisation — Government instructions to Sponsor Banks on mobilising capital may pave the way for privatisation of RRBs.

- Ignored Parliamentary Recommendations — Committees since 1993 have endorsed RRBs’ role and suggested forming NRBI, but these recommendations remain unimplemented.

- Interference by Sponsor Banks — Day-to-day functioning and statutory independence of RRBs are being compromised, with sponsor banks diverting commissions and profits.

- Colonial Attitude of Sponsor Banks — Sponsor institutions act as competitors rather than supporters, exploiting RRBs for vested interests.

The union further pointed to the robust financial performance of RRBs, which crossed ₹12.40 lakh crore in total business as of March 2025, with record-low NPAs and strong profits, reinforcing their capacity to serve rural India without privatisation.

Unprecedented Support to RRBs

On August 19, 2025, the Apex RRB unions staged a massive dharna in New Delhi against the move towards privatisation, drawing remarkable cross-party solidarity. Nearly 17 Members of Parliament, representing both the Lok Sabha and Rajya Sabha, joined the protest and addressed the gathering in support of the unions’ cause.

In recent months, critical issues such as opposition to the proposed IPOs in RRBs and the demand for establishing a National Rural Bank of India (NRBI) have gained strong political traction. This surge in support follows the Department of Financial Services (DFS) directive issued on May 16, 2025, which instructed sponsor banks to recommend eligible RRBs for public listing under newly defined criteria.

The support of MoS MSME Shobha Karandlaje has added significant political weight to AIRRBEA’s concerns and demands. Her endorsement strengthens the employees’ call for reforms that protect rural banking and keep it aligned with its founding mission.

No comments yet.