“₹6 Crore Retirement Loss?”: Is NPS Fund Choice Denial Costing Bank Employees Their Future?

Public sector bank employees under the National Pension System Corporate Model continue to demand the right to select their Pension Fund Manager and investment pattern, citing lower returns and unequal treatment compared to Central Government employees. Multiple union representations and regulatory clarifications have kept the issue in focus.

Author: Kalyani Mali

Published: July 2, 2025

Employees of Public Sector Banks (PSBs) governed under the Corporate Model of the National Pension System (NPS) have raised long-standing concerns over being denied the option to choose their Pension Fund Manager (PFM) and investment pattern. Despite clarifications from the Pension Fund Regulatory and Development Authority (PFRDA) and repeated appeals from unions, many banks have not yet extended this facility to their employees.

2018 PFRDA Circular and Employer Rights

According to the PFRDA Circular dated November 14, 2018, employers who were registered under the Corporate Model before this date retained the right to select the PFM and investment allocation on behalf of employees. However, for employers joining the Corporate Model after this date, the circular mandates that employees must be given the option to revise their fund manager and scheme choice after one year of enrollment.

Image: Excerpt from the PFRDA 2018 circular outlining employer control over Pension Fund and scheme selection

Investor Charter: Emphasis on Equality and Subscriber Choice

The PFRDA’s Investor Charter for NPS, issued in April 2024, outlines key subscriber rights, including equal treatment, risk-based investment options, and the freedom to choose regulated pension products. Employee associations have cited this charter to highlight contradictions in the current employer-controlled system for many PSB employees.

Image: Key clauses from the PFRDA Investor Charter 2024 focusing on subscriber equality and investment choice

Unions Push for NPS Reform to Restore Employee Fund Choice

The All India Bank Officers’ Confederation (AIBOC), All India Bank Officers’ Association (AIBOA), National Organisation of Bank Officers (NOBO), and Bank of Maharashtra Officers’ Organisation (BOMOO) have jointly urged the Indian Banks’ Association (IBA) to implement the subscriber-level model under the NPS. They argue that denying employees the right to choose their Pension Fund Manager and asset allocation contradicts PFRDA’s Investor Charter and has led to financial setbacks for many.

Image: Bank unions AIBOA, AIBOC, NOBO, and BOMOO demand fund choice rights for employees under NPS, citing financial losses and policy violations

PFRDA and IBA Clarify Guidelines on NPS Fund Choice; Implementation Still Pending Following persistent demands from unions and queries raised by several banks, the PFRDA clarified—through circulars and official communication—that employees under the Corporate NPS can be allowed to select their PFM and asset allocation, with changes permitted up to four times a year. In response, the IBA issued a circular to all banks in May 2024, advising them of this provision. However, despite this regulatory clarity, many banks have yet to implement the subscriber-level model, prompting unions to intensify their push for compliance.

Image: Official documents from PFRDA and IBA confirm that banks can allow employees to choose their Pension Fund Manager and asset allocation under the Corporate NPS model.

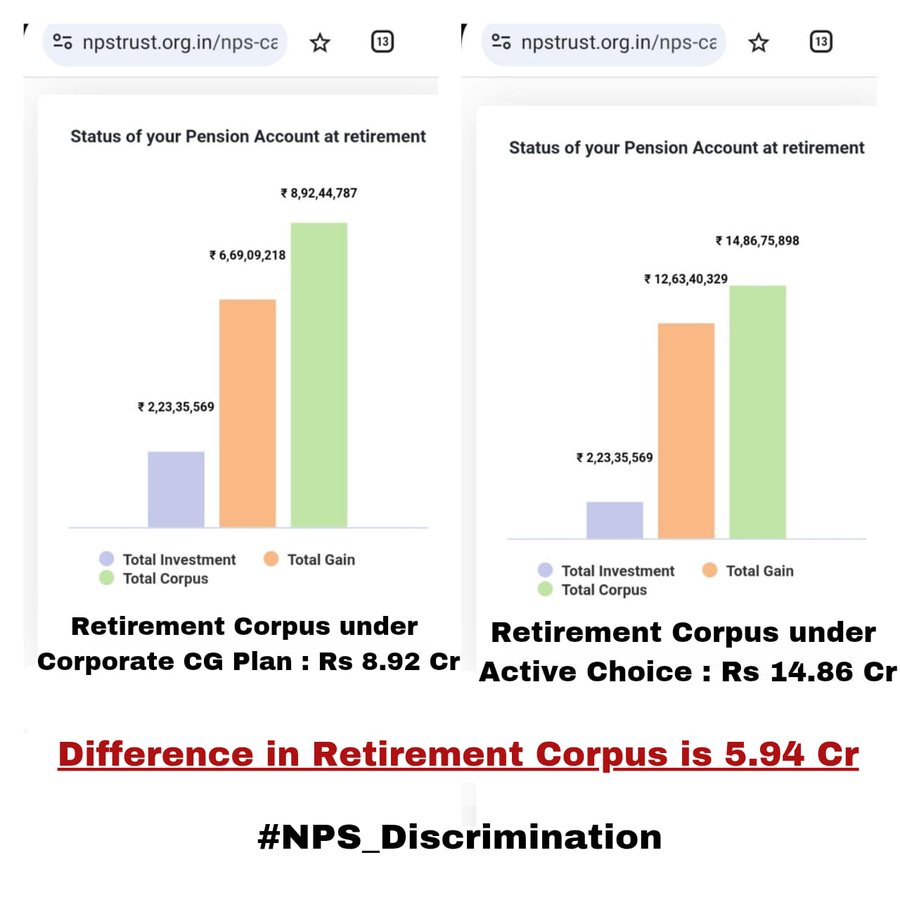

Illustration Highlights Variation in NPS Returns Across Investment Options

An illustration based on NPS Trust data compares projected retirement corpus outcomes under two investment options: the default Corporate CG Plan and the Active Choice model. The example shows a higher estimated corpus under Active Choice for the same total investment, indicating the potential impact of fund and asset allocation on long-term returns.

Image: Projected NPS returns vary based on investment choice

Source: @BankingChanakYa

Allegation ₹6 Crore Loss Due to Lack of NPS Fund Choice

Speaking to Kanal, a banker stated "The NPS scheme was implemented in our bank from 2010, following the Central Government pattern. The Central Government has already allowed its employees the option to select their PFM and investment scheme, but our bank has not done the same.

Advertisement

So far, four Public Sector Banks—Bank of India (BOI), Indian Overseas Bank (IOB), Punjab & Sind Bank (P&SB), and Indian Bank—have allowed this option to their employees. We are continuously pursuing this matter across all PSBs.

Under the Corporate Model, banks come under the NPS framework. Before the 14 November 2018 PFRDA circular, employers had the right to either retain this choice or delegate it to employees. However, after this circular, employers who joined NPS after this date are required to give employees the option to change their Pension Fund Manager and scheme after one year, even if the employer initially retained the choice.

Advertisement

Banks registered before this date still hold the right to retain or delegate this option, and many banks continue to retain it despite repeated employee requests and union representations. This issue was also discussed during the Bipartite Settlement negotiations.

Despite the PFRDA circular granting employers the authority to extend this option to employees, many banks are still not implementing it. This has resulted in discrimination between employees of employers/corporates registered under NPS pre- and post-2018.

Advertisement

Currently, over ₹90,000 crore of bank employees' funds are invested under the SBI Corporate CG plan, making SBI the largest fund holder. Unfortunately, SBI Pension Fund has been the lowest performer across equity and other parameters for many years.

One employee has allegedly suffered a loss of nearly ₹6 crore in their retirement corpus, compared to potential earnings from better-performing funds.

According to sources, around 50 bankers have written to PFRDA urging that this option be extended to employees. After gathering inputs from various banks, the PFRDA Ombudsman reportedly noted that only four banks have implemented it so far.

PFRDA has informed that the issue is under active deliberation. They indicated in February and March 2025 that more banks may soon extend this choice to employees. In February, Bank of Baroda informed PFRDA that they were in the process of implementing the option but have not done so till date. In March, UCO Bank, Punjab National Bank (PNB), and Canara Bank also agreed in principle but are yet to implement it."

As of now, four PSBs have implemented the option allowing employees to select their Pension Fund Manager and investment pattern under the NPS Corporate Model. Communications between PFRDA, IBA, and banks on this matter have taken place through multiple circulars and letters since 2024. According to available documents, PFRDA has stated that the matter is under deliberation, and some banks have indicated their intention to implement the option but have not yet done so.

No comments yet.